Question: I cannot figure these two incorrect answers out. The Harris Company is the lessee on a four-year lease with the following payments at the end

I cannot figure these two incorrect answers out.

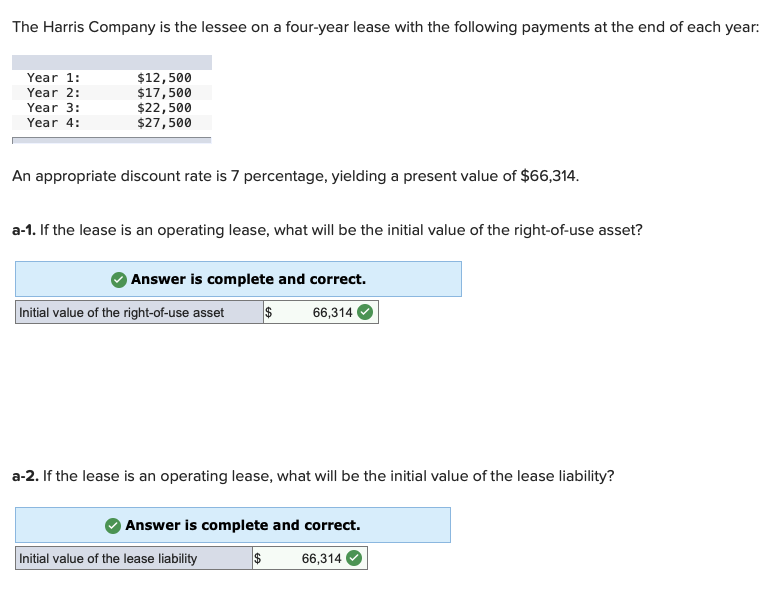

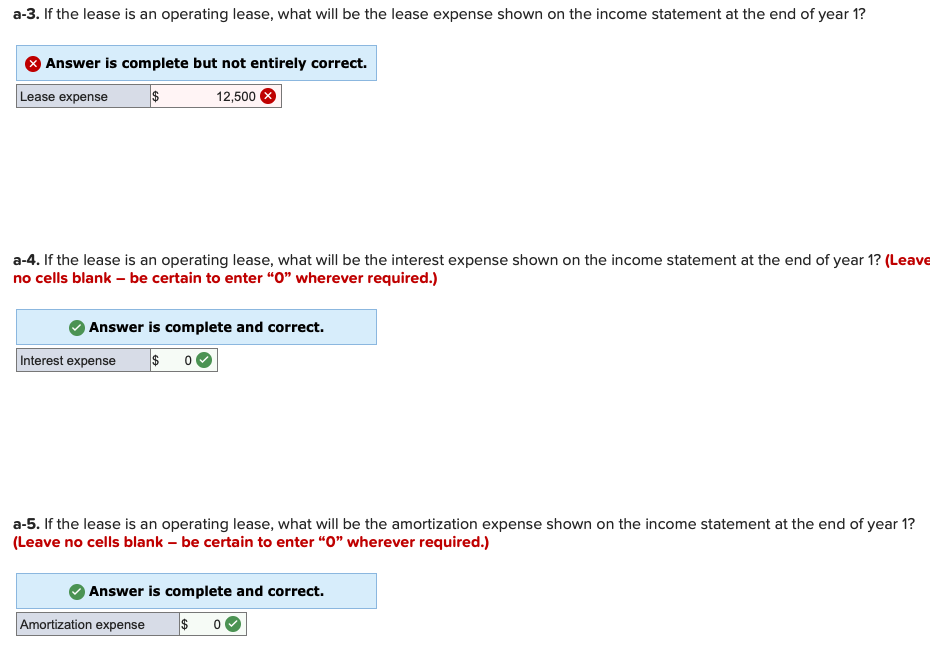

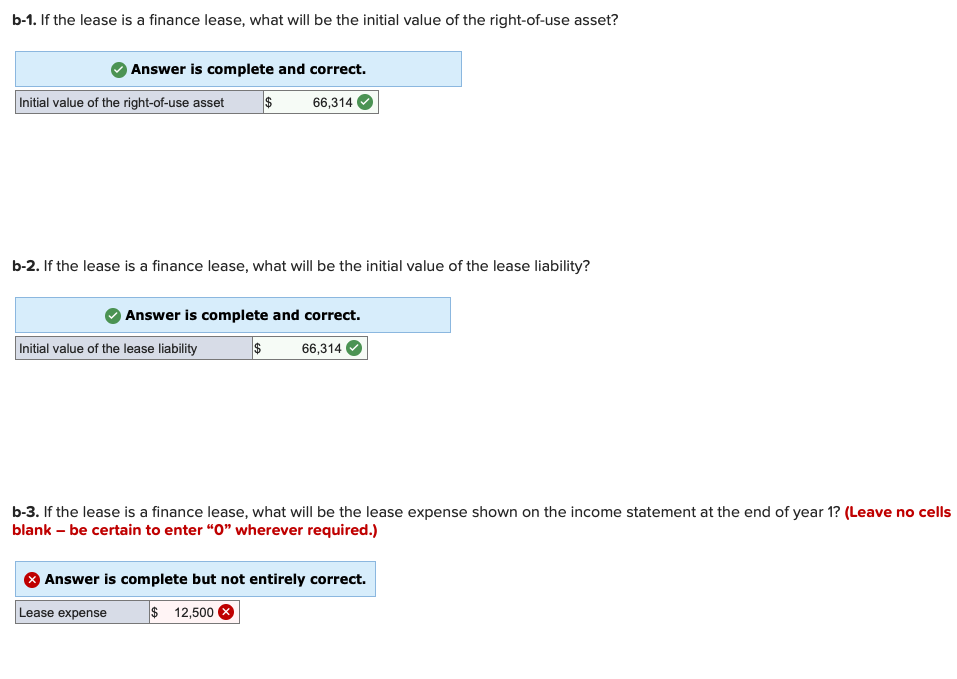

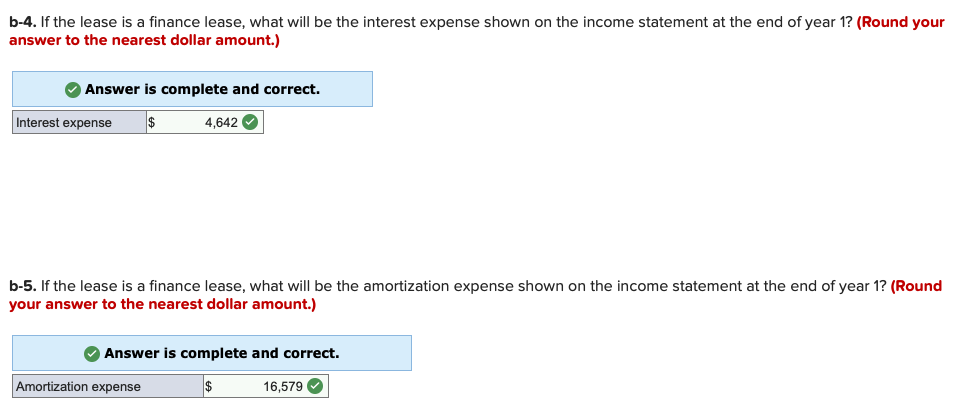

The Harris Company is the lessee on a four-year lease with the following payments at the end of each year: Year 1: Year 2: Year 3: Year 4: $12,500 $17,500 $22,500 $27,500 An appropriate discount rate is 7 percentage, yielding a present value of $66,314. a-1. If the lease is an operating lease, what will be the initial value of the right-of-use asset? Answer is complete and correct. Initial value of the right-of-use asset $ 66,314 a-2. If the lease is an operating lease, what will be the initial value of the lease liability? Answer is complete and correct. Initial value of the lease liability $ 66,314 a-3. If the lease is an operating lease, what will be the lease expense shown on the income statement at the end of year 1? Answer is complete but not entirely correct. Lease expense $ 12,500 a-4. If the lease is an operating lease, what will be the interest expense shown on the income statement at the end of year 1? (Leave no cells blank - be certain to enter "O" wherever required.) Answer is complete and correct. Interest expense $ 0 a-5. If the lease is an operating lease, what will be the amortization expense shown on the income statement at the end of year 1? (Leave no cells blank - be certain to enter "0" wherever required.) Answer is complete and correct. Amortization expense $ 0 b-1. If the lease is a finance lease, what will be the initial value of the right-of-use asset? Answer is complete and correct. Initial value of the right-of-use asset $ 66,314 b-2. If the lease is a finance lease, what will be the initial value of the lease liability? Answer is complete and correct. Initial value of the lease liability $ 66,314 b-3. If the lease is a finance lease, what will be the lease expense shown on the income statement at the end of year 1? (Leave no cells blank - be certain to enter "O" wherever required.) & Answer is complete but not entirely correct. Lease expense $ 12,500 b-4. If the lease is a finance lease, what will be the interest expense shown on the income statement at the end of year 1? (Round your answer to the nearest dollar amount.) Answer is complete and correct. Interest expense $ 4,642 b-5. If the lease is a finance lease, what will be the amortization expense shown on the income statement at the end of year 1? (Round your answer to the nearest dollar amount.) Answer is complete and correct. Amortization expense $ 16,579 The Harris Company is the lessee on a four-year lease with the following payments at the end of each year: Year 1: Year 2: Year 3: Year 4: $12,500 $17,500 $22,500 $27,500 An appropriate discount rate is 7 percentage, yielding a present value of $66,314. a-1. If the lease is an operating lease, what will be the initial value of the right-of-use asset? Answer is complete and correct. Initial value of the right-of-use asset $ 66,314 a-2. If the lease is an operating lease, what will be the initial value of the lease liability? Answer is complete and correct. Initial value of the lease liability $ 66,314 a-3. If the lease is an operating lease, what will be the lease expense shown on the income statement at the end of year 1? Answer is complete but not entirely correct. Lease expense $ 12,500 a-4. If the lease is an operating lease, what will be the interest expense shown on the income statement at the end of year 1? (Leave no cells blank - be certain to enter "O" wherever required.) Answer is complete and correct. Interest expense $ 0 a-5. If the lease is an operating lease, what will be the amortization expense shown on the income statement at the end of year 1? (Leave no cells blank - be certain to enter "0" wherever required.) Answer is complete and correct. Amortization expense $ 0 b-1. If the lease is a finance lease, what will be the initial value of the right-of-use asset? Answer is complete and correct. Initial value of the right-of-use asset $ 66,314 b-2. If the lease is a finance lease, what will be the initial value of the lease liability? Answer is complete and correct. Initial value of the lease liability $ 66,314 b-3. If the lease is a finance lease, what will be the lease expense shown on the income statement at the end of year 1? (Leave no cells blank - be certain to enter "O" wherever required.) & Answer is complete but not entirely correct. Lease expense $ 12,500 b-4. If the lease is a finance lease, what will be the interest expense shown on the income statement at the end of year 1? (Round your answer to the nearest dollar amount.) Answer is complete and correct. Interest expense $ 4,642 b-5. If the lease is a finance lease, what will be the amortization expense shown on the income statement at the end of year 1? (Round your answer to the nearest dollar amount.) Answer is complete and correct. Amortization expense $ 16,579

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts