Question: I dodnt find a solution for this problem , can sumbody help me with it 10.9 Assume that Evergreen Healthcare, a provider of skilled nursing

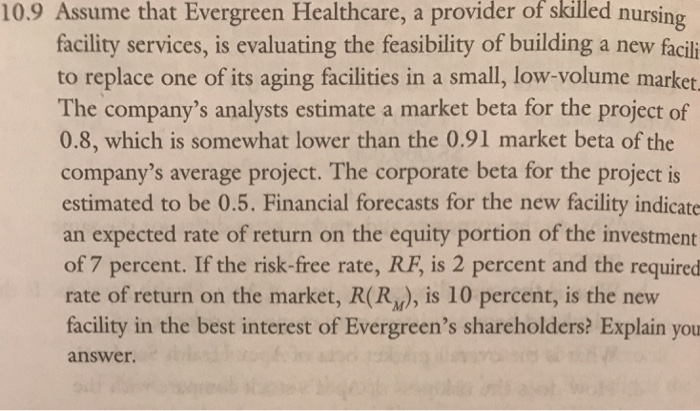

10.9 Assume that Evergreen Healthcare, a provider of skilled nursing facility services, is evaluating the feasibility of building a new facili to replace one of its aging facilities in a small, low-volume market The company's analysts estimate a market beta for the project of 0.8, which is somewhat lower than the 0.91 market beta of the company's average project. The corporate beta for the project is estimated to be 0.5. Financial forecasts for the new facility indicate an expected rate of return on the equity portion of the investment of 7 percent. If the risk-free rate, RF, is 2 percent and the required rate of return on the market, R(RM), is 10 percent, is the new facility in the best interest of Evergreen's shareholders? Explain you

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts