Question: I cant figure out the number that's marked wrong. Required information [The following information applies to the questions displayed below.) Cammie received 100 NQOs (each

I cant figure out the number that's marked wrong.

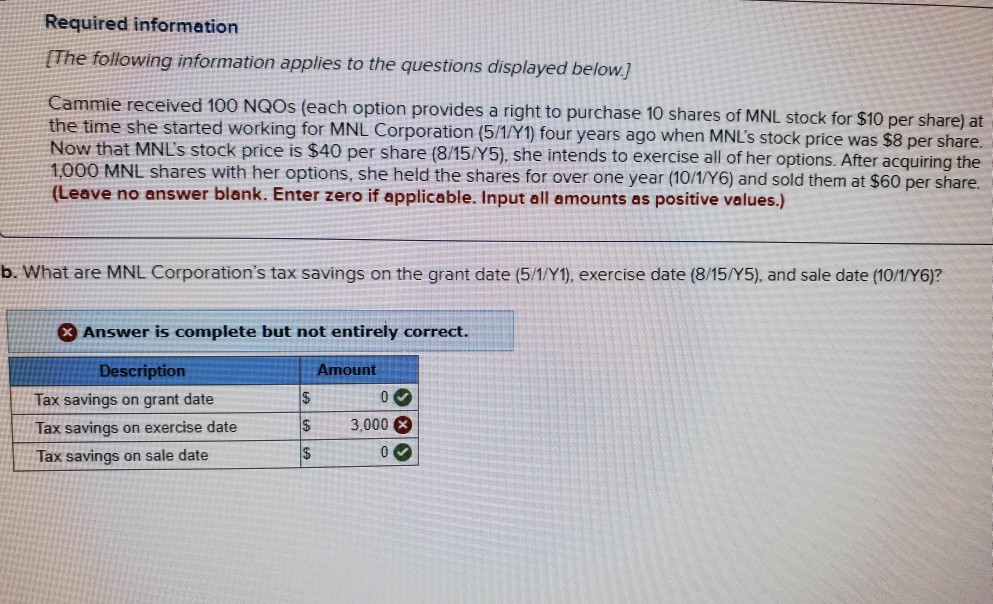

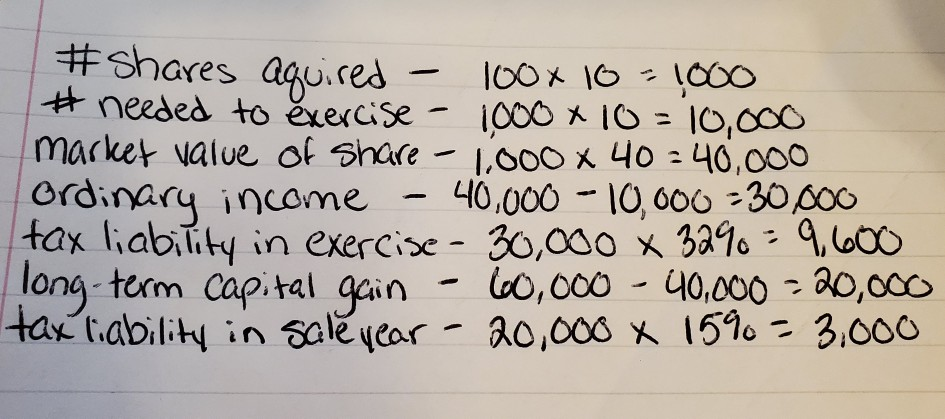

Required information [The following information applies to the questions displayed below.) Cammie received 100 NQOs (each option provides a right to purchase 10 shares of MNL stock for $10 per share) at the time she started working for MNL Corporation (5/1/Y1) four years ago when MNL's stock price was $8 per share. Now that MNL's stock price is $40 per share (8/15/Y5), she intends to exercise all of her options. After acquiring the 1,000 MNL shares with her options, she held the shares for over one year (10/1/Y6) and sold them at $60 per share. (Leave no answer blank. Enter zero if applicable. Input all amounts as positive values.) b. What are MNL Corporation's tax savings on the grant date (5/1/Y1), exercise date (8/15/Y5), and sale date (10/1/96)? & Answer is complete but not entirely correct. Amount 0 Description Tax savings on grant date Tax savings on exercise date Tax savings on sale date 3,000 0 # Shares aquired - 100 x 10-1000 #needed to exercise - 1000 x 10=10,000 market value of share - 1.000 x 40=40,000 ordinary income - 40,000 - 10,000 -30.000 tax liability in exercise - 30,000 X 32% 9,600 long-term capital gain - 600,000 - 40,000=20,000 tax liability in sale year - 20,000 X 15% = 3.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts