Question: I completed the first part need help with the last two Problem 3-5A Ayala Architects incorporated as licensed architects on April 1, 2017. During the

I completed the first part need help with the last two

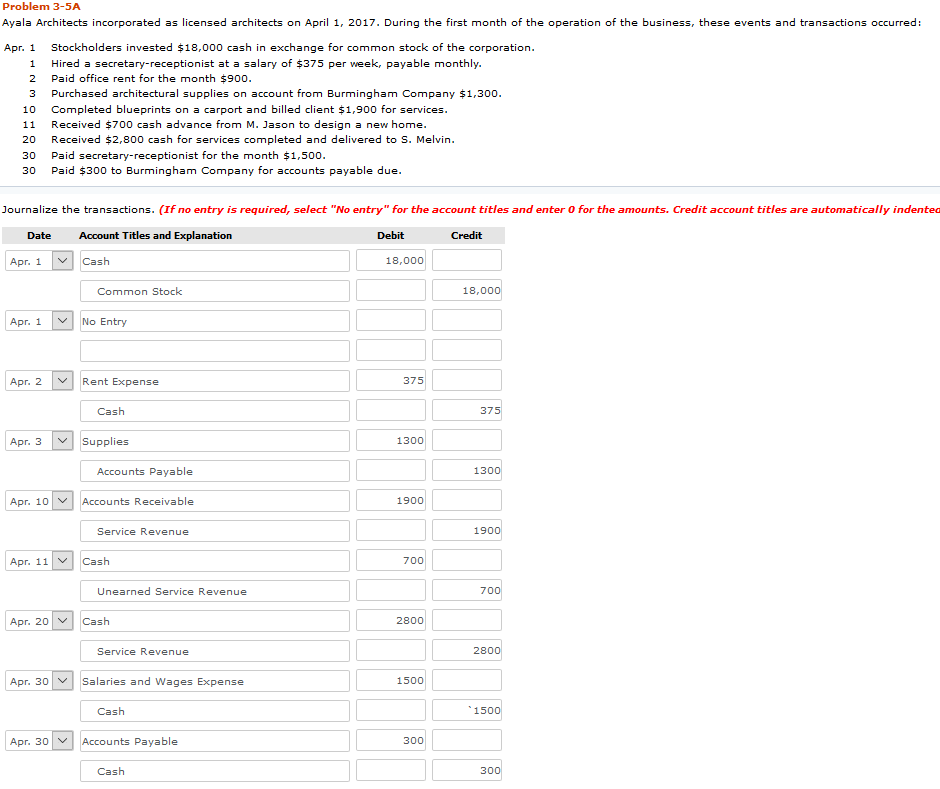

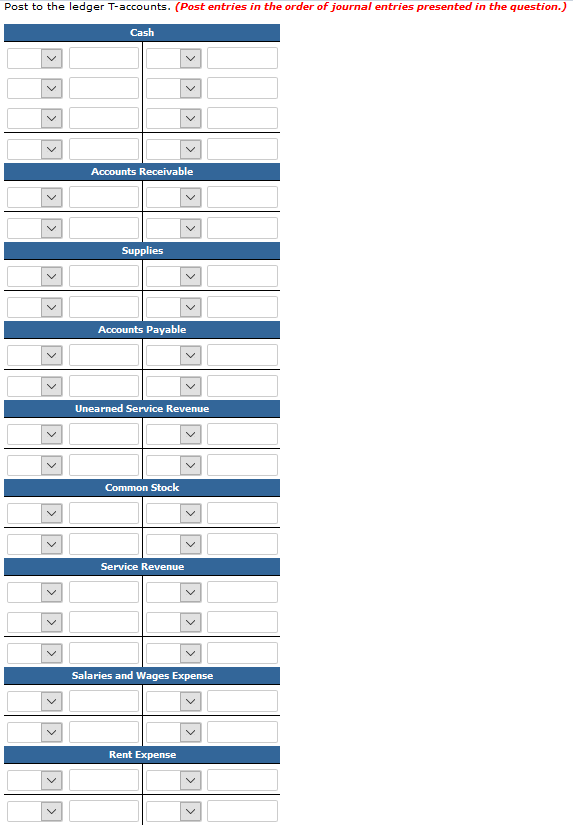

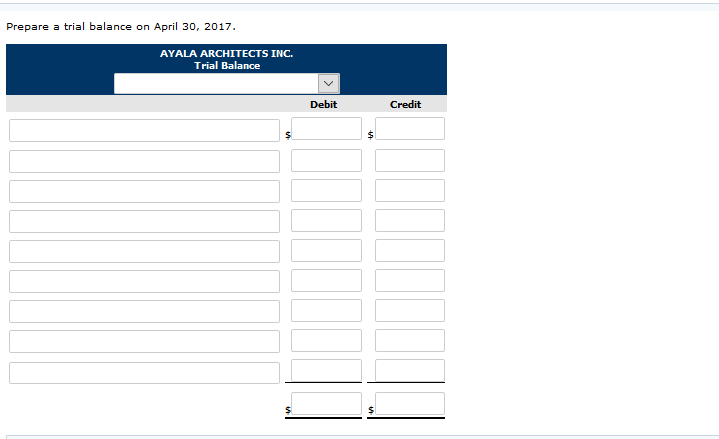

Problem 3-5A Ayala Architects incorporated as licensed architects on April 1, 2017. During the first month of the operation of the business, these events and transactions occurred: Apr. 1 Stockholders invested 18,000 cash in exchange for common stock of the corporation 1 2 3 Purchased architectural supplies on account from Burmingham Company $1,300 Hired a secretary-receptionist at a salary of $375 per week, payable monthly Paid office rent for the month $900 10 Completed blueprints on a carport and billed client $1,900 for services 11 Received $700 cash advance from M. Jason to design a new home 20 Received $2,800 cash for services completed and delivered to S. Melvin 30 Paid secretary-receptionist for the month $1,500 30 Paid $300 to Burmingham Company for accounts payable due Journalize the transactions. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indentea Date Account Titles and Explanation Debit Credit Apr. 1Cash 18,000 Common Stock 18 Apr. 1No Entry Apr. 2Rent Expense 375 Cash 37 Apr. 3Supplies 1300 Accounts Payable 130 Apr. 10Accounts Receivable 1900 Service Revenue Apr. 11 Cash 700 Unearned Service Revenue 70 Apr. 20Cash 2800 Service Revenue 28 Apr. 30Salaries and Wages Expense 1500 Cash 150 Apr. 30Accounts Payable 300 Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts