Question: I cannot figure out the numbers for part A, B, D, and F. Please show work! Analysis and Interpretation of Profitability Balance sheets and income

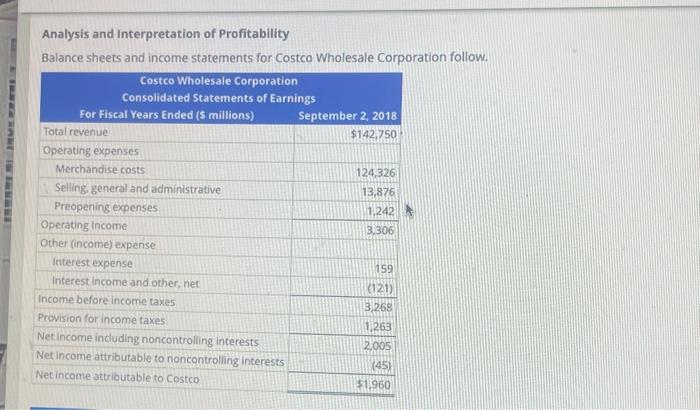

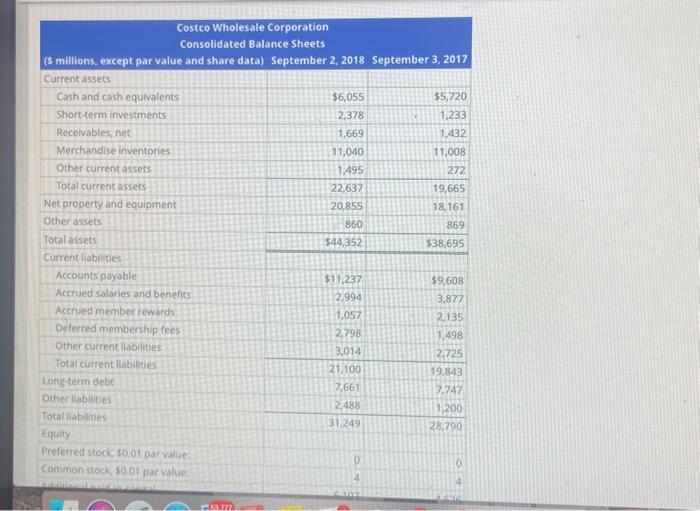

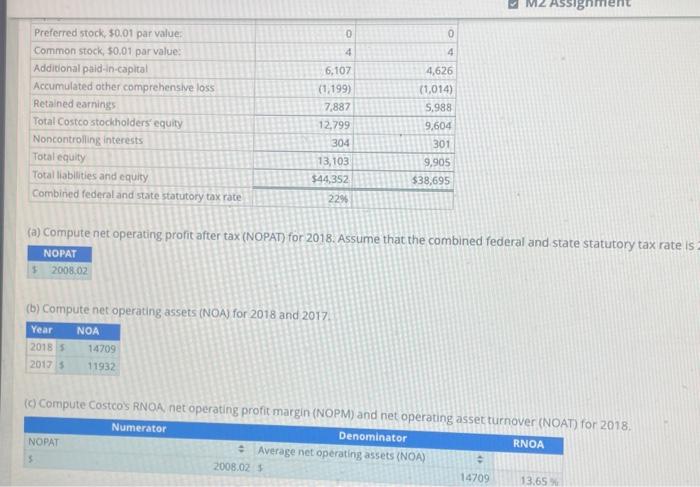

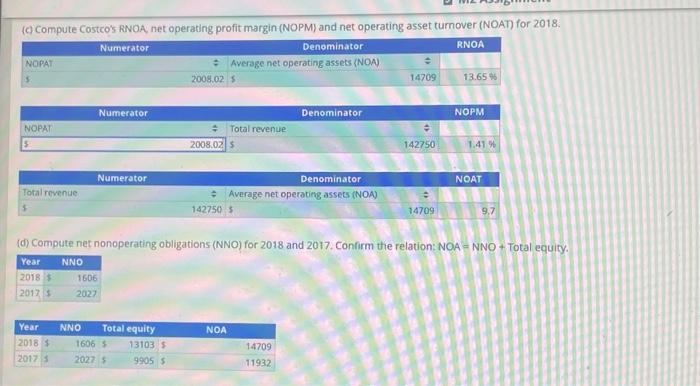

Analysis and Interpretation of Profitability Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation Consolidated Balance Sheets (s millions, except par value and share data) September 2, 2018 September 3, 2017 Equity Preferred stocks 50.01 par value Common stock 30,01 parvalue (a) Compute net operating profit after tax (NOPAT) for 2018. Assume that the combined federal and state statutory tax rate is (b) Compute net operating assets (NOA) for 2018 and 2017. (c) Compute Costcos RNOA net operating profit margin (NOPM) and net oDeratino accar (d) Compute net nonoperating obligations (NNO) for 2018 and 2017. Confirm the relation: NOA = NNO + Total equity. (d) Compute net nonoperating obligations (NNO) for 2018 and 2017 , Confirm the relation: NOA = NNO + Total equity, (e) Compute return on equity (ROE) for 2018 . (h) infer the nonoperating return component of ROE for 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts