Question: I. Calculate bond-equivalent yield for a US bill with 320 days to maturity yielding 9.5% on a bank discount basis if the price of the

I. Calculate bond-equivalent yield for a US bill with 320 days to maturity yielding 9.5% on a bank discount basis if the price of the bill is 95% of the face value.

2. What is the expected percentage return on a 6-year 1,200 face value bond with annual coupon of 5% if it is purchased at the beginning of the 2th year when market rate is 5.8% and it will be sold at the beginning of the 3th year when market rate is expected to be 6.3%?

3. Display graphically cash flows (calculate repayment of the principal amount and interest) on a fixed-payment loan, if the principal amount is 2,000, maturity is 5 years, interest rate is 12% per year, and frequency of payments is annual.

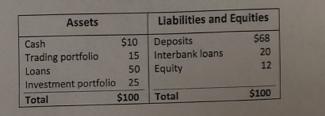

4. Show the Bank's balance sheet if the Bank purchases liabilities to offset a net deposit drain of 4. $10 million (required reserves ratio 10%).

Assets Liabilities and Equities Deposits Interbank loans Equity $68 20 Cash $10 Trading portfolio 15 12 Loans 50 Investment portfolio 25 $100 Total $100 Total

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

1 Bond Equivalent Yield BEY 365DY360DTMDY where DY 95 ... View full answer

Get step-by-step solutions from verified subject matter experts