Question: I didn't know what question this answer was about, and the answer was wrong. $11,000 - pard as . down $1,10,000 Xio y payment. Cant

I didn't know what question this answer was about, and the answer was wrong.

I didn't know what question this answer was about, and the answer was wrong.

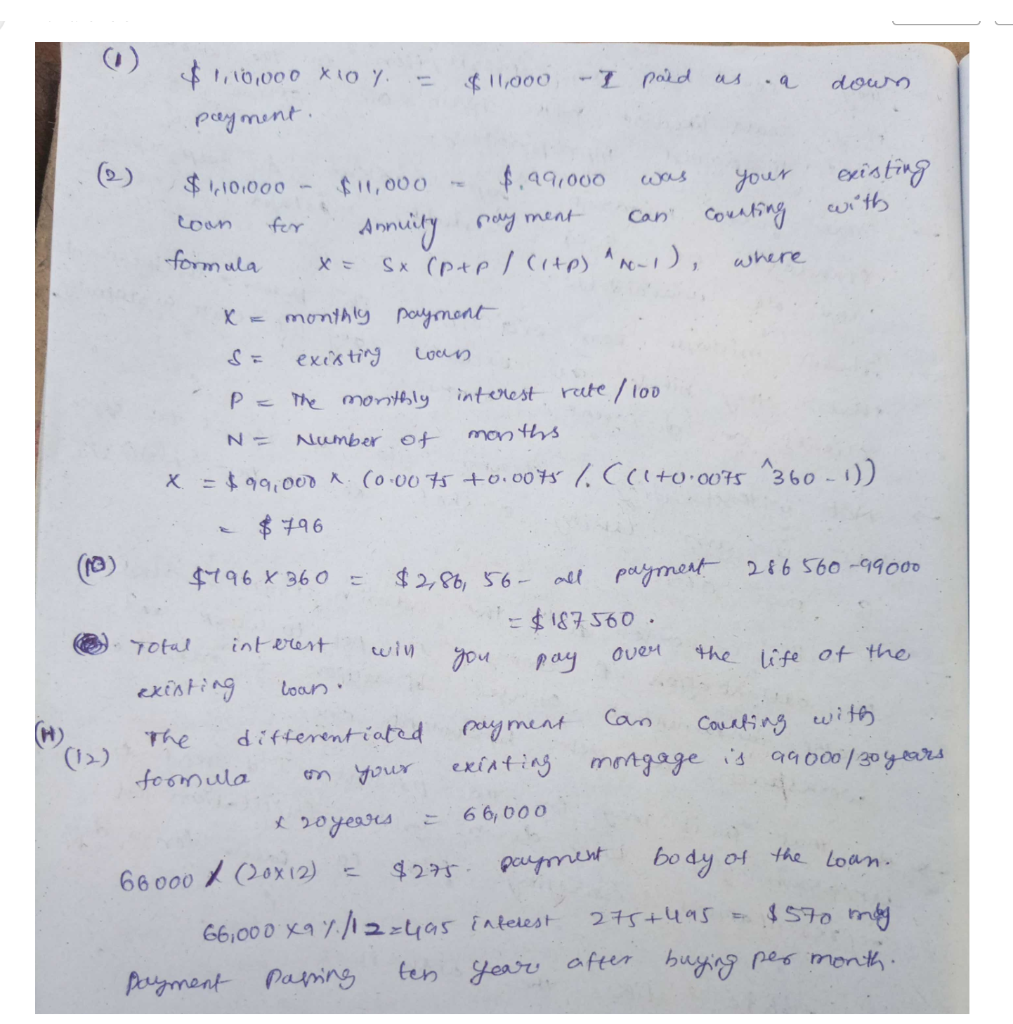

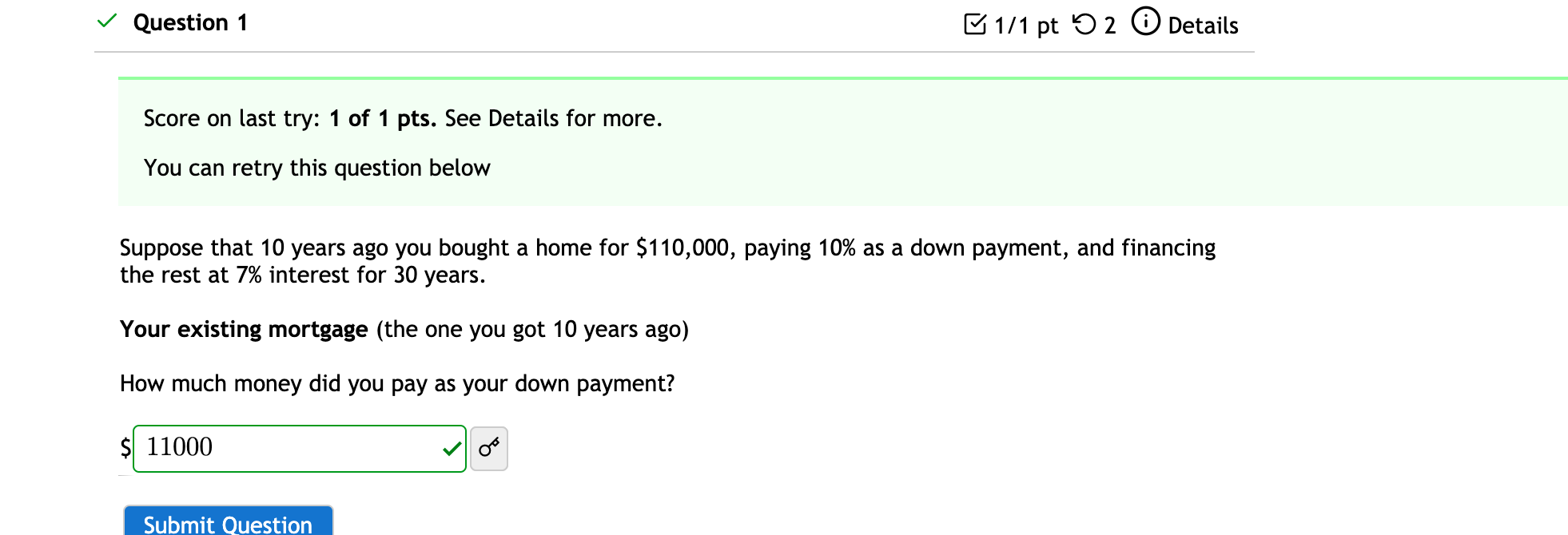

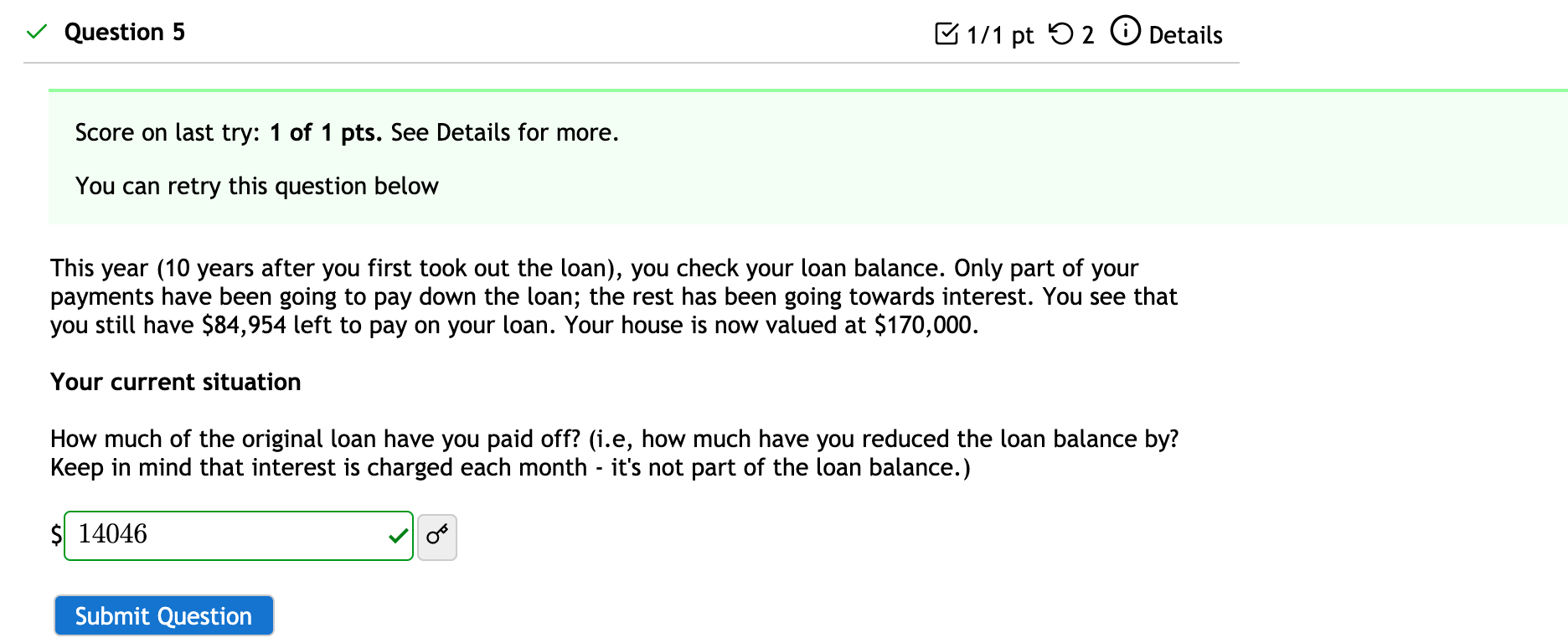

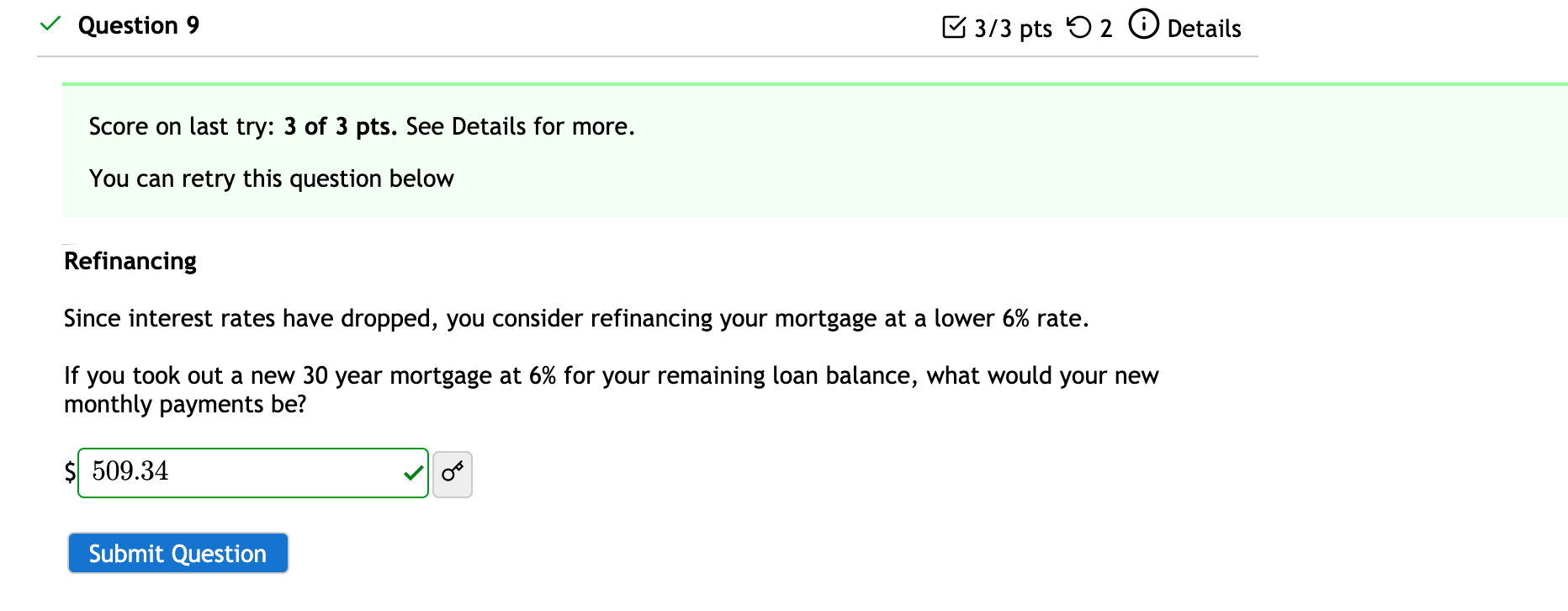

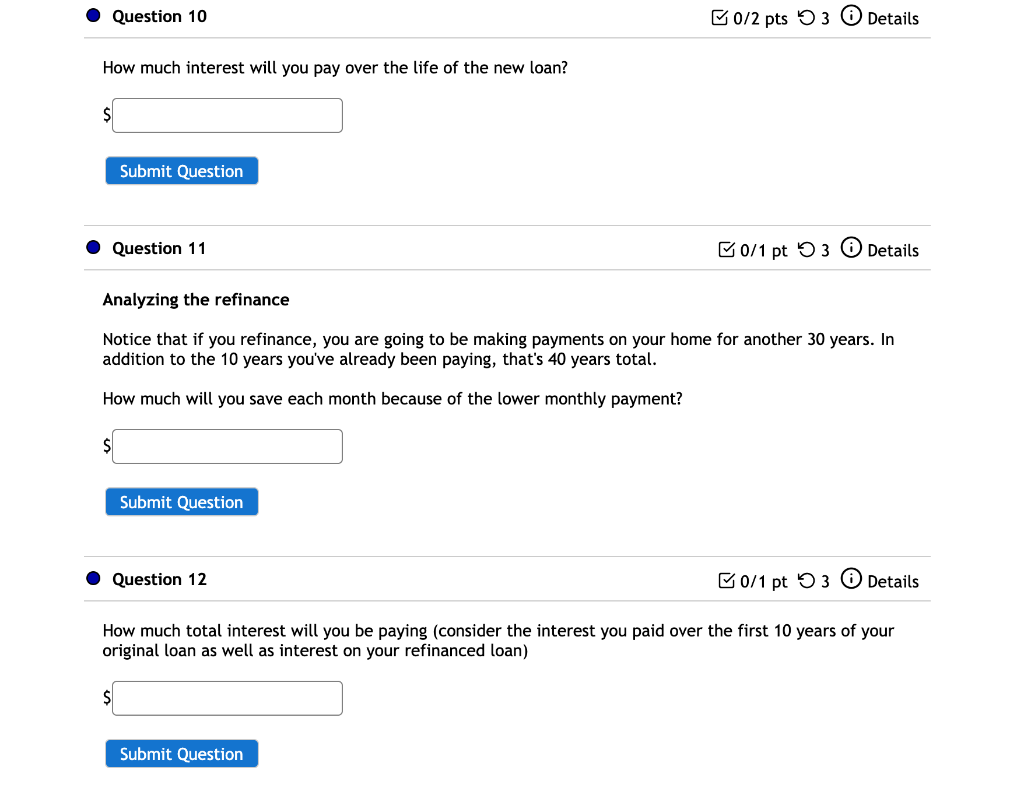

$11,000 - pard as . down $1,10,000 Xio y payment. Cant Annuity payment N- 110.000 $11,000 $.99,000 was your existing with for counting formula Sx (Ptp / CAP) Mo-1), where Xe monthly payment existing loan P = the monthly interest rate / 100 Number of months x = $99,000 X. (0.0075 +0.0075 / ((1+0.0075 4360 - 1)) $ 796 $496 X 360 = $2,86, 56- all payment 286560-99000 =$187580 Total interest wiu you pay the life of the existing loan. ( differentiated Can payment Counting with (12) formula your exifting mortgage is 99000/30 years x 20 years 66,000 66000 / () ox 12) = $275 payment body of 66,000x9 7/12=495 interest 275+495 $570 maj payment passing ten years after buying per month. over the loan. Question 1 1/1 pt 5 2 0 Details Score on last try: 1 of 1 pts. See Details for more. You can retry this question below Suppose that 10 years ago you bought a home for $110,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years. Your existing mortgage (the one you got 10 years ago) How much money did you pay as your down payment? $ 11000 Submit Question Question 5 1/1 pt 52 Details Score on last try: 1 of 1 pts. See Details for more. You can retry this question below This year (10 years after you first took out the loan), you check your loan balance. Only part of your payments have been going to pay down the loan; the rest has been going towards interest. You see that you still have $84,954 left to pay on your loan. Your house is now valued at $170,000. Your current situation How much of the original loan have you paid off? (i.e, how much have you reduced the loan balance by? Keep in mind that interest is charged each month - it's not part of the loan balance.) $ 14046 Submit Question Question 9 3/3 pts 5 2 0 Details Score on last try: 3 of 3 pts. See Details for more. You can retry this question below Refinancing Since interest rates have dropped, you consider refinancing your mortgage at a lower 6% rate. If you took out a new 30 year mortgage at 6% for your remaining loan balance, what would your new monthly payments be? $ 509.34 Submit Question Question 10 B0/2 pts 3 Details How much interest will you pay over the life of the new loan? $ Submit Question Question 11 B0/1 pt 3 Details Analyzing the refinance Notice that if you refinance, you are going to be making payments on your home for another 30 years. In addition to the 10 years you've already been paying, that's 40 years total. How much will you save each month because of the lower monthly payment? $ Submit Question Question 12 B0/1 pt 03 Details How much total interest will you be paying (consider the interest you paid over the first 10 years of your original loan as well as interest on your refinanced loan) $ Submit Question $11,000 - pard as . down $1,10,000 Xio y payment. Cant Annuity payment N- 110.000 $11,000 $.99,000 was your existing with for counting formula Sx (Ptp / CAP) Mo-1), where Xe monthly payment existing loan P = the monthly interest rate / 100 Number of months x = $99,000 X. (0.0075 +0.0075 / ((1+0.0075 4360 - 1)) $ 796 $496 X 360 = $2,86, 56- all payment 286560-99000 =$187580 Total interest wiu you pay the life of the existing loan. ( differentiated Can payment Counting with (12) formula your exifting mortgage is 99000/30 years x 20 years 66,000 66000 / () ox 12) = $275 payment body of 66,000x9 7/12=495 interest 275+495 $570 maj payment passing ten years after buying per month. over the loan. Question 1 1/1 pt 5 2 0 Details Score on last try: 1 of 1 pts. See Details for more. You can retry this question below Suppose that 10 years ago you bought a home for $110,000, paying 10% as a down payment, and financing the rest at 7% interest for 30 years. Your existing mortgage (the one you got 10 years ago) How much money did you pay as your down payment? $ 11000 Submit Question Question 5 1/1 pt 52 Details Score on last try: 1 of 1 pts. See Details for more. You can retry this question below This year (10 years after you first took out the loan), you check your loan balance. Only part of your payments have been going to pay down the loan; the rest has been going towards interest. You see that you still have $84,954 left to pay on your loan. Your house is now valued at $170,000. Your current situation How much of the original loan have you paid off? (i.e, how much have you reduced the loan balance by? Keep in mind that interest is charged each month - it's not part of the loan balance.) $ 14046 Submit Question Question 9 3/3 pts 5 2 0 Details Score on last try: 3 of 3 pts. See Details for more. You can retry this question below Refinancing Since interest rates have dropped, you consider refinancing your mortgage at a lower 6% rate. If you took out a new 30 year mortgage at 6% for your remaining loan balance, what would your new monthly payments be? $ 509.34 Submit Question Question 10 B0/2 pts 3 Details How much interest will you pay over the life of the new loan? $ Submit Question Question 11 B0/1 pt 3 Details Analyzing the refinance Notice that if you refinance, you are going to be making payments on your home for another 30 years. In addition to the 10 years you've already been paying, that's 40 years total. How much will you save each month because of the lower monthly payment? $ Submit Question Question 12 B0/1 pt 03 Details How much total interest will you be paying (consider the interest you paid over the first 10 years of your original loan as well as interest on your refinanced loan) $ Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts