Question: I could really use some help on this question. PLease show the work in excel. Thank you. Question 12 3 pts St David's North Austin

I could really use some help on this question. PLease show the work in excel. Thank you.

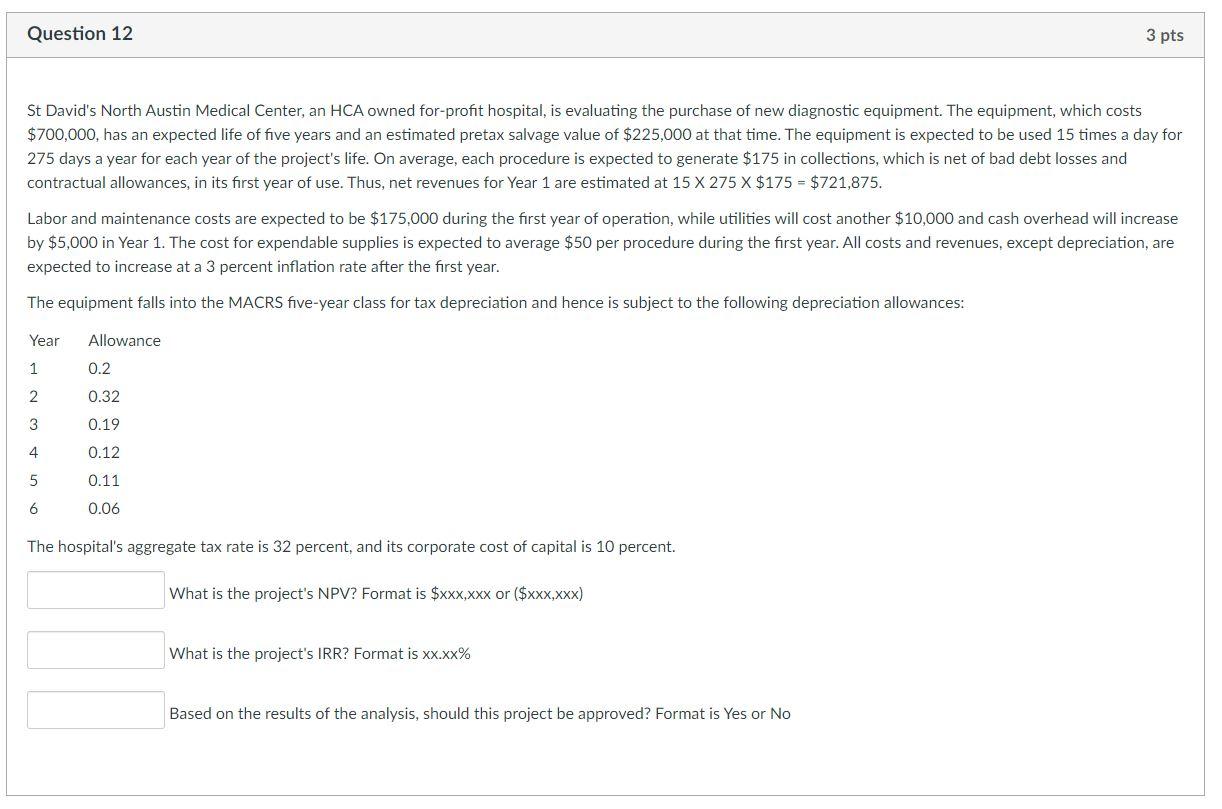

Question 12 3 pts St David's North Austin Medical Center, an HCA owned for-profit hospital, is evaluating the purchase of new diagnostic equipment. The equipment, which costs $700,000, has an expected life of five years and an estimated pretax salvage value of $225,000 at that time. The equipment is expected to be used 15 times a day for 275 days a year for each year of the project's life. On average, each procedure is expected to generate $175 in collections, which is net of bad debt losses and contractual allowances, in its first year of use. Thus, net revenues for Year 1 are estimated at 15 X 275 X $175 - $721,875. Labor and maintenance costs are expected to be $175,000 during the first year of operation, while utilities will cost another $10,000 and cash overhead will increase by $5,000 in Year 1. The cost for expendable supplies is expected to average $50 per procedure during the first year. All costs and revenues, except depreciation, are expected to increase at a 3 percent inflation rate after the first year. The equipment falls into the MACRS five-year class for tax depreciation and hence is subject to the following depreciation allowances: Year Allowance 1 0.2 0.32 2 3 0.19 4 0.12 5 0.11 6 0.06 The hospital's aggregate tax rate is 32 percent, and its corporate cost of capital is 10 percent. What is the project's NPV? Format is $xxx,xxx or ($xxx,xxx) What is the project's IRR? Format is xx.xx% Based on the results of the analysis, should this project be approved? Format is Yes or No

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts