Question: I can't figure out the rest. Please only answer if you know how to do it :) Master It! Solution Using the table below, calculate

I can't figure out the rest. Please only answer if you know how to do it :)

I can't figure out the rest. Please only answer if you know how to do it :)

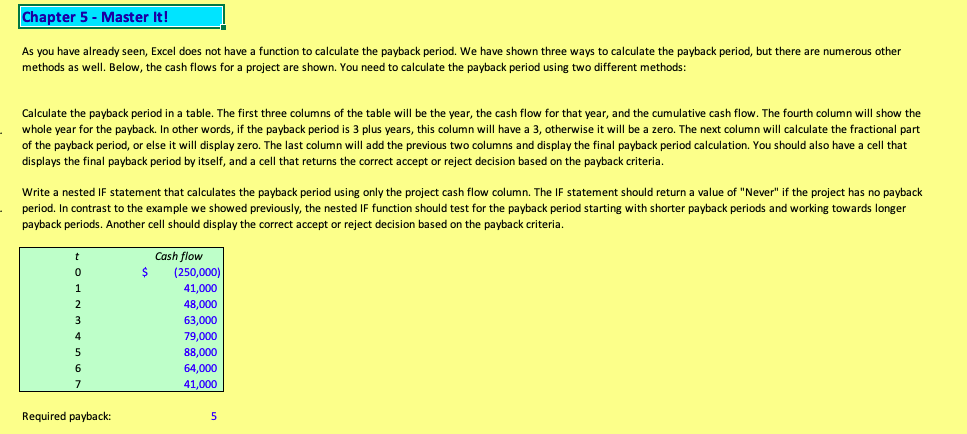

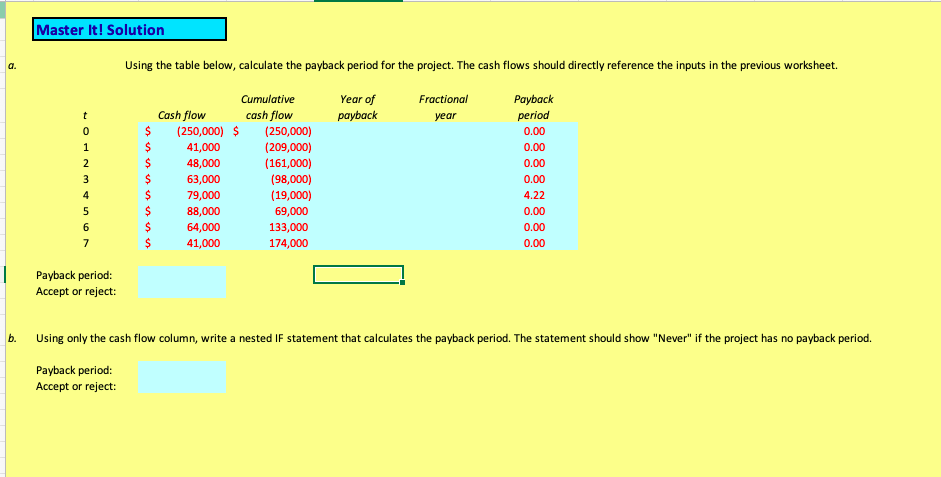

Master It! Solution Using the table below, calculate the payback period for the project. The cash flows should directly reference the inputs in the previous worksheet. a. Year of Fractional Payback Cash flow cash flow 000) (250,000) (209,000) ear (250,0 0.00 $41,000 $48,000 $63,000 $79,000 $88,000 $64,000 $41,000 0.00 (161,000) (98,000) (19,000) 0.00 0.00 4.22 69,000 0.00 133,000 0.00 174,000 0.00 Payback period: Accept or reject: b. Using only the cash flow column, write a nested IF statement that calculates the payback period. The statement should show "Never" if the project has no payback period. Payback period Accept or reject: Master It! Solution Using the table below, calculate the payback period for the project. The cash flows should directly reference the inputs in the previous worksheet. a. Year of Fractional Payback Cash flow cash flow 000) (250,000) (209,000) ear (250,0 0.00 $41,000 $48,000 $63,000 $79,000 $88,000 $64,000 $41,000 0.00 (161,000) (98,000) (19,000) 0.00 0.00 4.22 69,000 0.00 133,000 0.00 174,000 0.00 Payback period: Accept or reject: b. Using only the cash flow column, write a nested IF statement that calculates the payback period. The statement should show "Never" if the project has no payback period. Payback period Accept or reject

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts