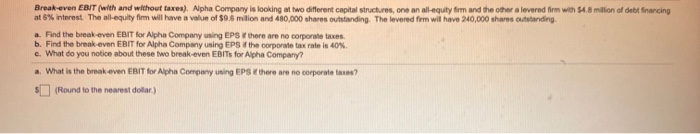

Question: i do not understand can you please help! Break-even EBIT (with and without taxes). Alpha Company is looking at two different capital structures, one an

i do not understand can you please help!

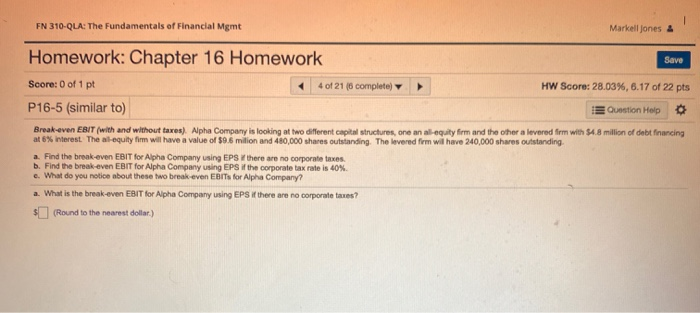

i do not understand can you please help! Break-even EBIT (with and without taxes). Alpha Company is looking at two different capital structures, one an all-equity firm and the other levered firm with $4.8 million of debt financing at 6% interest The all-equity firm will have a value of $9.5 milion and 480,000 shares outstanding. The levered from wil have 240,000 shares outstanding a. Find the break even EBIT for Alpha Company using EPS there are no corporate taxes b. Find the break even EBIT for Alpha Company using EPS the corporate tax rate is 40% c. What do you notice about these two break-even EBITS for Alpha Company? a. What is the break even EBIT for Alpha Company using EPs there are no corporate ? (Round to the nearest dollar) FN 310-QLA: The Fundamentals of Financial Mgmt Markell Jones & Homework: Chapter 16 Homework Save Score: 0 of 1 pt 4 of 21 (0 complete) HW Score: 28.03%, 6.17 of 22 pts P16-5 (similar to) Question Help Break-even EBIT (with and without taxes). Alpha Company is looking at two different capital structures, one an all-equity firm and the other a levered frm with $4.8 million of debt financing at 6% interest. The all-equity firm wil have a value of $9.6 million and 480,000 shares outstanding. The levered frm will have 240,000 shares outstanding. a. Find the break-even EBIT for Alpha Company using EPS there are no corporate taxes. b. Find the break-even EBIT for Alpha Company using EPS if the corporate tax rate is 40% e. What do you notice about these two break even Elts for Alpha Company? a. What is the break-even EBIT for Alpha Company using EPS i there are no corporate taxes? $(Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts