Question: i cannot figure out this practice question can someone help me understand part a b and c split it i to two pictures so it

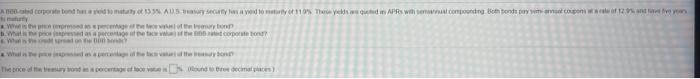

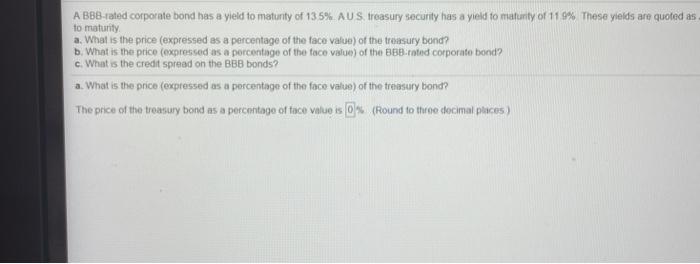

Acontent US to 110% There in APR will come on 2 Wapo Wonen where A BBB-rated corporate bond has a yield to matunity of 13 5% AUS treasury security has a yield to maturity of 119% These yields are quoted as to maturity a. What is the price (expressed as a percentage of the face value) of the treasury bond? b. What is the price (expressed as a porcentage of the face value) of the BBB-rated corporate bond? c. What is the credit spread on the BBB bonds? a. What is the price (expressed as a percentage of the face value) of the treasury bond? The price of the treasury bond as a percentage of face value is 0% (Round to these decimal places) ield to matunty of 11.99. These yields are quoted as APRs with semiannual compounding Both bonds pay semi-annual coupons at a rate of 12 9% and have five years bond? al places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts