Question: I can not figure out Require B part 2. IT IS NOT 13,825 either. Can someone please help me figure this out? Parnell Company acquired

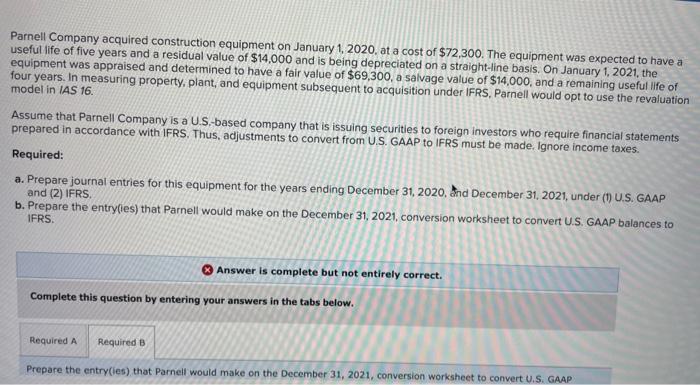

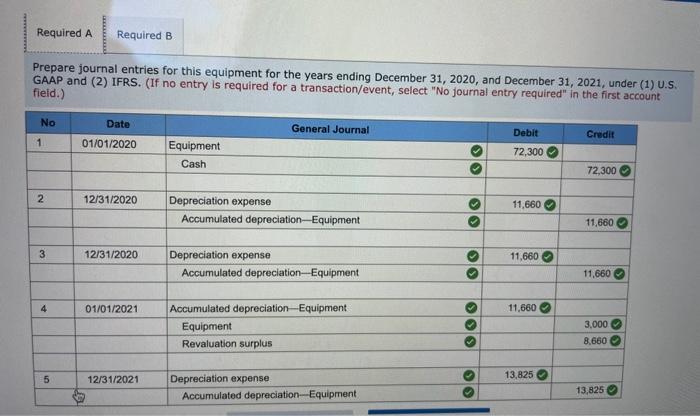

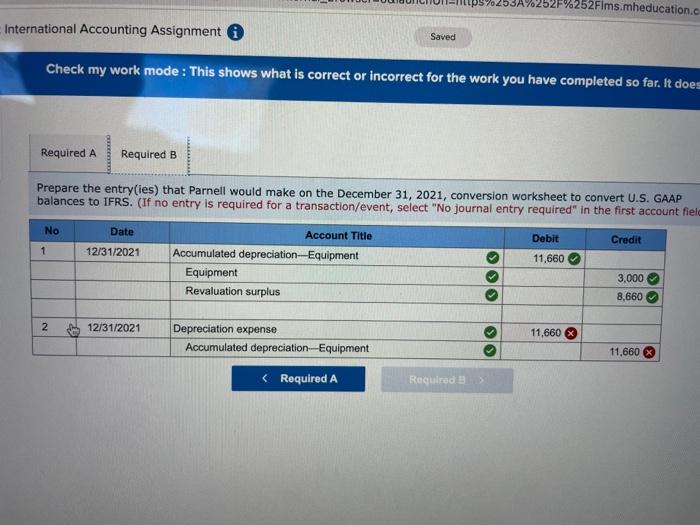

Parnell Company acquired construction equipment on January 1, 2020, at a cost of $72,300. The equipment was expected to have a useful life of five years and a residual value of $14,000 and is being depreciated on a straight-line basis. On January 1,2021 , the four years. In me model in 1AS16. and equipment subsequent to acquisition under IFRS, Parnell would opt to use the revaluation Assume that Parnell Company is a U.S.-based company that is issuing securities to foreign investors who require financial statements prepared in accordance with IFRS. Thus, adjustments to convert from U.S. GAAP to IFRS must be made. Ignore income taxes. Required: a. Prepare journal entries for this equipment for the years ending December 31, 2020, and December 31, 2021, under (1) U.S. GAAP and (2) IFRS. b. Prepare the entry(ies) that Parnell would make on the December 31,2021 , conversion worksheet to convert U.S. GAAP balances to IFRS. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare journal entries for this equipment for the years ending December 31, 2020, and December 31,2021 , under (1) U.S. GAAP and (2) IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account fieid.) International Accounting Assignment (i Check my work mode : This shows what is correct or incorrect for the work you have completed so far. It doe Prepare the entry(ies) that Parnell would make on the December 31,2021 , conversion worksheet to convert U.S. GAAP balances to IFRS. (If no entry is required for a transaction/event, select "No journal entry required" in the first account fie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts