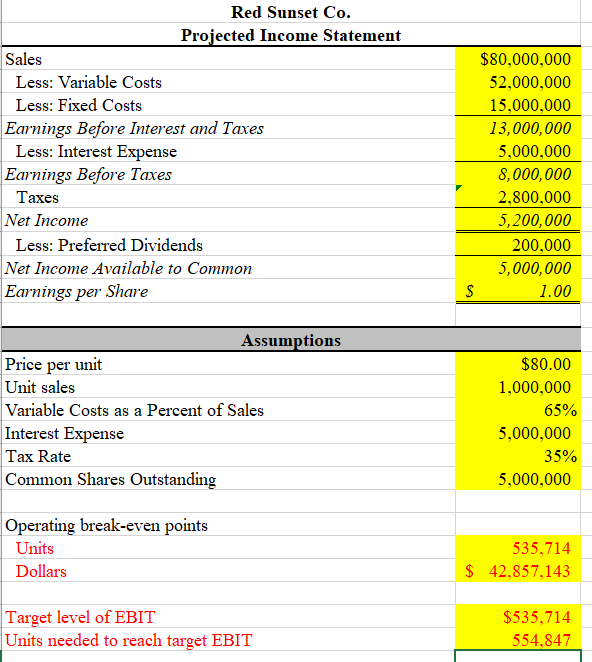

Question: I do not know if my red numbers are correct, but I especially need help with the last question, how to calculate preferred dividend payment

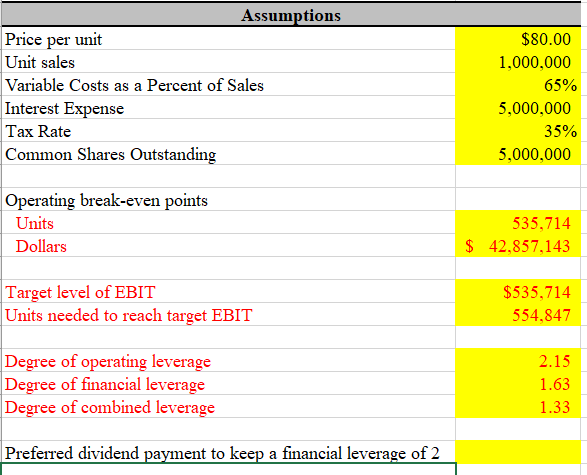

I do not know if my "red" numbers are correct, but I especially need help with the last question, how to calculate "preferred dividend payment to keep financial leverage at 2"?

Red Sunset Co. Projected Income Statement Sales Less: Variable Costs Less: Fixed Costs Earnings Before Interest and Taxes Less: Interest Expense Earnings Before Taxes Taxes Net Income Less: Preferred Dividends Net Income Available to Common Earnings per Share $80,000,000 52,000,000 15,000,000 13,000,000 5,000,000 8,000,000 2,800,000 5,200,000 200,000 5,000,000 $ 1.00 Assumptions Price per unit Unit sales Variable Costs as a Percent of Sales Interest Expense Tax Rate Common Shares Outstanding $80.00 1,000,000 65% 5,000,000 35% 5,000,000 Operating break-even points Units Dollars 535,714 $ 42,857,143 Target level of EBIT Units needed to reach target EBIT $535,714 554,847 Assumptions Price per unit Unit sales Variable Costs as a Percent of Sales Interest Expense Tax Rate Common Shares Outstanding $80.00 1,000,000 65% 5,000,000 35% 5,000,000 Operating break-even points Units Dollars 535,714 $ 42,857,143 Target level of EBIT Units needed to reach target EBIT $535,714 554,847 Degree of operating leverage Degree of financial leverage Degree of combined leverage 2.15 1.63 1.33 Preferred dividend payment to keep a financial leverage of 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts