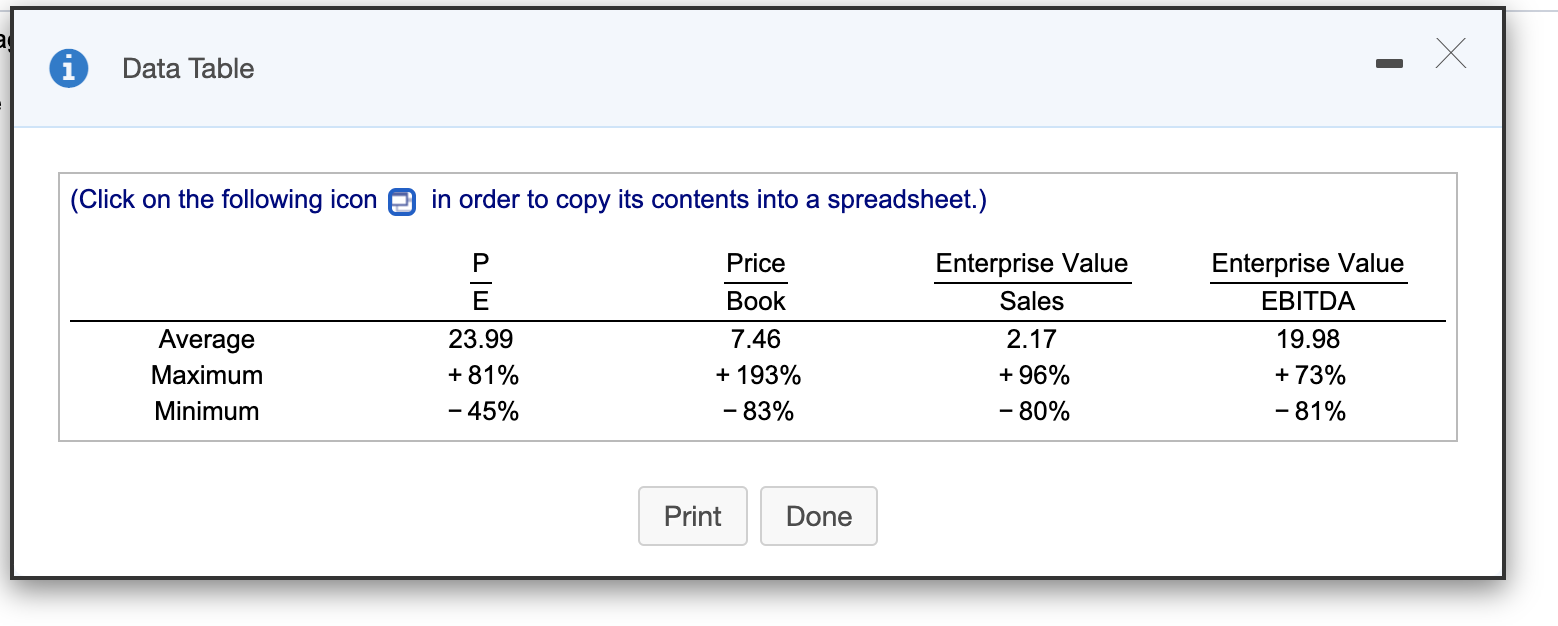

Question: i Data Table (Click on the following icon e in order to copy its contents into a spreadsheet.) P Price Enterprise Value Enterprise Value E

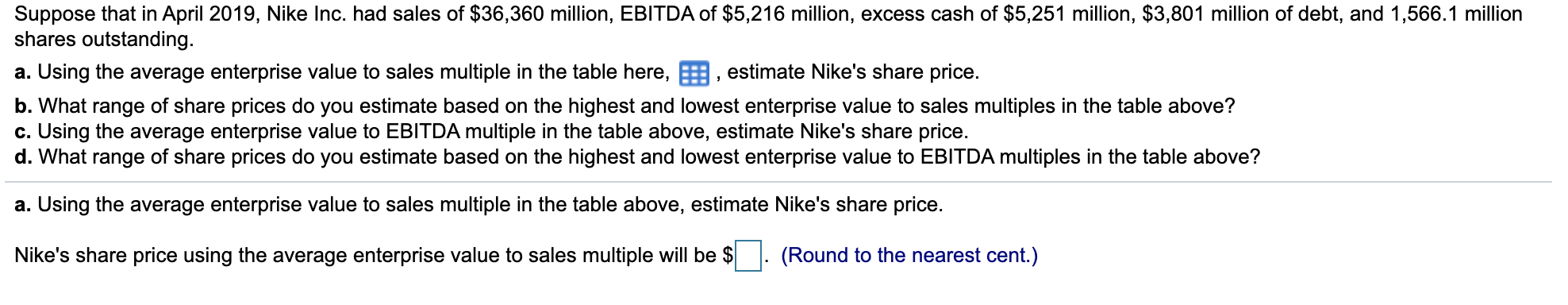

i Data Table (Click on the following icon e in order to copy its contents into a spreadsheet.) P Price Enterprise Value Enterprise Value E Book Sales EBITDA 23.99 7.46 2.17 19.98 Average Maximum + 81% + 193% + 96% + 73% Minimum - 45% - 83% - 80% -81% Print Done Suppose that in April 2019, Nike Inc. had sales of $36,360 million, EBITDA of $5,216 million, excess cash of $5,251 million, $3,801 million of debt, and 1,566.1 million shares outstanding. a. Using the average enterprise value to sales multiple in the table here, E, estimate Nike's share price. b. What range of share prices do you estimate based on the highest and lowest enterprise value to sales multiples in the table above? c. Using the average enterprise value to EBITDA multiple in the table above, estimate Nike's share price. d. What range of share prices do you estimate based on the highest and lowest enterprise value to EBITDA multiples in the table above? a. Using the average enterprise value to sales multiple in the table above, estimate Nike's share price. Nike's share price using the average enterprise value to sales multiple will be $ (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts