Question: i dnt have no1 so i need only no2 ans Zinn Corporation recently agreed to a union contract provision that guarantees a minimum wage of

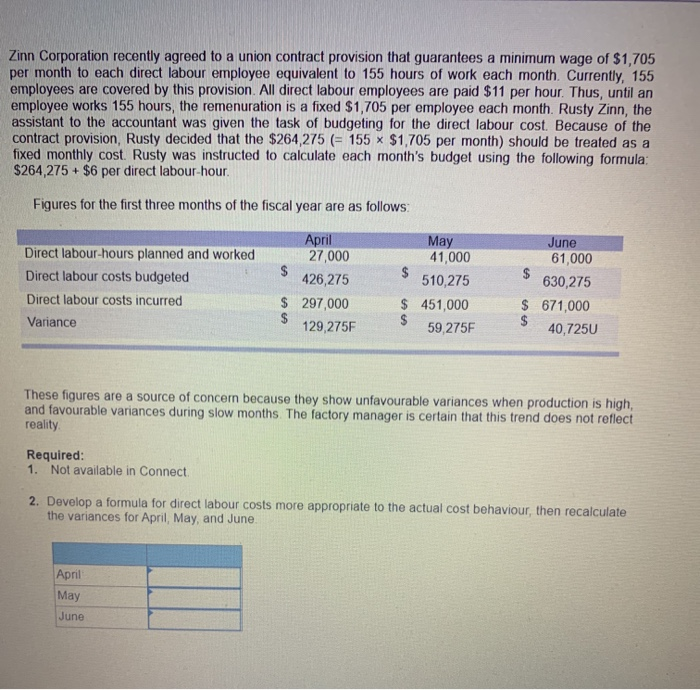

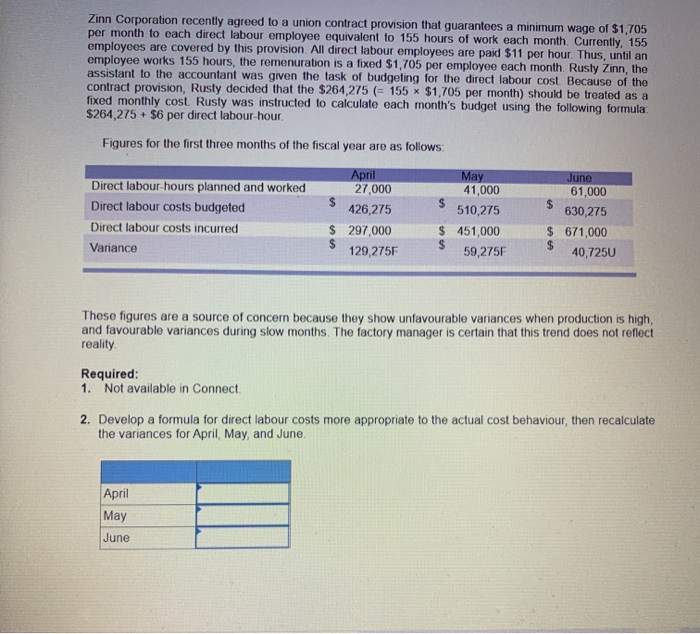

Zinn Corporation recently agreed to a union contract provision that guarantees a minimum wage of $1,705 per month to each direct labour employee equivalent to 155 hours of work each month. Currently, 155 employees are covered by this provision. All direct labour employees are paid $11 per hour. Thus, until an employee works 155 hours, the remenuration is a fixed $1,705 per employee each month. Rusty Zinn, the assistant to the accountant was given the task of budgeting for the direct labour cost. Because of the contract provision, Rusty decided that the $264,275 = 155 x $1,705 per month) should be treated as a fixed monthly cost. Rusty was instructed to calculate each month's budget using the following formula: $264,275 + $6 per direct labour-hour. Figures for the first three months of the fiscal year are as follows: Direct labour-hours planned and worked Direct labour costs budgeted Direct labour costs incurred Variance April 27,000 $ 426,275 $ 297,000 $ 129,275F May 41,000 $ 510,275 $ 451,000 $ 59,275F June 61,000 630,275 $ 671,000 $ 40,7250 These figures are a source of concem because they show unfavourable variances when production is high, and favourable variances during slow months. The factory manager is certain that this trend does not reflect reality Required: 1. Not available in Connect 2. Develop a formula for direct labour costs more appropriate to the actual cost behaviour, then recalculate the variances for April, May, and June April May June Zinn Corporation recently agreed to a union contract provision that guarantees a minimum wage of $1,705 per month to each direct labour employee equivalent to 155 hours of work each month. Currently, 155 employees are covered by this provision. All direct labour employees are paid $11 per hour. Thus, until an employee works 155 hours, the remenuration is a fixed $1,705 per employee each month. Rusty Zinn, the assistant to the accountant was given the task of budgeting for the direct labour cost. Because of the contract provision, Rusty decided that the $264,275 (= 155 * $1,705 per month) should be treated as a fixed monthly cost. Rusty was instructed to calculate each month's budget using the following formula: $264,275 + $6 per direct labour-hour. Figures for the first three months of the fiscal year are as follows: Direct labour hours planned and worked Direct labour costs budgeted Direct labour costs incurred Variance April 27,000 $ 426,275 $ 297,000 $ 129,275F May 41,000 $ 510,275 $ 451,000 $ 59,275F June 61,000 $ 630,275 $ 671,000 $ 40,7250 These figures are a source of concern because they show unfavourable variances when production is high, and favourable variances during slow months. The factory manager is certain that this trend does not reflect reality Required: 1. Not available in Connect 2. Develop a formula for direct labour costs more appropriate to the actual cost behaviour, then recalculate the variances for April May, and June April May June

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts