Question: I did the first part I need the second part what is the answer Seminoles Corporation's fscal year-end is December 31, 2018. The following is

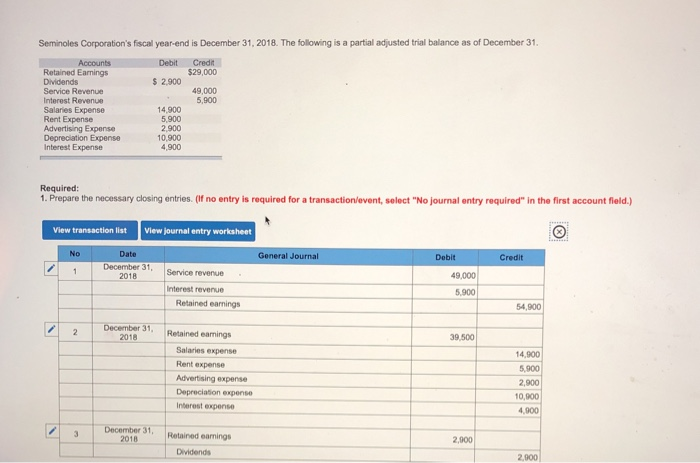

Seminoles Corporation's fscal year-end is December 31, 2018. The following is a partial adjusted trial balance as of December 31. Accounts Debit Credit $29,000 Retained Earnings Dividends Service Revenue Interest Revenue Salaries Expense Rent Expense Advertising Expense Depreciation Expense nterest Expense $ 2900 49,000 5,900 14,900 5,900 2,900 10,900 4,900 Required: 1. Prepare the necessary closing entries. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list View journal entry worksheet No Date General Journal Debit Credit 2018Service revenue Interest revenue 49,000 5,900 Retained earnings 54,900 Retained eamings 2018 39,500 Salaries expense Rent expense Advertising expense Depreciation expense Interest expense 4,900 5,900 2,900 10,900 4,900 Retained eamings 2018 2,000 Dividend 2,900 December Retained eanings 31 2,900 2018 Calculate the ending balance of Retained Earnings Hints References eBook & Resources Hint # MacBook Pro 20 esc 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts