Question: I checked the answer, maximum CCA is $23,350, and the ending UCC is $130,650, but I don't know how to get them. Can you help

I checked the answer, maximum CCA is $23,350, and the ending UCC is $130,650, but I don't know how to get them. Can you help me with that please?

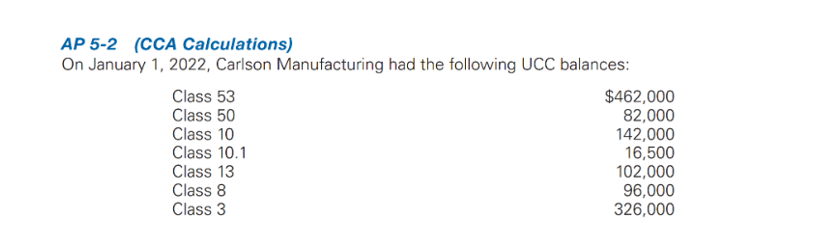

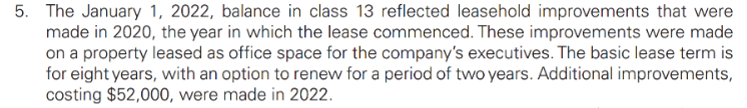

AP 5-2 (CCA Calculations) On January 1, 2022, Carlson Manufacturing had the following UCC balances: 5. The January 1, 2022, balance in class 13 reflected leasehold improvements that were made in 2020, the year in which the lease commenced. These improvements were made on a property leased as office space for the company's executives. The basic lease term is for eight years, with an option to renew for a period of two years. Additional improvements, costing $52,000, were made in 2022 . Required: Calculate the maximum CCA that can be claimed by Carlson Manufacturing on each class of property for the taxation year ending December 31, 2022. In addition, calculate the UCC for each class as of January 1, 2023, and determine the amount of any capital gains, recapture, or terminal loss. Ignore GST/HST \& PST considerations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts