Question: I calculated the answer for a, but I am not sure on the calculations moving forward. Thanks. Alternative dividend policies Given the earnings per share

I calculated the answer for a, but I am not sure on the calculations moving forward. Thanks.

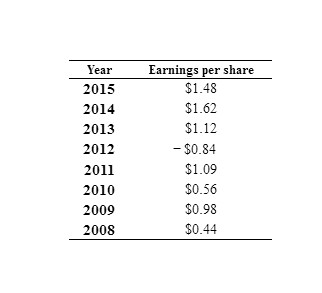

Alternative dividend policies Given the earnings per share over the period 2008-2015 shown in the following table,dmine the annual dividend per share under each of the policies set forth in parts a through d. a. Pay out 40% of earnings in all years with positive earnings. b. Pay $0.40 per share and increase to $0.50 per share whenever earnings per share rise above S0.90 per share for two consecutive years. C. Pay $0.40 per share except when earnings exceed $1.00 per share, in which case pay an extra dividend of 50% of earnings above $1.00 per share. d. Combine policies in parts b and c. When the dividend is raised (in part b), raise the excess dividend base (in part c) from $1.00 to $1.10 per share. e. Compare and contrast each of the dividend policies described in parts a through d a. If the firm pays out 40% of earnings in all years with positive earnings, the annual dividend the firm would pay in year 2010 is $ 0.22. (Round to the nearest cent.) b. If the firm pays $0.40 per share and increases the dividend to S0.50 per share whenever earnings per share rise above S0.90 per share for two consecutive years, the annual dividend the firm would pay in year 2010 is S (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts