Question: I cannot use excel I am using a financial calculator. please explain the exact steps! thank you! Suppose you are evaluating a project for The

I cannot use excel I am using a financial calculator. please explain the exact steps! thank you!

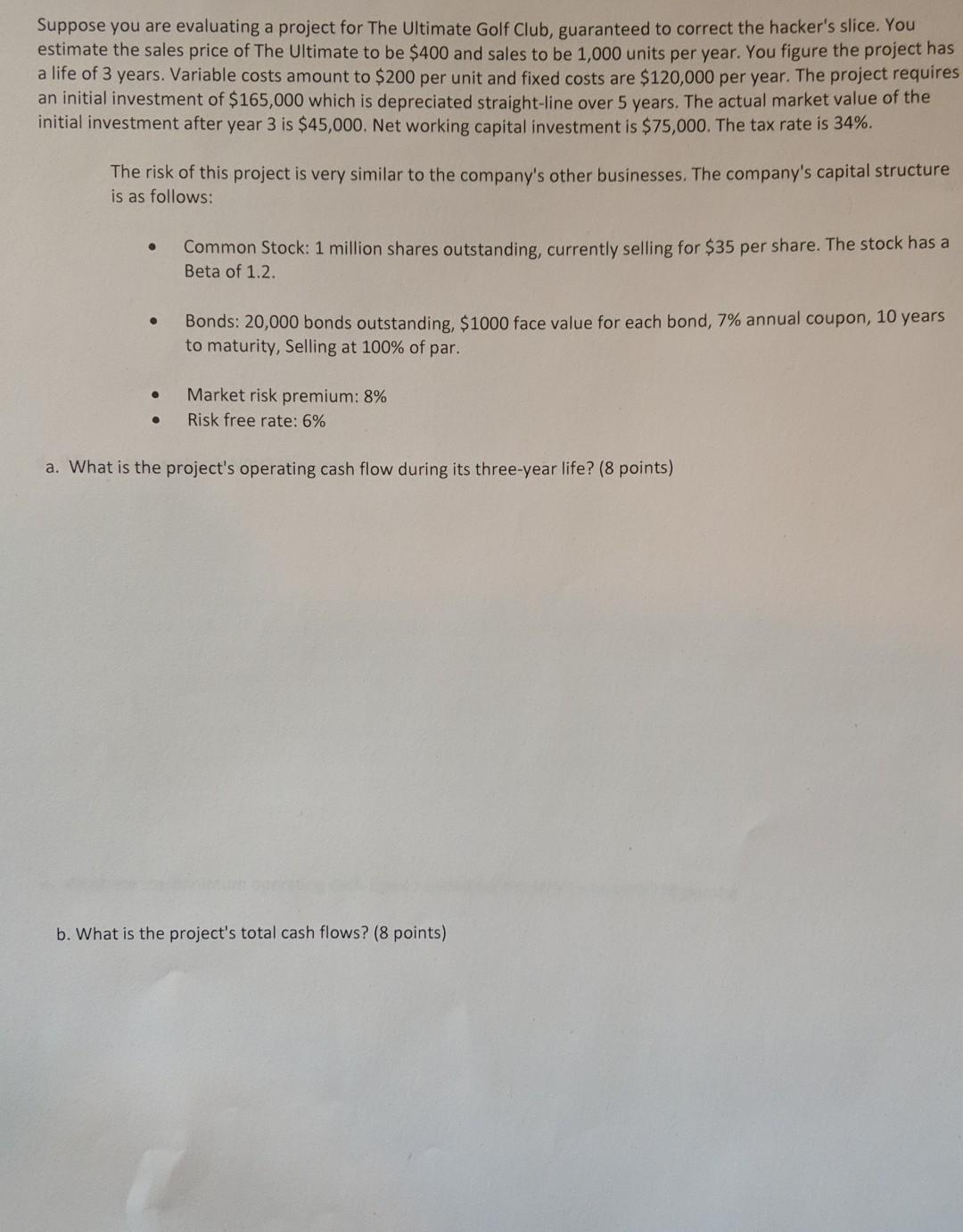

Suppose you are evaluating a project for The Ultimate Golf Club, guaranteed to correct the hacker's slice. You estimate the sales price of The Ultimate to be $400 and sales to be 1,000 units per year. You figure the project has a life of 3 years. Variable costs amount to $200 per unit and fixed costs are $120,000 per year. The project requires an initial investment of $165,000 which is depreciated straight-line over 5 years. The actual market value of the initial investment after year 3 is $45,000. Net working capital investment is $75,000. The tax rate is 34%. The risk of this project is very similar to the company's other businesses. The company's capital structure is as follows: Common Stock: 1 million shares outstanding, currently selling for $35 per share. The stock has a Beta of 1.2. Bonds: 20,000 bonds outstanding, $1000 face value for each bond, 7% annual coupon, 10 years to maturity, Selling at 100% of par. Market risk premium: 8% Risk free rate: 6% a. What is the project's operating cash flow during its three-year life? (8 points) b. What is the project's total cash flows? (8 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts