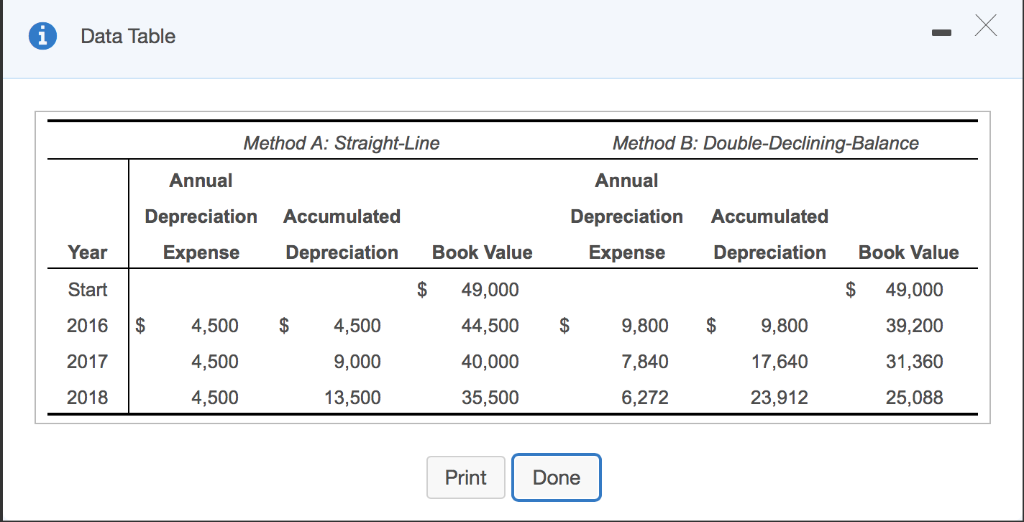

Question: i Data Table Method B: Double-Declining-Balance Annual Depreciation E xpense Accumulated Depreciation Year Book Value Method A: Straight-Line Annual Depreciation Accumulated Expense Depreciation Book Value

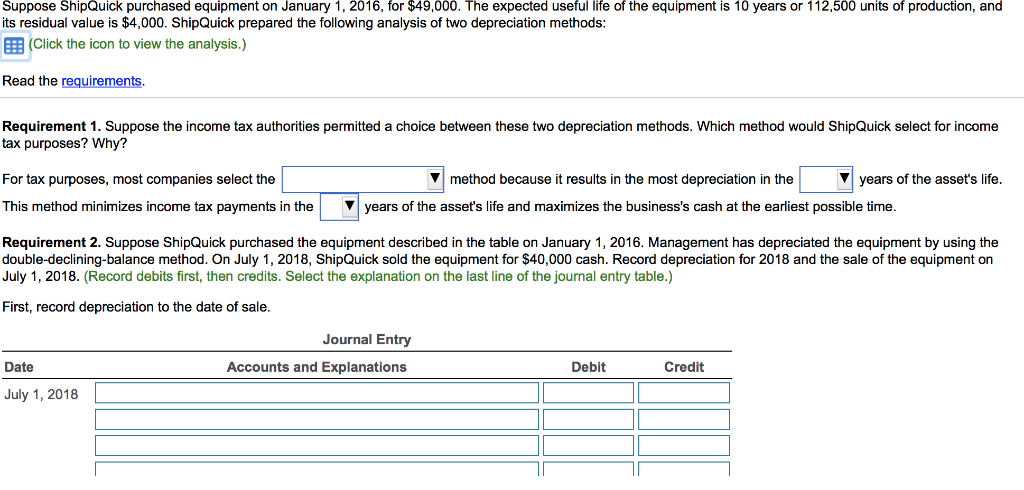

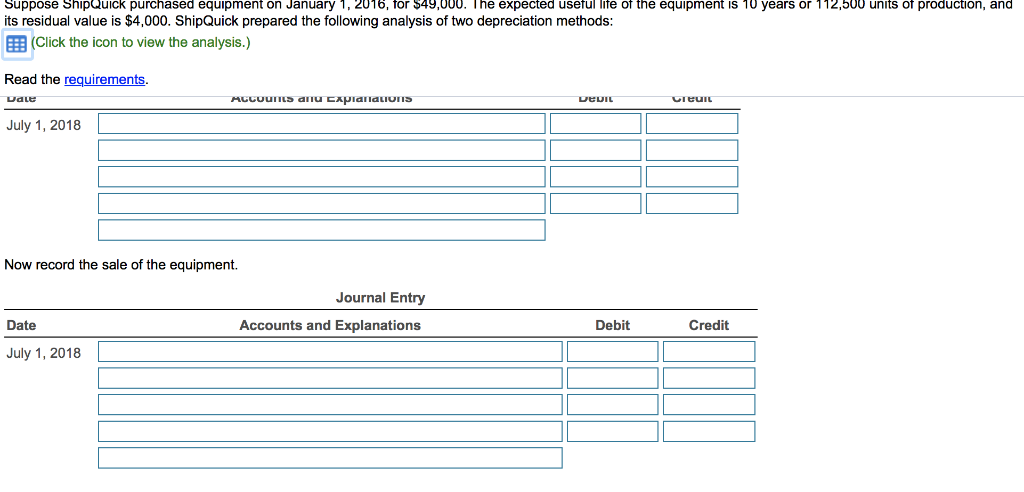

i Data Table Method B: Double-Declining-Balance Annual Depreciation E xpense Accumulated Depreciation Year Book Value Method A: Straight-Line Annual Depreciation Accumulated Expense Depreciation Book Value $ 49,000 4,500 $ 4,500 44,500 4,500 9,000 40,000 4,500 13,500 35,500 Start $ $ $ 2016 2017 2018 9,800 7,840 6,272 9,800 17,640 23,912 49,000 39,200 31,360 25,088 Print Done Suppose Ship Quick purchased equipment on January 1, 2016, for $49,000. The expected useful life of the equipment is 10 years or 112,500 units of production, and its residual value is $4,000. Ship Quick prepared the following analysis of two depreciation methods: (Click the icon to view the analysis.) Read the requirements. Requirement 1. Suppose the income tax authorities permitted a choice between these two depreciation methods. Which method would Ship Quick select for income tax purposes? Why? For tax purposes, most companies select the This method minimizes income tax payments in the method because it results in the most depreciation in the years of the asset's life. years of the asset's life and maximizes the business's cash at the earliest possible time. Requirement 2. Suppose Ship Quick purchased the equipment described in the table on January 1, 2016. Management has depreciated the equipment by using the double-declining-balance method. On July 1, 2018, Ship Quick sold the equipment for $40,000 cash. Record depreciation for 2018 and the sale of the equipment on July 1, 2018. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) First, record depreciation to the date of sale. Journal Entry Accounts and Explanations Date Debit Credit July 1, 2018 Suppose Ship Quick purchased equipment on January 1, 2016, for $49,000. The expected useful life of the equipment is 10 years or 112,500 units of production, and its residual value is $4,000. Ship Quick prepared the following analysis of two depreciation methods: E: (Click the icon to view the analysis.) Read the requirements. Date ALCUUITLS anu CapiallaLIUNIS DEVIL uleur July 1, 2018 Now record the sale of the equipment. Journal Entry Accounts and Explanations Debit Credit Date July 1, 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts