Question: I can't understand why this question is still incorrect. Could someone please help? Answer is complete but not entirely correct. a. 4.95 b. 2.58 C.

I can't understand why this question is still incorrect. Could someone please help?

I can't understand why this question is still incorrect. Could someone please help?

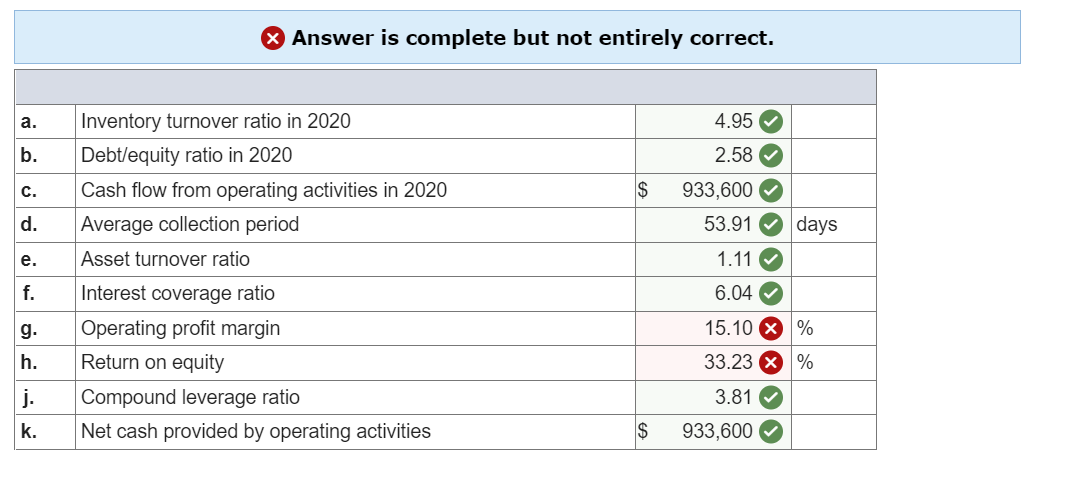

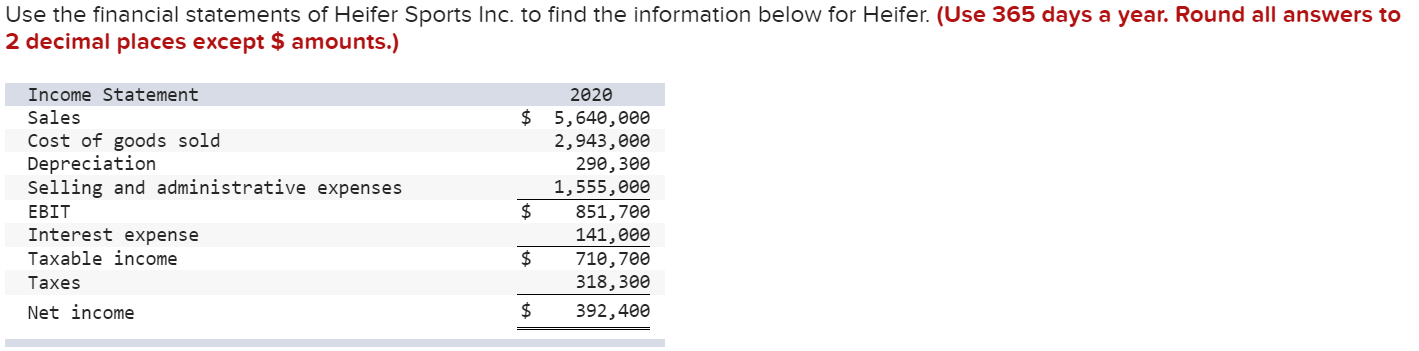

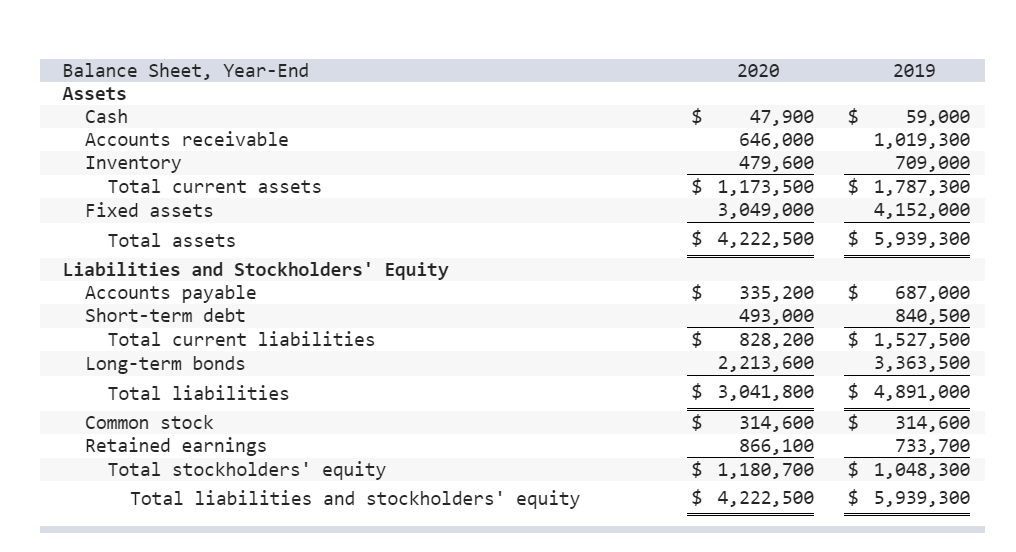

Answer is complete but not entirely correct. a. 4.95 b. 2.58 C. Inventory turnover ratio in 2020 Debt/equity ratio in 2020 Cash flow from operating activities in 2020 Average collection period Asset turnover ratio $ 933,600 53.91 d. days e. 1.11 f. 6.04 g. Interest coverage ratio Operating profit margin Return on equity Compound leverage ratio Net cash provided by operating activities 15.10 % 33.23 X % h. j. 3.81 k. $ 933,600 Use the financial statements of Heifer Sports Inc. to find the information below for Heifer. (Use 365 days a year. Round all answers to 2 decimal places except $ amounts.) Income Statement Sales Cost of goods sold Depreciation Selling and administrative expenses EBIT Interest expense Taxable income Taxes Net income 2020 $ 5,640,000 2,943,000 290, 300 1,555,000 $ 851,700 141,000 $ 710,700 318,300 $ 392,400 2020 2019 $ 47,900 646,000 479,600 $ 1,173,500 3,049,000 $ 4,222,500 $ 59,000 1,019,300 709,000 $ 1,787,300 4,152,000 $ 5,939,300 Balance Sheet, Year-End Assets Cash Accounts receivable Inventory Total current assets Fixed assets Total assets Liabilities and Stockholders' Equity Accounts payable Short-term debt Total current liabilities Long-term bonds Total liabilities Common stock Retained earnings Total stockholders' equity Total liabilities and stockholders' equity $ 335,200 493,000 $ 828, 200 2,213,600 $ 3,041,800 $ 314,600 866,100 $ 1,180,700 $ 4,222,500 $ 687,000 840,500 $ 1,527,500 3,363,500 $ 4,891,000 $ 314,600 733,700 $ 1,048,300 $ 5,939,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts