Question: I do not understand why my answer is wrong. According to my textbook, the AMT Exclusion amount for a head of household individual in 2

I do not understand why my answer is wrong. According to my textbook, the AMT Exclusion amount for a head of household individual in is $ Am I missing something? Problem information below:

Problem LO Algo

The following information applies to the questions displayed below.

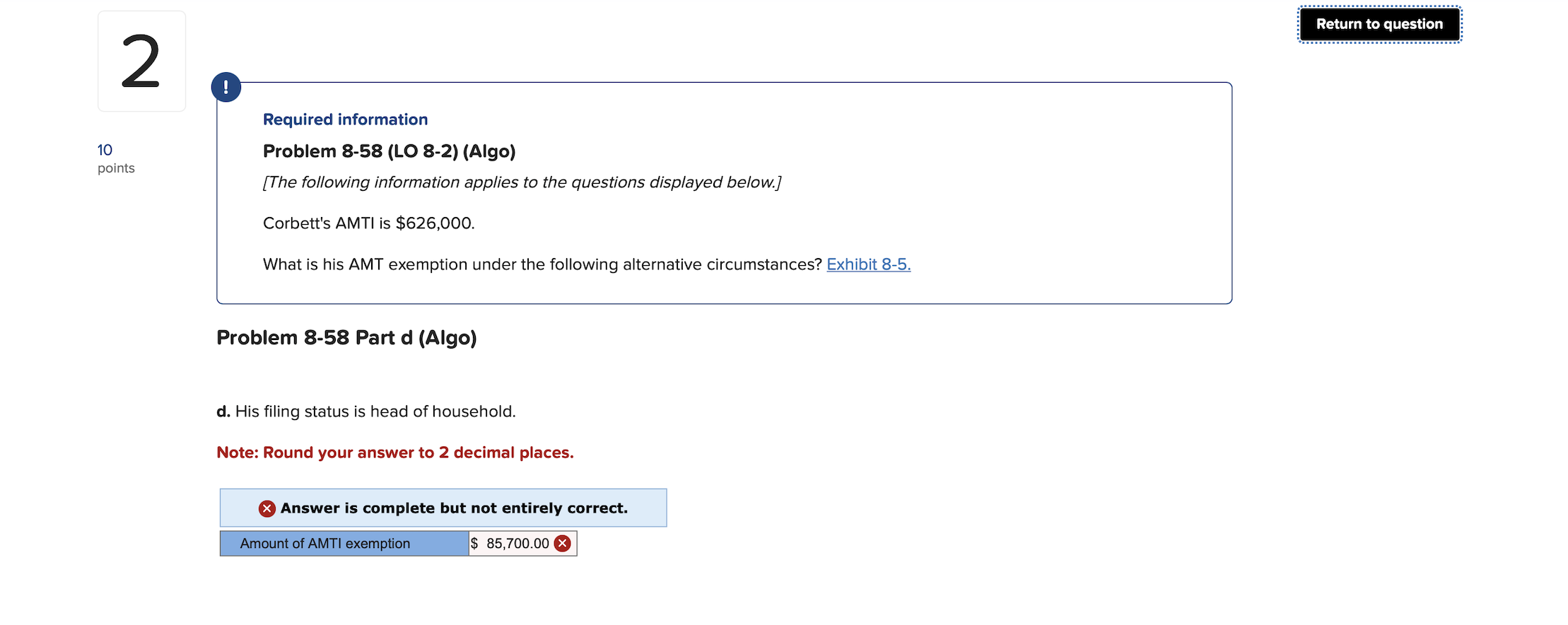

Corbett's AMTI is $

What is his AMT exemption under the following alternative circumstances?

d His filing status is head of household.

AMT Exemption

To help ensure that most taxpayers aren't required to pay the alternative minimum tax, Congress allows taxpayers to deduct an alternative minimum tax underlinemathbfA M T exemption amount to determine their alternative minimum tax base. The amount of the exemption depends on the taxpayer's filing status. The exemption is phased out reduced by cents for every dollar the AMTI exceeds the threshold amount.

Exhibit identifies, by filing status, the base exemption amount, the phaseout threshold, and the range of AMTI over which the exemption is phased out for

EXHIBIT AMT Exemptions

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock