Question: I Can, Corp (Can) has approached Exhale about a possible business combination in which can would purchase Exhale. Assume the pre-merger (fair value) Exhale is

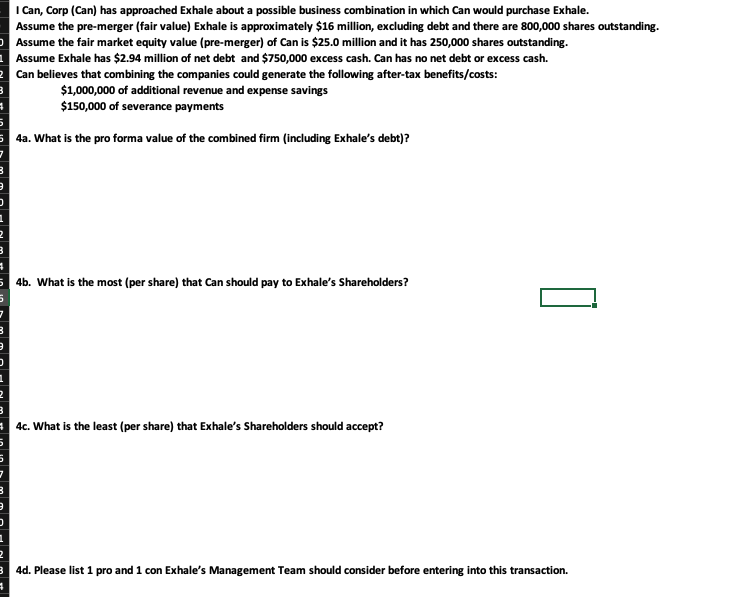

I Can, Corp (Can) has approached Exhale about a possible business combination in which can would purchase Exhale. Assume the pre-merger (fair value) Exhale is approximately $16 million, excluding debt and there are 800,000 shares outstanding. Assume the fair market equity value (pre-merger) of Can is $25.0 million and it has 250,000 shares outstanding. Assume Exhale has $2.94 million of net debt and $750,000 excess cash. Can has no net debt or excess cash. Can believes that combining the companies could generate the following after-tax benefits/costs: $1,000,000 of additional revenue and expense savings $150,000 of severance payments 3 4a. What is the pro forma value of the combined firm (including Exhale's debt)? 4b. What is the most (per share) that can should pay to Exhale's Shareholders? 4c. What is the least (per share) that Exhale's Shareholders should accept? 4d. Please list 1 pro and 1 con Exhale's Management Team should consider before entering into this transaction. 1 I Can, Corp (Can) has approached Exhale about a possible business combination in which can would purchase Exhale. Assume the pre-merger (fair value) Exhale is approximately $16 million, excluding debt and there are 800,000 shares outstanding. Assume the fair market equity value (pre-merger) of Can is $25.0 million and it has 250,000 shares outstanding. Assume Exhale has $2.94 million of net debt and $750,000 excess cash. Can has no net debt or excess cash. Can believes that combining the companies could generate the following after-tax benefits/costs: $1,000,000 of additional revenue and expense savings $150,000 of severance payments 3 4a. What is the pro forma value of the combined firm (including Exhale's debt)? 4b. What is the most (per share) that can should pay to Exhale's Shareholders? 4c. What is the least (per share) that Exhale's Shareholders should accept? 4d. Please list 1 pro and 1 con Exhale's Management Team should consider before entering into this transaction. 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts