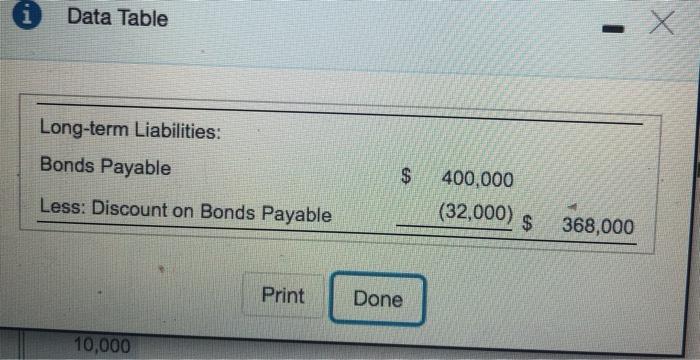

Question: i Data Table Long-term Liabilities: Bonds Payable Less: Discount on Bonds Payable $ 400,000 (32,000) $ 368,000 Print Done 10,000 -yed ayn 1. Answer the

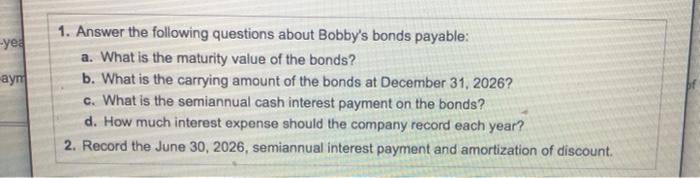

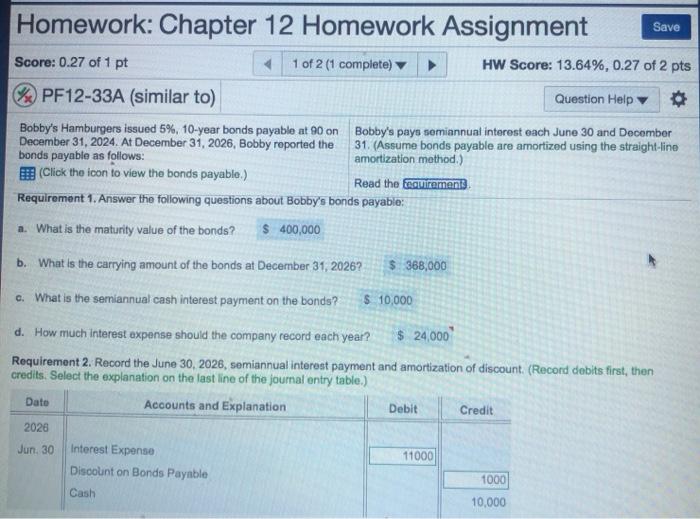

i Data Table Long-term Liabilities: Bonds Payable Less: Discount on Bonds Payable $ 400,000 (32,000) $ 368,000 Print Done 10,000 -yed ayn 1. Answer the following questions about Bobby's bonds payable: a. What is the maturity value of the bonds? b. What is the carrying amount of the bonds at December 31, 2026? c. What is the semiannual cash interest payment on the bonds? d. How much interest expense should the company record each year? 2. Record the June 30, 2026, semiannual interest payment and amortization of discount Homework: Chapter 12 Homework Assignment Save Score: 0.27 of 1 pt 1 of 2 (1 complete) HW Score: 13.64%, 0.27 of 2 pts PF12-33A (similar to) Question Help Bobby's Hamburgers issued 5%, 10-year bonds payable at 90 on Bobby's pays semiannual interest each June 30 and December December 31, 2024. At December 31, 2026, Bobby reported the 31 (Assume bonds payable are amortized using the straight-line bonds payable as follows: amortization method.) (Click the icon to view the bonds payable.) Read the fuquirements Requirement 1. Answer the following questions about Bobby's bonds payable: a. What is the maturity value of the bonds? $ 400,000 b. What is the carrying amount of the bonds at December 31, 2026? $. 368,000 c. What is the semiannual cash interest payment on the bands? $ 10,000 d. How much interest expense should the company record each year? $ 24,000 Requirement 2. Record the June 30, 2026, semiannual interest payment and amortization of discount. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and explanation Debit Credit 2028 Jun 30 Interest Expense 11000 Discount on Bonds Payable 1000 Cash 10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts