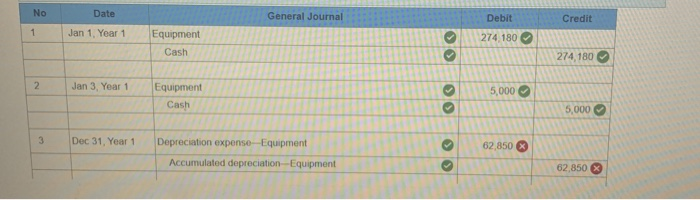

Question: i cant figure out what i am doing wrong No Date General Journal Debit Credit Jan 1. Year 1 274.180 Equipment Cash O 274, 180

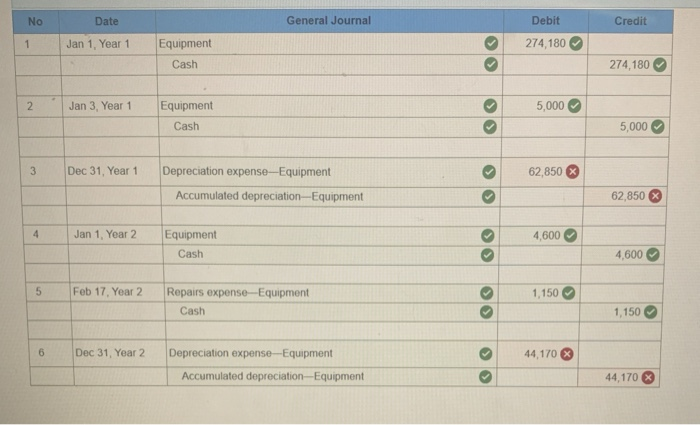

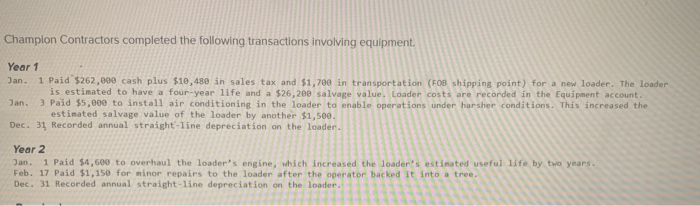

No Date General Journal Debit Credit Jan 1. Year 1 274.180 Equipment Cash O 274, 180 2 Jan 3, Year 1 > Equipment Cash 5,000 5,000 3 Dec 31, Year 1 62,850 Depreciation expense Equipment Accumulated depreciation - Equipment 62,850 No Date General Journal Debit Credit Jan 1, Year 1 274,180 Equipment Cash 274,180 2 Jan 3, Year 1 5,000 Equipment Cash 5,000 3 Dec 31, Year 1 62,850 Depreciation expense-Equipment Accumulated depreciation--Equipment 62,850 4 Jan 1, Year 2 4,600 Equipment Cash >> 4.600 5 Feb 17, Year 2 1,150 Repairs expense-Equipment Cash 1,150 6 Dec 31, Year 2 44,170 Depreciation expense-Equipment Accumulated depreciation-Equipment 44,170 Champion Contractors completed the following transactions involving equipment. Year 1 Jan. 1 Paid $262,000 cash plus $10,480 in sales tax and $1,700 in transportation (FOB shipping point for a new loader. The loader is estimated to have a four-year life and a $26,200 salvage value. Loader costs are recorded in the Equipment account. Jan. 3 Paid $5,000 to install air conditioning in the loader to enable operations under harsher conditions. This increased the estimated salvage value of the loader by another $1,500. Dec. 31 Recorded annual straight-line depreciation on the loader. Year 2 Jan. 1 Paid $4,600 to overhaul the loader's engine, which increased the loader's estimated useful life by two years. Feb. 17 Paid $1,150 for minor repairs to the loader after the operator backed it into a tree. Dec. 31 Recorded annual straight-line depreciation on the loader

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts