Question: I completely understand the calculation process . However, I wonder why the correct answer is C ( borrow debt and buy shares), but not D

I completely understand the calculation process.

However, I wonder why the correct answer is C (borrow debt and buy shares), but not D (lend debt and sell shares)?

Please do NOT calculate the question again. I know how to get the figures. I'm just confused with borrow/lending and buying/selling part. Thank you.

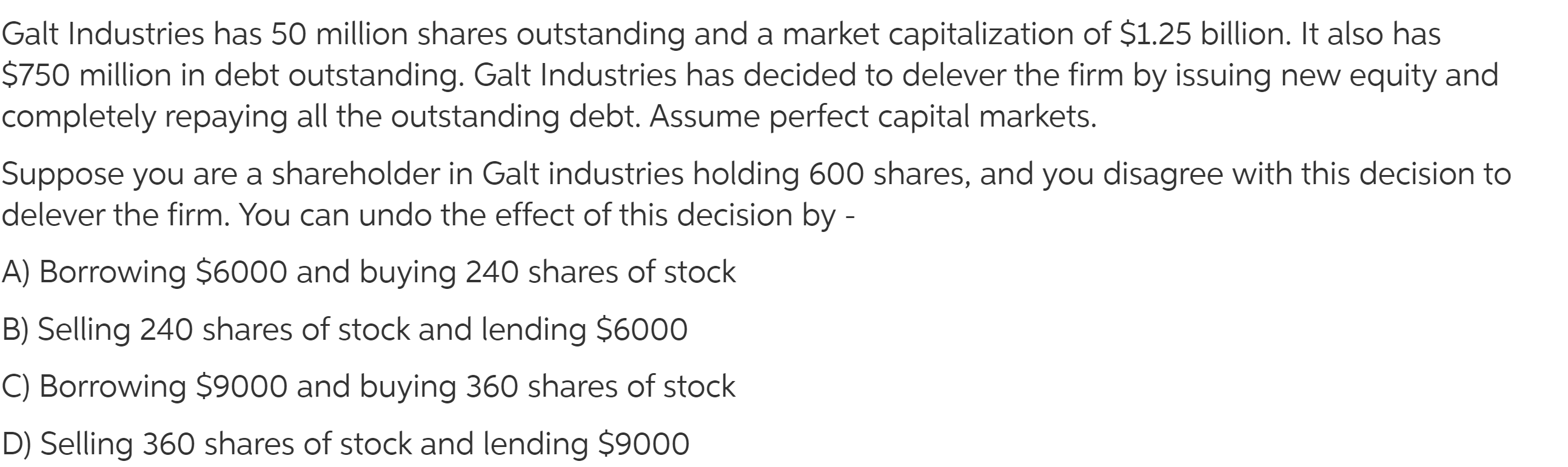

Galt Industries has 50 million shares outstanding and a market capitalization of $1.25 billion. It also has $750 million in debt outstanding. Galt Industries has decided to delever the firm by issuing new equity and completely repaying all the outstanding debt. Assume perfect capital markets. Suppose you are a shareholder in Galt industries holding 600 shares, and you disagree with this decision to delever the firm. You can undo the effect of this decision by - A) Borrowing $6000 and buying 240 shares of stock B) Selling 240 shares of stock and lending $6000 C) Borrowing $9000 and buying 360 shares of stock D) Selling 360 shares of stock and lending $9000 Ans: option c Explanation: share price = $25 value of equity = 25 x 600 =$15000 = = * Galt's pre-delevered Debt/Equity = 60 for every $1 equity need $0.60 debt, so you need to borrow $0.60 x $15000= $,9000 and then buy $9000/$25 = 360 more shares of stock =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts