Question: (i) Construct the NPV profiles of Projects A and B from the given NPV values of the two projects at various discount rates: Discount Rate

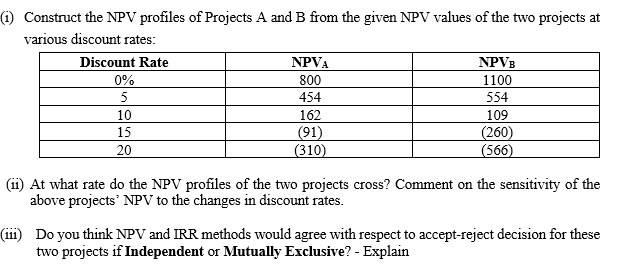

(i) Construct the NPV profiles of Projects A and B from the given NPV values of the two projects at various discount rates: Discount Rate NPVA NPVB 0% 800 1100 5 454 554 10 162 109 15 (91) (260) 20 (310) (566) (ii) At what rate do the NPV profiles of the two projects cross? Comment on the sensitivity of the above projects NPV to the changes in discount rates. (iii) Do you think NPV and IRR methods would agree with respect to accept-reject decision for these two projects if Independent or Mutually Exclusive? - Explain

(i) Construct the NPV profiles of Projects A and B from the given NPV values of the two projects at various discount rates: Discount Rate NPVA NPVB 0% 800 1100 5 454 554 10 162 109 15 (91) (260) 20 (310) (566) (ii) At what rate do the NPV profiles of the two projects cross? Comment on the sensitivity of the above projects NPV to the changes in discount rates. (iii) Do you think NPV and IRR methods would agree with respect to accept-reject decision for these two projects if Independent or Mutually Exclusive? - Explain

(1) Construct the NPV profiles of Projects A and B from the given NPV values of the two projects at various discount rates: Discount Rate NPVA NPV 800 1100 5 454 554 10 162 109 15 (91) (260) 20 (310) (566) 0% At what rate do the NPV profiles of the two projects cross? Comment on the sensitivity of the above projects' NPV to the changes in discount rates. (111) Do you think NPV and IRR methods would agree with respect to accept-reject decision for these two projects if Independent or Mutually Exclusive? - Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts