Question: i do not know how to calculate this , i want to know the step ONE BY ONE Questions 138 to 140 relate to the

i do not know how to calculate this , i want to know the step ONE BY ONE

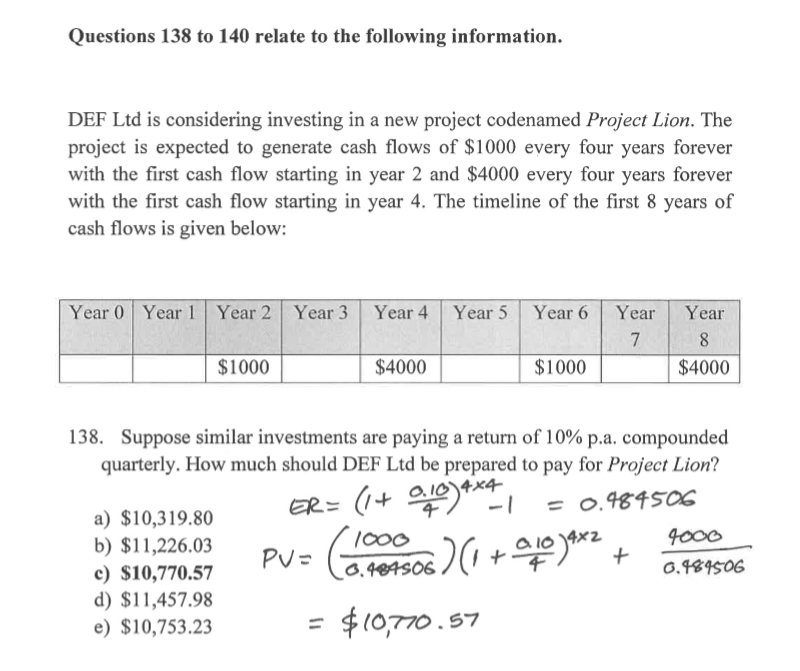

Questions 138 to 140 relate to the following information. DEF Ltd is considering investing in a new project codenamed Project Lion. The project is expected to generate cash flows of $1000 every four years forever with the first cash flow starting in year 2 and $4000 every four years forever with the first cash flow starting in year 4. The timeline of the first 8 years of cash flows is given below: Year 0 YearYear 2 Year 3 Year 4 Year 5 Year 6 Year Year $1000 $4000 $1000 $4000 138. Suppose similar investments are paying a return of 10% pa. compounded quarterly. How much should DEF Ltd be prepared to pay for Project Lion? aI04x2 b) $11,226.03 S10,770.57 d) $11,457.98 e) $10,753.23 # $10770.57

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts