Question: I cannot solve part B (the rest is fine)! Case 3 Dodge Products uses a job-costing system for its units, which pass from the Machining

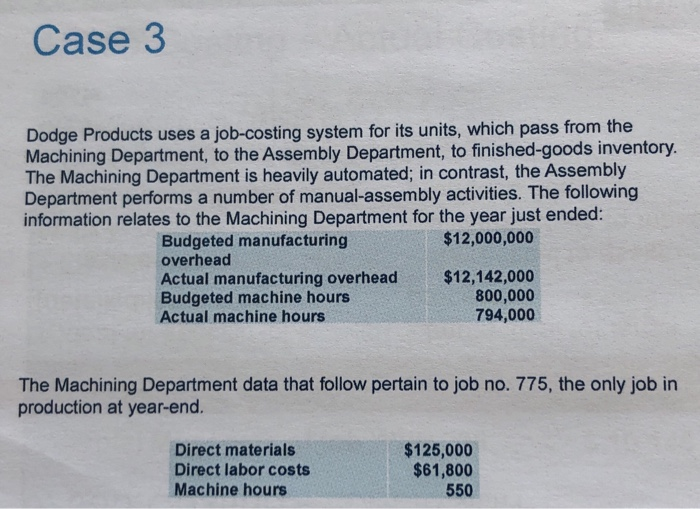

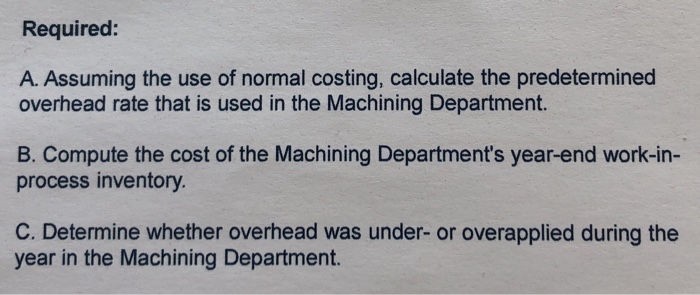

Case 3 Dodge Products uses a job-costing system for its units, which pass from the Machining Department, to the Assembly Department, to finished-goods inventory The Machining Department is heavily automated; in contrast, the Assembly Department performs a number of manual-assembly activities. The following information relates to the Machining Department for the year just ended: $12,000,000 Budgeted manufacturing overhead Actual manufacturing overhead Budgeted machine hours Actual machine hours $12,142,000 800,000 794,000 The Machining Department data that follow pertain to job no. 775, the only job in production at year-end. $125,000 $61,800 550 Direct materials Direct labor costs Machine hours Required: A. Assuming the use of normal costing, calculate the predetermined overhead rate that is used in the Machining Department. B. Compute the cost of the Machining Department's year-end work-in- process inventory. C. Determine whether overhead was under- or overapplied during the year in the Machining Department

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts