Question: I did not receive an answer for Q2 The table below contains the current prices for calls and puts with various strike prices and a

I did not receive an answer for Q2

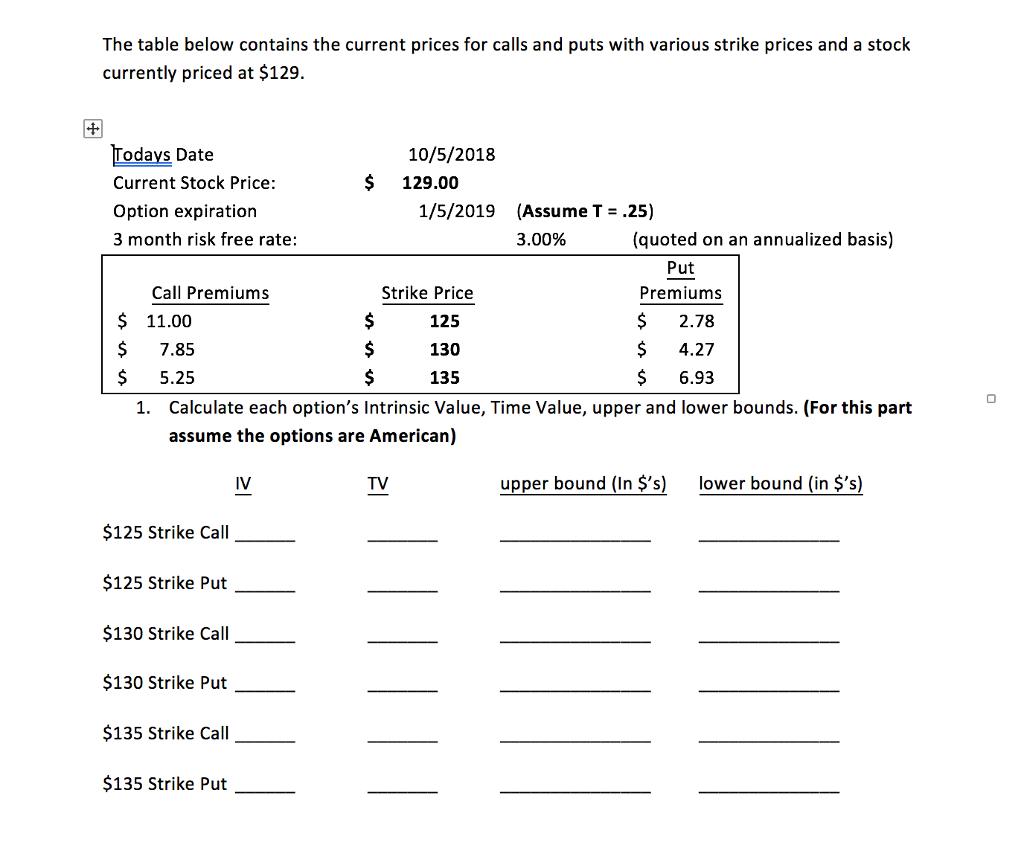

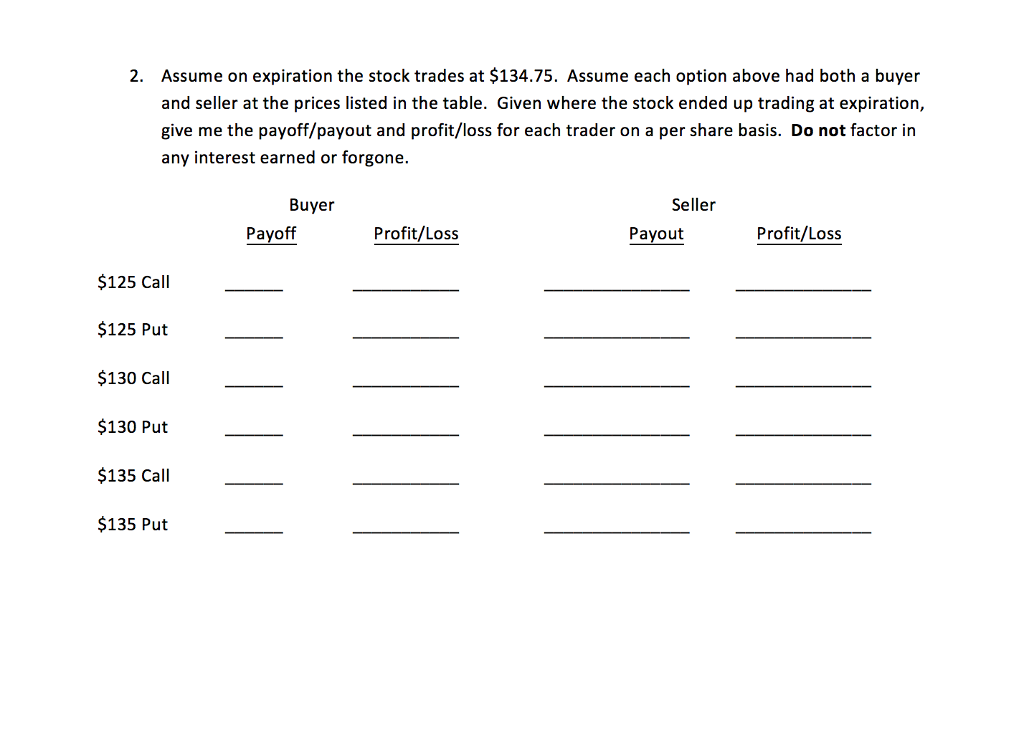

The table below contains the current prices for calls and puts with various strike prices and a stock currently priced at $129. 10/5/2018 Todays Date Current Stock Price: Option expiration 3 month risk free rate: $129.00 1/5/2019 (Assume T-.25) 3.00% (quoted on an annualized basis) Put Premiums $ 2.78 $ 4.27 $ 6.93 Call Premiums Strike Price $ 11.00 $ 7.85 5.25 125 130 135 Calculate each option's Intrinsic Value, Time Value, upper and lower bounds. (For this part assume the options are American) 1. IV TV upper bound (In S's)lower bound (in 's) $125 Strike Call $125 Strike Put S130 Strike Call $130 Strike Put $135 Strike Call 135 Strike Put

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts