Question: i can not figure out the EFN for this problem and would love some help. The most recent financial statements for Crosby, Incorporated, follow. Sales

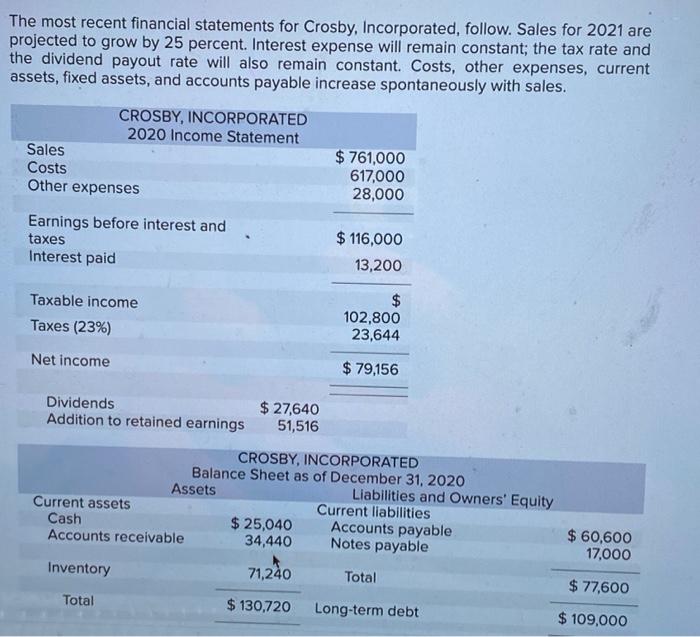

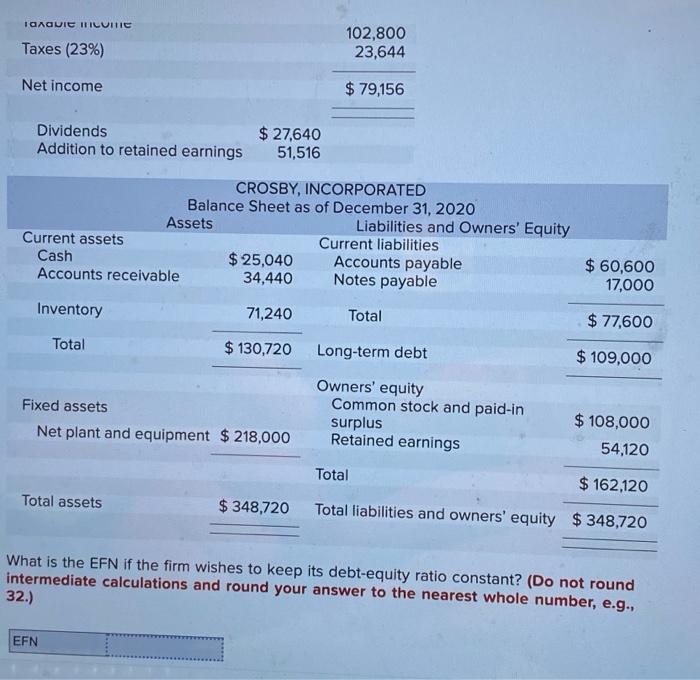

The most recent financial statements for Crosby, Incorporated, follow. Sales for 2021 are projected to grow by 25 percent. Interest expense will remain constant; the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets, fixed assets, and accounts payable increase spontaneously with sales. CROSBY, INCORPORATED 2020 Income Statement Sales Costs Other expenses $ 761,000 617,000 28,000 Earnings before interest and taxes Interest paid $ 116,000 13,200 Taxable income Taxes (23%) $ 102,800 23,644 Net income $ 79,156 Dividends $ 27,640 Addition to retained earnings 51,516 CROSBY, INCORPORATED Balance Sheet as of December 31, 2020 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 25,040 Accounts payable Accounts receivable 34,440 Notes payable $ 60,600 17,000 Inventory 71,240 Total $ 77,600 Total $ 130,720 Long-term debt $ 109,000 IOAQUIE HILUITIC Taxes (23%) 102,800 23,644 Net income $ 79,156 Dividends Addition to retained earnings $ 27,640 51,516 CROSBY, INCORPORATED Balance Sheet as of December 31, 2020 Assets Liabilities and Owners' Equity Current assets Current liabilities Cash $ 25,040 Accounts payable Accounts receivable 34,440 Notes payable $ 60,600 17,000 Inventory 71,240 Total $ 77,600 Total $ 130,720 Long-term debt $ 109,000 Fixed assets Net plant and equipment $ 218,000 Owners' equity Common stock and paid-in surplus Retained earnings $ 108,000 54,120 Total $ 162,120 Total assets $ 348,720 Total liabilities and owners' equity $ 348,720 What is the EFN if the firm wishes to keep its debt-equity ratio constant? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) EFN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts