Question: I do not understand how to answer this question. please help. Brief Exercise 18-7 (Part Level Submission) Pronghorn Corp. purchased depreciable assets costing $31,200 on

I do not understand how to answer this question. please help.

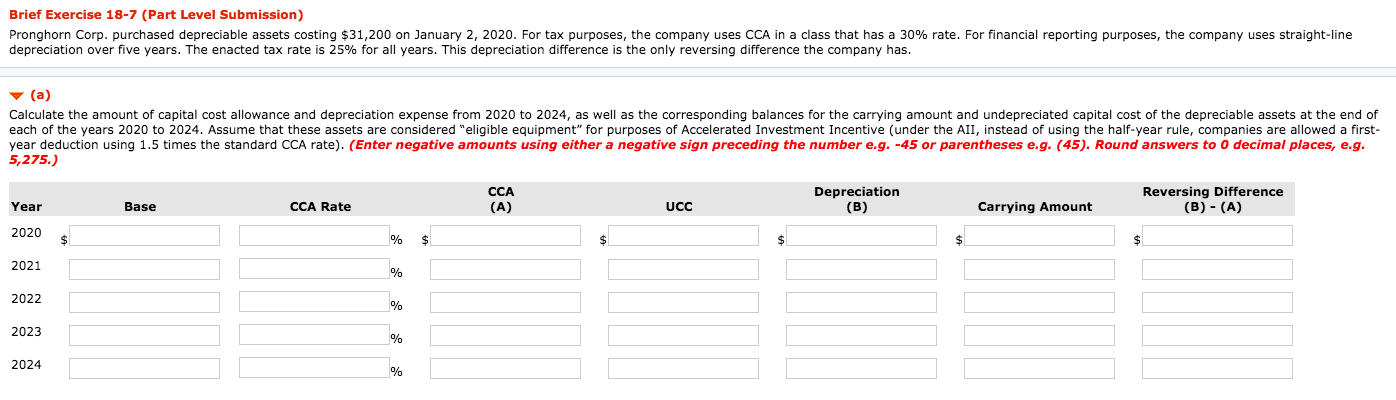

Brief Exercise 18-7 (Part Level Submission) Pronghorn Corp. purchased depreciable assets costing $31,200 on January 2, 2020. For tax purposes, the company uses CCA in a class that has a 30% rate. For financial reporting purposes, the company uses straight-line depreciation over five years. The enacted tax rate is 25% for all years. This depreciation difference is the only reversing difference the company has. (a) Calculate the amount of capital cost allowance and depreciation expense from 2020 to 2024, as well as the corresponding balances for the carrying amount and undepreciated capital cost of the depreciable assets at the end of each of the years 2020 to 2024. Assume that these assets are considered "eligible equipment" for purposes of Accelerated Investment Incentive (under the AII, instead of using the half-year rule, companies are allowed a first- year deduction using 1.5 times the standard CCA rate). (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45). Round answers to 0 decimal places, e.g. 5,275.) CCA Depreciation Reversing Difference Year Base CCA Rate (A) UCC (B) Carrying Amount (B) - (A) 2020 $ $ 2021 2022 0/ 2023 2024

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts