Question: I do not understand 2 things: How is depreciation calculated here? In my text it uses 1.3M-175 / 7, but I don't understand why the

I do not understand 2 things: How is depreciation calculated here? In my text it uses 1.3M-175 / 7, but I don't understand why the depreciable base is not 1.4M (1.3M + 100k shipping cost).

I do not understand 2 things: How is depreciation calculated here? In my text it uses 1.3M-175 / 7, but I don't understand why the depreciable base is not 1.4M (1.3M + 100k shipping cost).

Next I am unsure as to how to calculate Terminal cash flow. Please help!

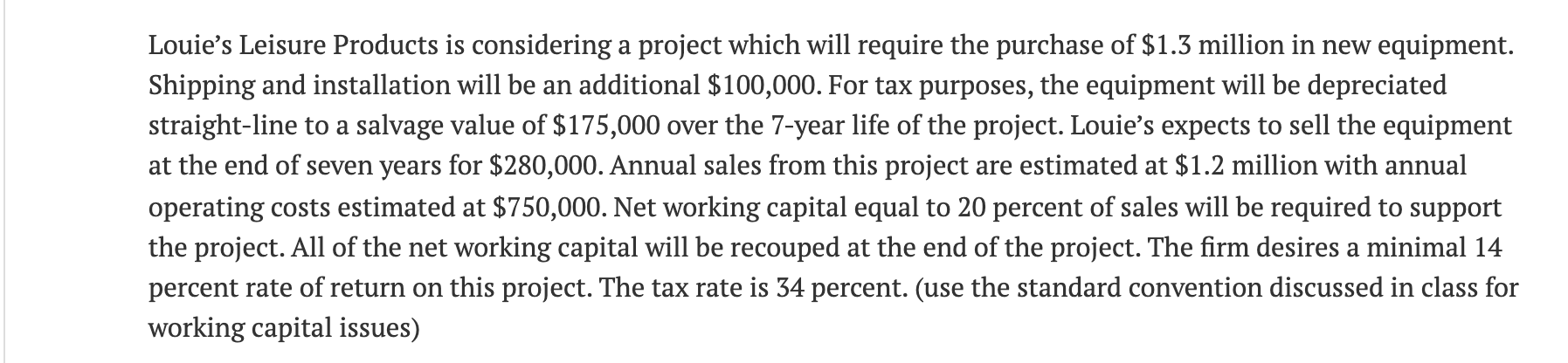

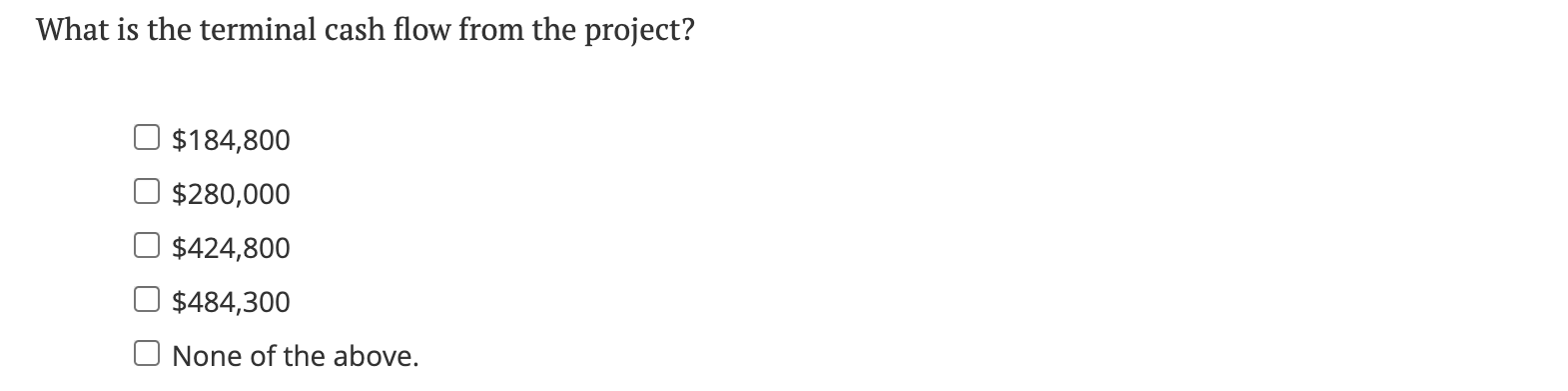

Louie's Leisure Products is considering a project which will require the purchase of $1.3 million in new equipment. Shipping and installation will be an additional $100,000. For tax purposes, the equipment will be depreciated straight-line to a salvage value of $175,000 over the 7-year life of the project. Louie's expects to sell the equipment at the end of seven years for $280,000. Annual sales from this project are estimated at $1.2 million with annual operating costs estimated at $750,000. Net working capital equal to 20 percent of sales will be required to support the project. All of the net working capital will be recouped at the end of the project. The firm desires a minimal 14 percent rate of return on this project. The tax rate is 34 percent. (use the standard convention discussed in class for working capital issues) What is the terminal cash flow from the project? $184,800 $280,000 $424,800 $484,300 None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts