Question: 5. DURATION OF INVERSE FLOATERS Assume that LIBOR rates are risk free. Suppose you have a 10 year note that pays a quarterly coupon

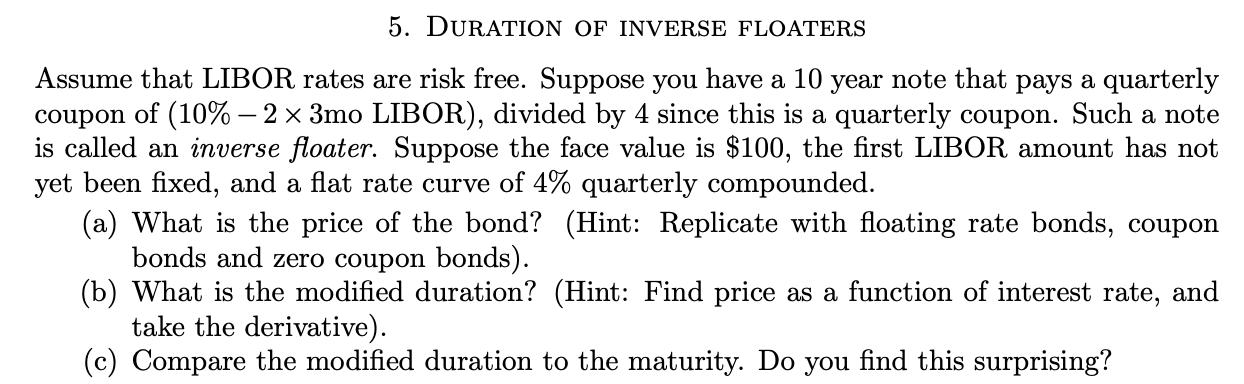

5. DURATION OF INVERSE FLOATERS Assume that LIBOR rates are risk free. Suppose you have a 10 year note that pays a quarterly coupon of (10% - 2 3mo LIBOR), divided by 4 since this is a quarterly coupon. Such a note is called an inverse floater. Suppose the face value is $100, the first LIBOR amount has not yet been fixed, and a flat rate curve of 4% quarterly compounded. (a) What is the price of the bond? (Hint: Replicate with floating rate bonds, coupon bonds and zero coupon bonds). (b) What is the modified duration? (Hint: Find price as a function of interest rate, and take the derivative). (c) Compare the modified duration to the maturity. Do you find this surprising?

Step by Step Solution

There are 3 Steps involved in it

To address the questions about the inverse floater bond well go through each part step by step 1 Understanding the Inverse Floater Bond Coupon Payment The bond pays a quarterly coupon of 10 2 3moLIBOR ... View full answer

Get step-by-step solutions from verified subject matter experts