Question: i do not know where they are getting these numbers for the taxable income @ rate. I do not know where 9,275 or 27,825 is

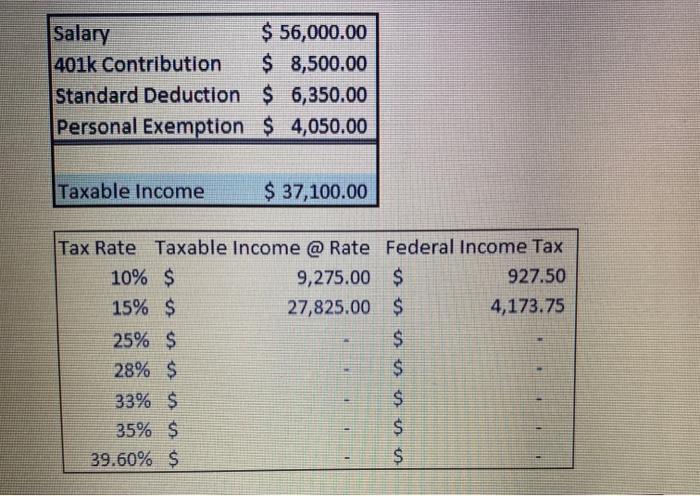

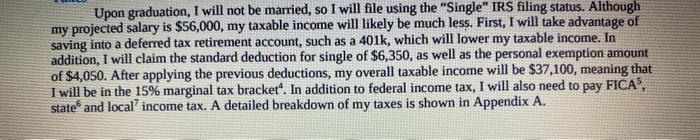

Salary $ 56,000.00 401k Contribution $ 8,500.00 Standard Deduction $ 6,350.00 Personal Exemption $ 4,050.00 Taxable Income $ 37,100.00 Tax Rate Taxable Income @ Rate Federal Income Tax 10% $ 9,275.00 $ 927.50 15% $ 27,825.00 $ 4,173.75 25% $ $ 28% $ $ 33% $ $ 35% $ $ 39.60% $ $ Upon graduation, I will not be married, so I will file using the "Single" IRS filing status. Although my projected salary is $56,000, my taxable income will likely be much less. First, I will take advantage of saving into a deferred tax retirement account, such as a 401k, which will lower my taxable income. In addition, I will claim the standard deduction for single of $6,350, as well as the personal exemption amount of $4,050. After applying the previous deductions, my overall taxable income will be $37,100, meaning that I will be in the 15% marginal tax bracket'. In addition to federal income tax, I will also need to pay FICAS, state and local income tax. A detailed breakdown of my taxes is shown in Appendix A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts