Question: I did this exercise today in class with my professor now I am trying to do it again by myself and I get a different

I did this exercise today in class with my professor now I am trying to do it again by myself and I get a different answer, can some body explain it to me in the same format my professor did, please

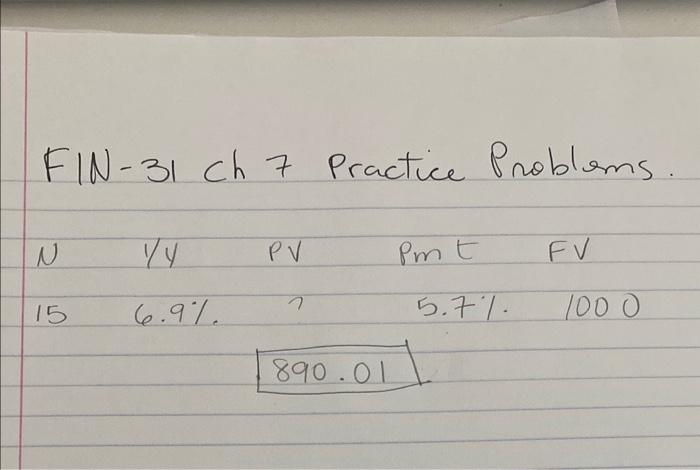

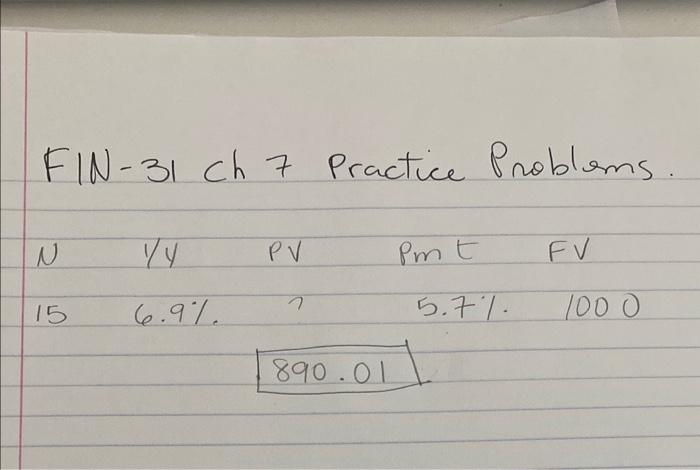

he used the financial calculator

and in the second picture I show how he explained it

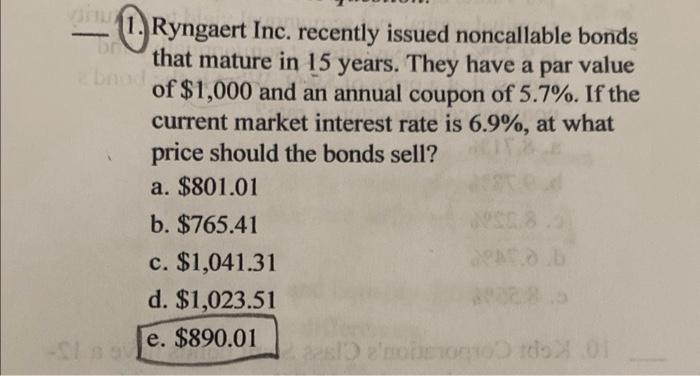

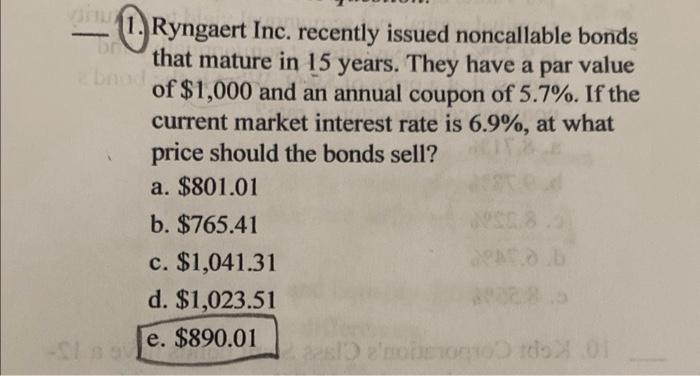

1. Ryngaert Inc. recently issued noncallable bonds that mature in 15 years. They have a par value of $1,000 and an annual coupon of 5.7%. If the current market interest rate is 6.9%, at what price should the bonds sell? a. $801.01 b. $765.41 c. $1,041.31 d. $1,023.51 e. $890.01 FIN-3I Ch 7 Practice Problems. N151/46.9%PV?Pmt5.7%FV1000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock