Question: I completed the question. Can someone please check my work. Thank you! Required information [The following information applies to the questions displayed below.] Lehighton Chalk

I completed the question. Can someone please check my work. Thank you!

Required information

[The following information applies to the questions displayed below.]

Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $22 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Lehightons first two years of operation is as follows:

| Year 1 | Year 2 | ||||||

| Sales (in units) | 3,000 | 3,000 | |||||

| Production (in units) | 3,600 | 2,400 | |||||

| Production costs: | |||||||

| Variable manufacturing costs | $ | 15,480 | $ | 10,320 | |||

| Fixed manufacturing overhead | 19,080 | 19,080 | |||||

| Selling and administrative costs: | |||||||

| Variable | 12,000 | 12,000 | |||||

| Fixed | 11,000 | 11,000 | |||||

Selected information from Lehightons year-end balance sheets for its first two years of operation is as follows:

| LEHIGHTON CHALK COMPANY | ||||||

| Selected Balance Sheet Information | ||||||

| Based on absorption costing | End of Year 1 | End of Year 2 | ||||

| Finished-goods inventory | $ | 5,760 | $ | 0 | ||

| Retained earnings | 8,700 | 13,840 | ||||

| Based on variable costing | End of Year 1 | End of Year 2 | ||||

| Finished-goods inventory | $ | 2,580 | $ | 0 | ||

| Retained earnings | 5,520 | 13,840 | ||||

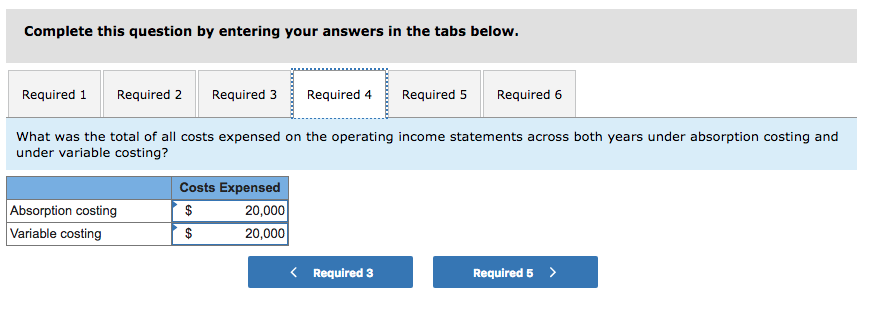

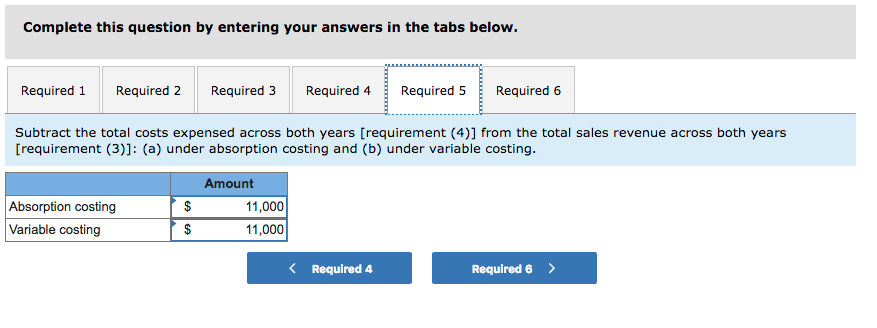

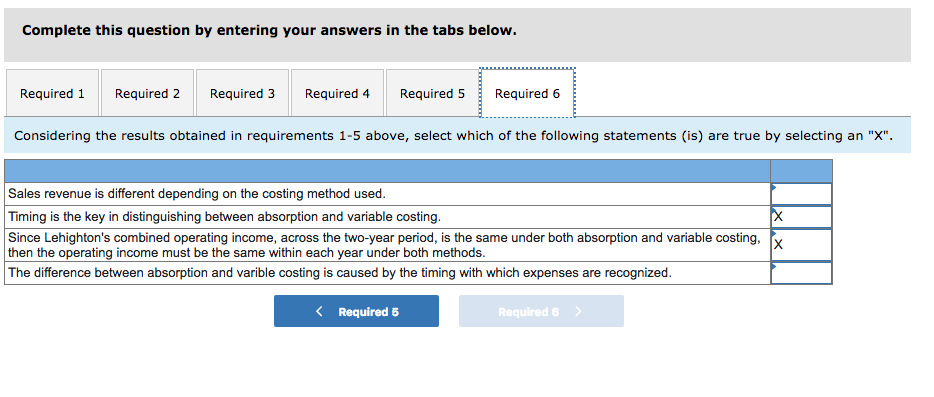

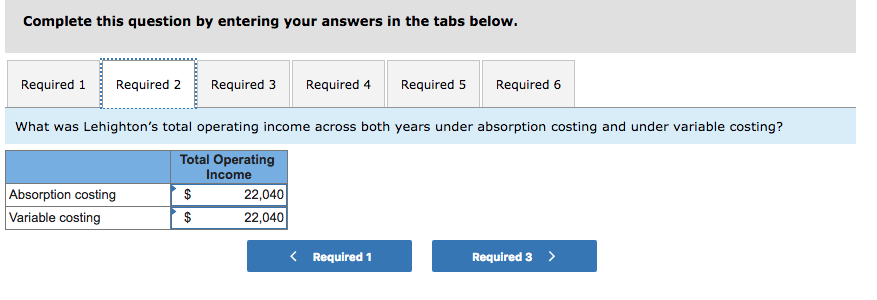

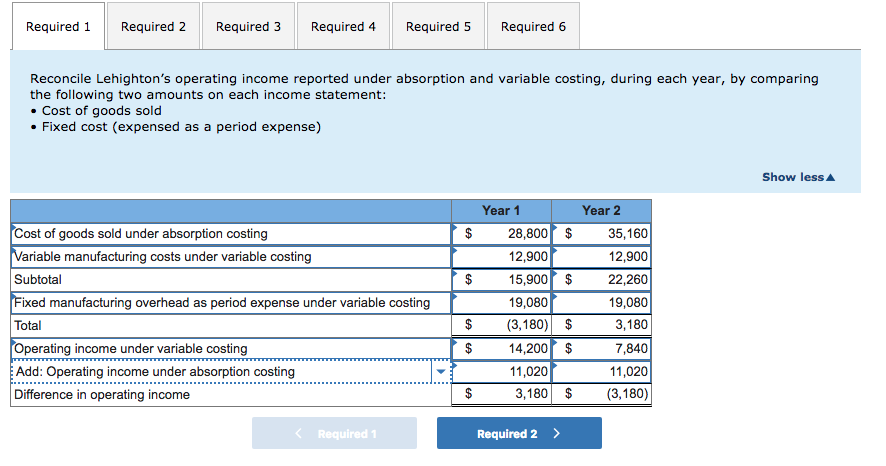

| Required: Reconcile Lehightons operating income reported under absorption and variable costing, during each year, by comparing the following two amounts on each income statement: Cost of goods sold Fixed cost (expensed as a period expense) What was Lehightons total operating income across both years under absorption costing and under variable costing? What was the total sales revenue across both years under absorption costing and under variable costing? What was the total of all costs expensed on the operating income statements across both years under absorption costing and under variable costing? Subtract the total costs expensed across both years [requirement (4)] from the total sales revenue across both years [requirement (3)]: (a) under absorption costing and (b) under variable costing. Considering the results obtained in requirements 1-5 above, select which of the following statements (is) are true by selecting an "X".

| ||||||

Required 1Required 2 Required 3 Required 4Required 5 Required 6 Reconcile Lehighton's operating income reported under absorption and variable costing, during each year, by comparing the following two amounts on each income statement . Cost of goods sold . Fixed cost (expensed as a period expense) Show less Year 1 Year 2 Cost of goods sold under absorption costing 28,800 $ 12,900 35,160 12,900 15,900 22,260 19,080 3,180 7,840 11,020 3,180$(3,180) riable manufacturing costs under variable costing Subtotal ixed manufacturing overhead as period expense under variable costing Total 19,080 $(3,180)$ 14,200 $ erating income under variable costing Add: Operating income under absorption costing Difference in operating income 11,020 Required 2>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts

![Required information [The following information applies to the questions displayed below.] Lehighton](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66de73c06a783_65666de73c007f9e.jpg)