Question: I cannot figure out how to get the right answer for the ones with the red X. If someone could answer and explain how they

I cannot figure out how to get the right answer for the ones with the red X. If someone could answer and explain how they got it, it would help me greatly. Thank you!

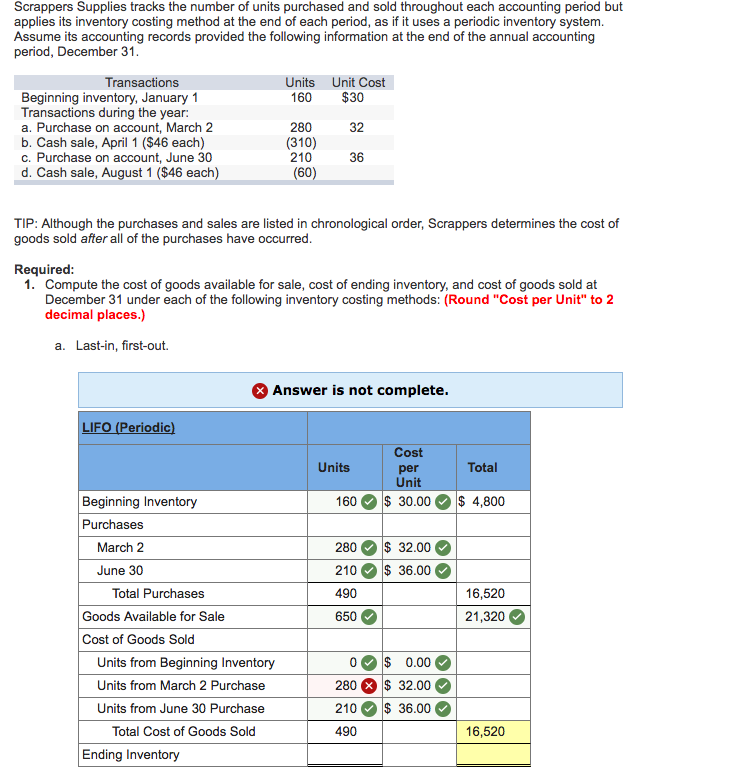

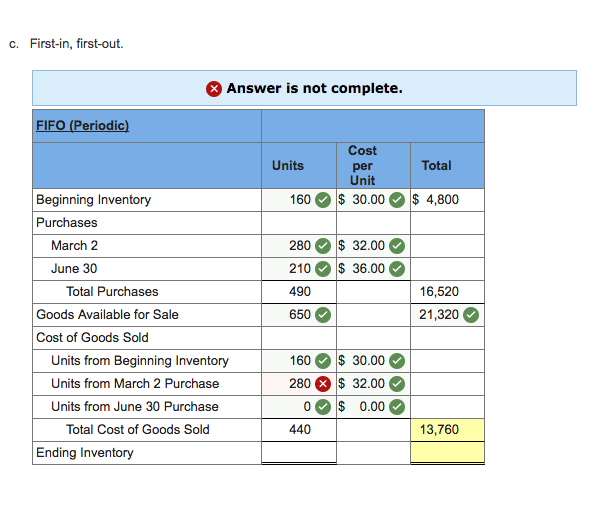

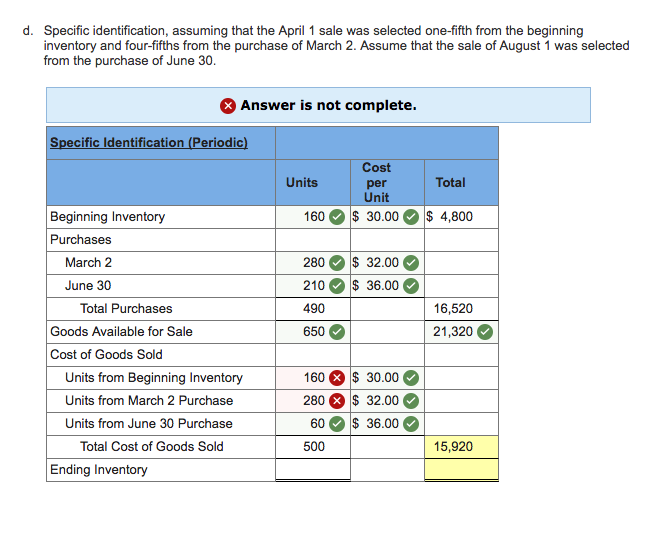

Scrappers Supplies tracks the number of units purchased and sold throughout each accounting period but applies its inventory costing method at the end of each period, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31 Transactions Units Unit Cost 160 $30 Beginning inventory, January 1 Transactions during the year: a. Purchase on account, March 2 b. Cash sale, April 1 ($46 each) c. Purchase on account, June 30 d. Cash sale, August 1 ($46 each) 280 (310) 210 32 36 60 TIP: Although the purchases and sales are listed in chronological order, Scrappers determines the cost of goods sold after all of the purchases have occurred Required 1. Compute the cost of goods available for sale, cost of ending inventory, and cost of goods sold at December 31 under each of the following inventory costing methods: (Round "Cost per Unit" to 2 decimal places.) a. Last-in, first-out. Answer is not complete. IFO (Periodic Cost per Unit Units Total Beginning Inventory 160 30.004,800 Purchases March 2 June 30 2800 $ 32.000 210 $ 36.00 490 650 Total Purchases 16,520 Goods Available for Sale 21,320 Cost of Goods Sold Units from Beginning Inventory Units from March 2 Purchase Units from June 30 Purchase Total Cost of Goods Sold 001$ 0.000 280 32.00 210 $ 36.00 490 16,520 Ending Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts