Question: I cannot figure out how to get the right answer even with the help, please walk through the numbers you use and why. Use the

I cannot figure out how to get the right answer even with the help, please walk through the numbers you use and why.

Use the formula below. Make sure you use the proper order. Remember a decrease in liabilities is a deemed distribution by the amount the liabilities decreased.

| Beginning Basis | |

| Contributions | + |

| Deemed Contributions | + |

| Income items | + |

| Tax-exempt income | + |

| Distributions | - |

| Deemed Distributions | - |

| Loss items | - |

| Non-deductible expenses | - |

| Ending Basis | = |

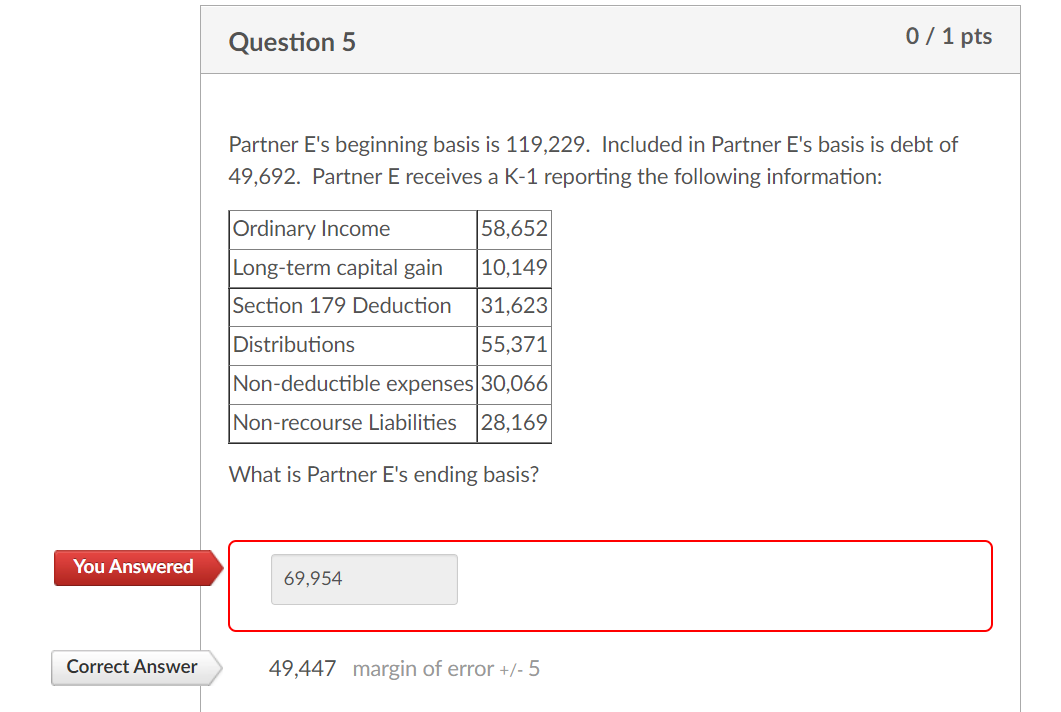

Question 5 0/1 pts Partner E's beginning basis is 119,229. Included in Partner E's basis is debt of 49,692. Partner E receives a K-1 reporting the following information: 58,652 Ordinary Income Long-term capital gain Section 179 Deduction 10,149 31,623 Distributions 55,371 Non-deductible expenses 30,066 Non-recourse Liabilities 28,169 What is Partner E's ending basis? You Answered 69,954 Correct Answer 49,447 margin of error +/- 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts