Question: I can't figure out c only. please help Entries for Investment in Bonds, Interest, and Sale of Bonds Gonzalez Company acquired $165,600 of Walker Co.,

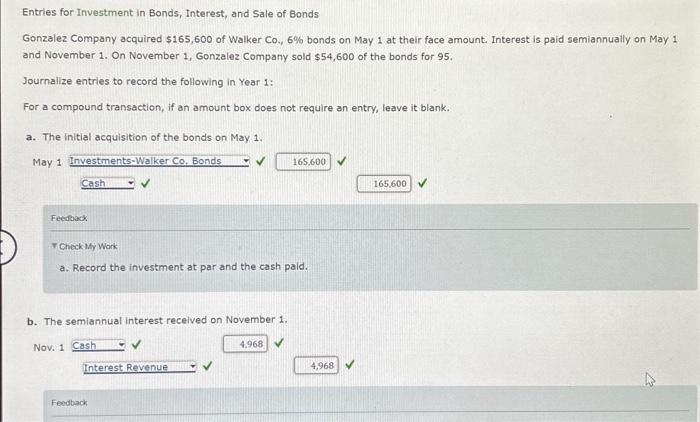

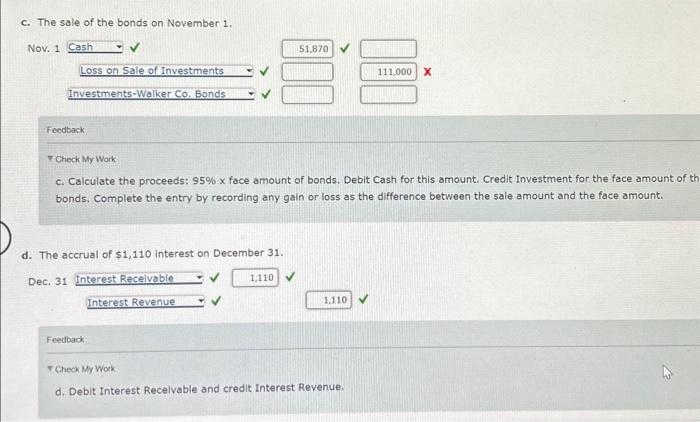

Entries for Investment in Bonds, Interest, and Sale of Bonds Gonzalez Company acquired $165,600 of Walker Co., 6% bonds on May 1 at their face amount. Interest is paid semiannually on May 1 and November 1. On November 1, Gonzalez Company sold $54,600 of the bonds for 95 . Journalize entries to record the following in Year 1 : For a compound transaction, if an amount box does not require an entry, leave it blank. a. The initial acquisition of the bonds on May 1. May 1 Feedoack T Check My Wark a. Record the investment at par and the cash paid. b. The semiannual interest received on November 1 . Nov. 1 TCheck My Work c. Calculate the proceeds: 95% face amount of bonds. Debit Cash for this amount. Credit Investment for the face amount of bonds. Complete the entry by recording any gain or loss as the difference between the sale amount and the face amount. d. The accrual of $1,110 interest on December 31 . Dec. 31 Feedback F Check My Work d. Debit Interest Recelvable and credit Interest Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts