Question: i couldnt get the right answer. im at a total loss. Company J bought a piece of equipment for $270,000. This equipment has a useful

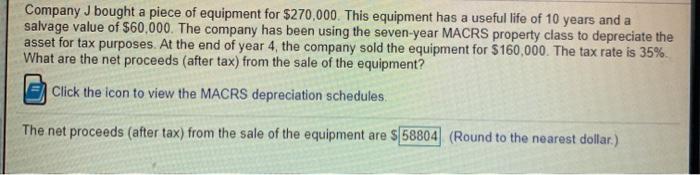

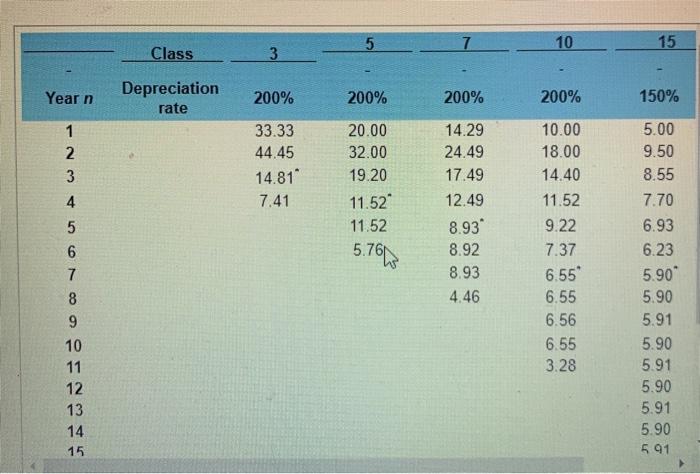

Company J bought a piece of equipment for $270,000. This equipment has a useful life of 10 years and a salvage value of $60,000. The company has been using the seven-year MACRS property class to depreciate the asset for tax purposes. At the end of year 4, the company sold the equipment for $160,000. The tax rate is 35% What are the net proceeds (after tax) from the sale of the equipment? Click the icon to view the MACRS depreciation schedules The net proceeds (after tax) from the sale of the equipment are $(58804 (Round to the nearest dollar.) 5 10 15 Class 3 Year n Depreciation rate 200% 200% 200% 200% 150% 1 2 3 4 33.33 44.45 14.81 7.41 20.00 32.00 19.20 11.52 11.52 10.00 18.00 14.40 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 5.766 5 6 7 8 9 10 11 12 13 14 15. 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts