Question: I didn't really understand the way the answer key did it. Shouldn't you use the market rate to find the Present Value and the back

I didn't really understand the way the answer key did it. Shouldn't you use the market rate to find the Present Value and the back up the discount? Can anyone use an alternative way to solve it or to explain how the answer key did it? Thank you.

I didn't really understand the way the answer key did it. Shouldn't you use the market rate to find the Present Value and the back up the discount? Can anyone use an alternative way to solve it or to explain how the answer key did it? Thank you.

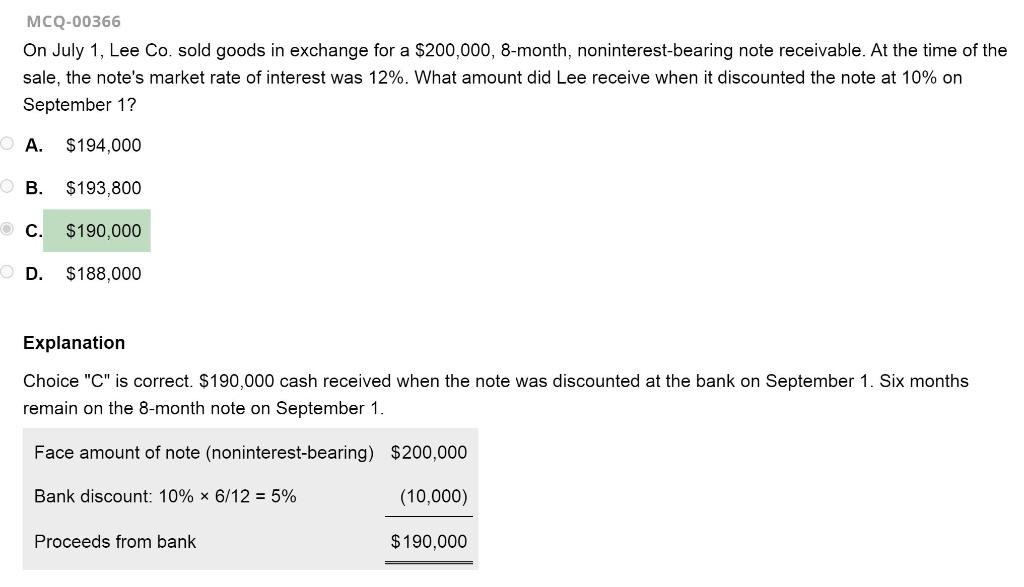

MCQ-00366 On July 1, Lee Co. sold goods in exchange for a $200,000, 8-month, noninterest-bearing note receivable. At the time of the sale, the note's market rate of interest was 12%. What amount did Lee receive when it discounted the note at 10% on September 1? A. $194,000 B. $193,800 C. $190,000 D. $188,000 Explanation Choice "C" is correct. $190,000 cash received when the note was discounted at the bank on September 1. Six months remain on the 8-month note on September 1. Face amount of note (noninterest-bearing) $200,000 Bank discount: 10% 6/12 = 5% (10,000) Proceeds from bank $190,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts