Question: (i) Calculate the expected return and standard deviations for Project Alpha and Project Beta. (ii) Calculate the coefficient variation of both projects. Assuming Jerry is

(i) Calculate the expected return and standard deviations for Project Alpha and Project Beta.

(ii) Calculate the coefficient variation of both projects. Assuming Jerry is a risk-averse investor, recommend the project that he should accept.

(iii) Explain the meaning of standard deviation and coefficient of variation to an investor

(iv) Factoring is one of the sources of short-term financing. Discuss SIX (6) benefits of factoring

(v) Differentiate between business risk and financial risk.

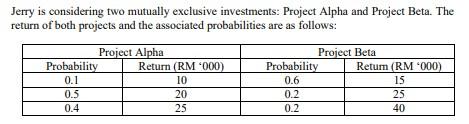

Jerry is considering two mutually exclusive investments: Project Alpha and Project Beta. The return of both projects and the associated probabilities are as follows: Project Alpha Probability Return (RM 1000) 0.1 10 0.5 20 0.4 25 Project Beta Probability Retum (RM1000) 0.6 15 0.2 25 0.2 40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts