Question: I do not need explication, I just need A,B,C or D answer. Thank you!! 22. A company wants to earn an income of $60,000 after-taxes.

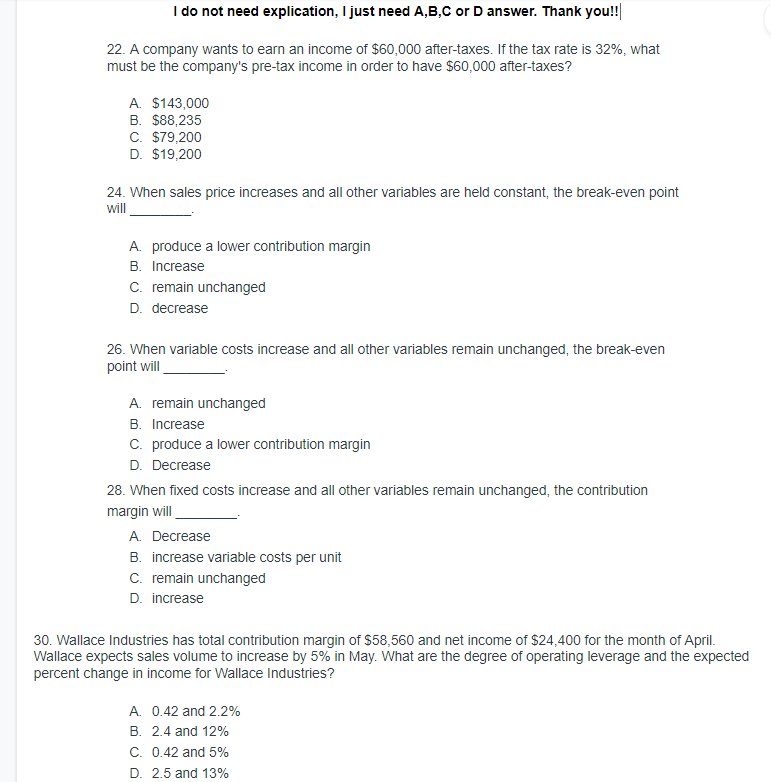

I do not need explication, I just need A,B,C or D answer. Thank you!! 22. A company wants to earn an income of $60,000 after-taxes. If the tax rate is 32%, what must be the company's pre-tax income in order to have $60,000 after-taxes? A $143,000 B. $88,235 C. $79,200 D. $19,200 24. When sales price increases and all other variables are held constant, the break-even point will A produce a lower contribution margin B. Increase C. remain unchanged D. decrease 26. When variable costs increase and all other variables remain unchanged, the break-even point will A remain unchanged B. Increase C. produce a lower contribution margin D. Decrease 28. When fixed costs increase and all other variables remain unchanged, the contribution margin will A. Decrease B. increase variable costs per unit C. remain unchanged D. increase 30. Wallace Industries has total contribution margin of $58,560 and net income of $24,400 for the month of April. Wallace expects sales volume to increase by 5% in May. What are the degree of operating leverage and the expected percent change in income for Wallace Industries? A. 0.42 and 2.2% B. 2.4 and 12% C. 0.42 and 5% D. 2.5 and 13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts