Question: I could use help mostly with part B. Problem 24 points) a. Suppose the interest rate in Taiwan is 4% and forecast Taiwanese inflation is

I could use help mostly with part B.

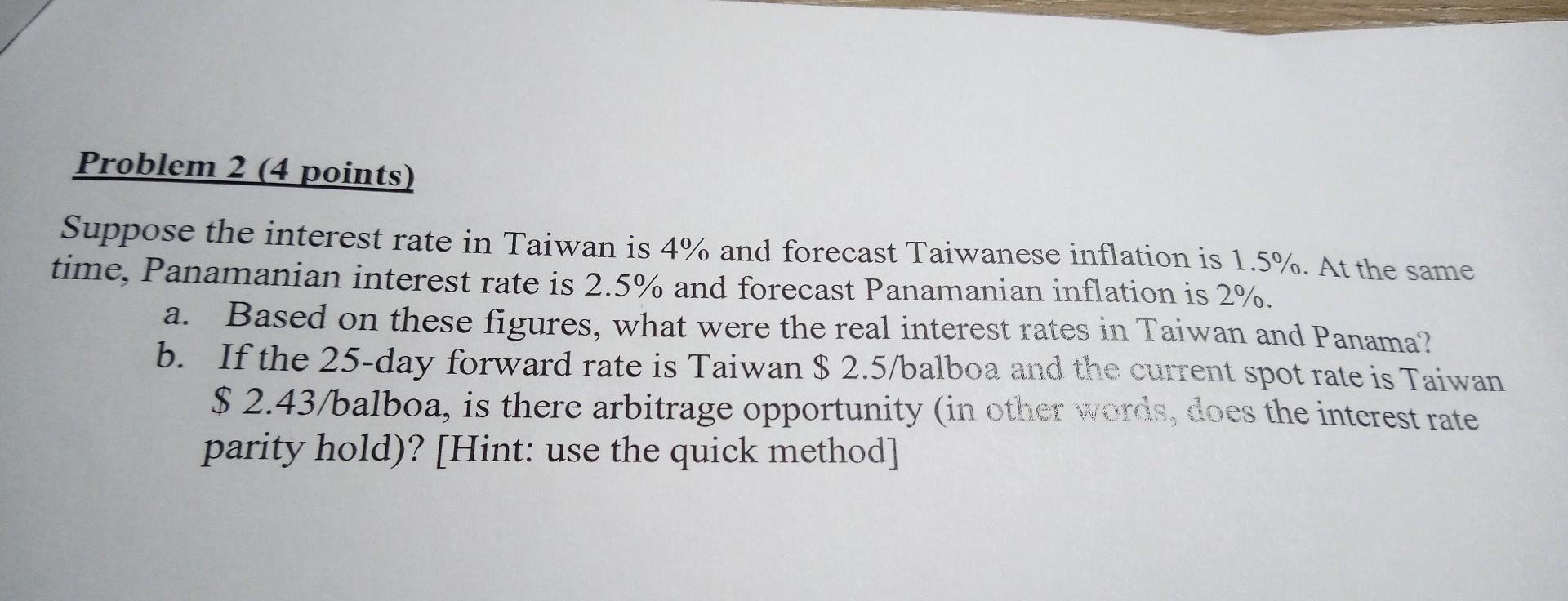

Problem 24 points) a. Suppose the interest rate in Taiwan is 4% and forecast Taiwanese inflation is 1.5%. At the same time, Panamanian interest rate is 2.5% and forecast Panamanian inflation is 2%. Based on these figures, what were the real interest rates in Taiwan and Panama? b. If the 25-day forward rate is Taiwan $ 2.5/balboa and the current spot rate is Taiwan $ 2.43/balboa, is there arbitrage opportunity (in other words, does the interest rate parity hold)? [Hint: use the quick method]

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock