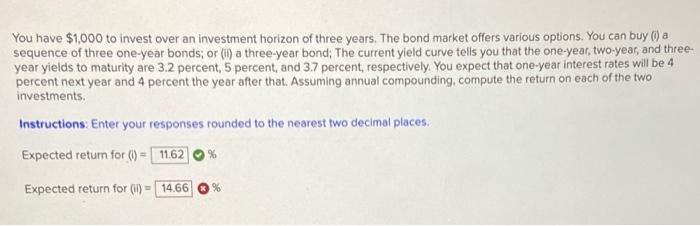

Question: i cant get the second answer. it says its wrong You have $1,000 to invest over an investment horizon of three years. The bond market

You have $1,000 to invest over an investment horizon of three years. The bond market offers various options. You can buy a sequence of three one-year bonds; or (l) a three-year bond: The current yield curve tells you that the one-year , two-year, and three- year yields to maturity are 3.2 percent, 5 percent, and 3.7 percent, respectively. You expect that one year interest rates will be 4 percent next year and 4 percent the year after that. Assuming annual compounding, compute the return on each of the two investments Instructions: Enter your responses rounded to the nearest two decimal places Expected return for (0) - 11.62 % Expected return for (1) 14.66

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts