Question: I did not understand this question well. I understand how did we get the answer, which is $484.20. But my question is why the project

I did not understand this question well. I understand how did we get the answer, which is $484.20.

But my question is "why the project in this case is considered to be worthy? is it because it is positive? If not please explain.

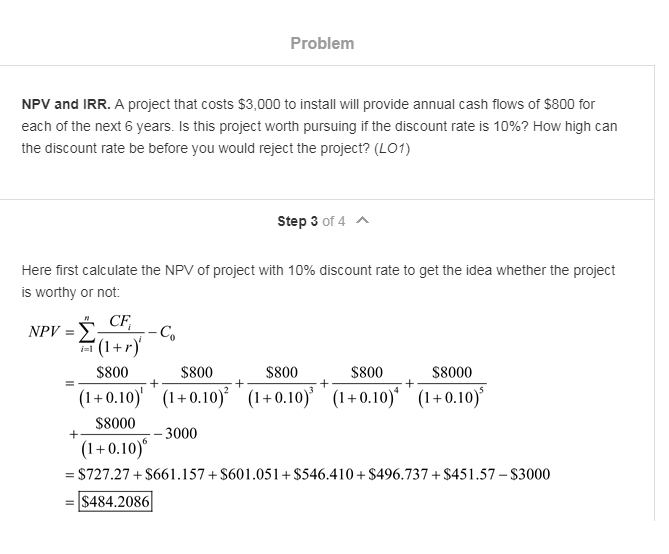

Problem NPV and IRR. A project that costs $3,000 to install will provide annual cash flows of $800 for each of the next 6 years. Is this project worth pursuing if the discount rate is 10%? How high can the discount rate be before you would reject the project? (LO1) Step 3 of 4 Here first calculate the NPV of project with 10% discount rate to get the idea whether the project is worthy or not CF S800+ S800H $800+ S8000 (0.10) (1-0.0010010) (-010y 6 3000 (1+0.10 = $727.27 + $661 . I 57 + $601 .051 + $546.4 1 0 + $496.737 + $451 .57-$3000 $484.2086

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts