Question: I done all question, but have 4 errors need help. Grouper Warehouse distributes suitcases to retail stores and extends credit terms of n/30 to all

I done all question, but have 4 errors need help.

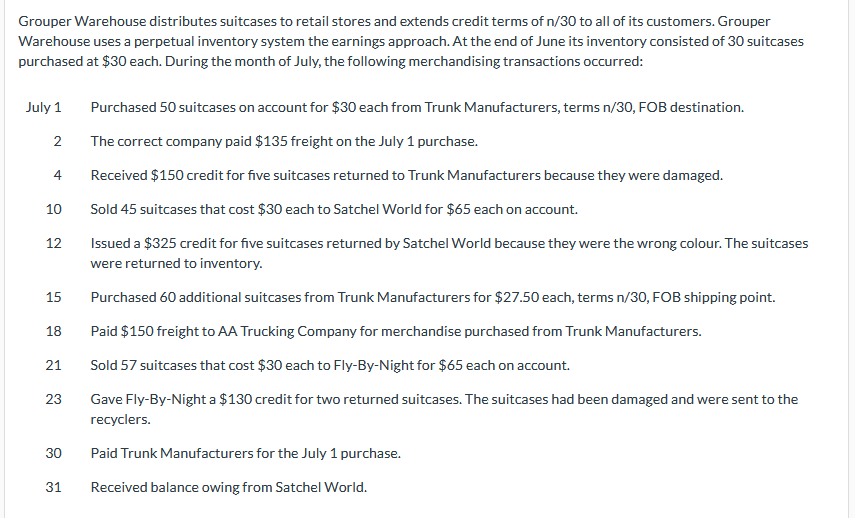

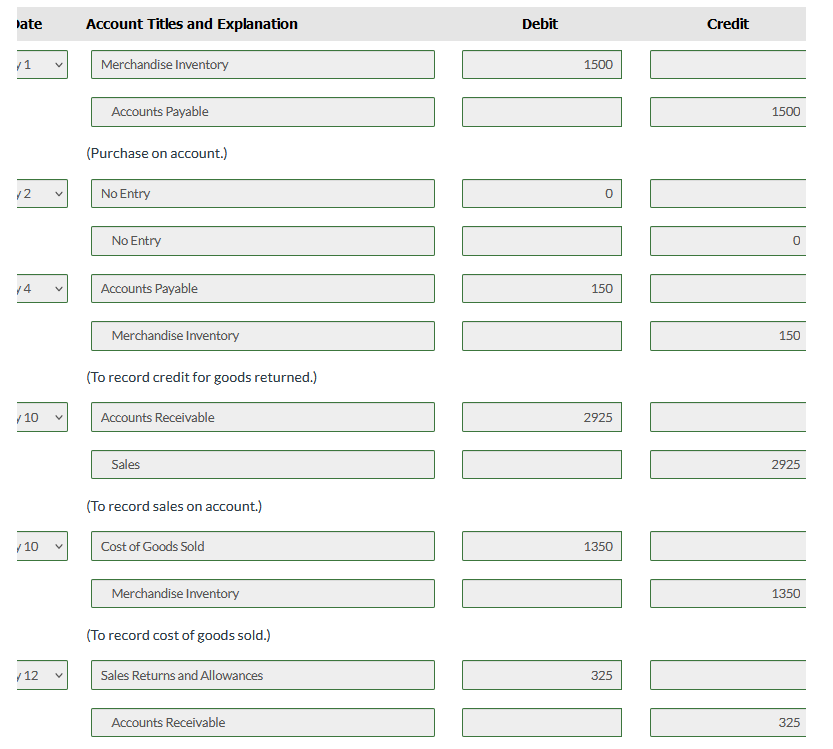

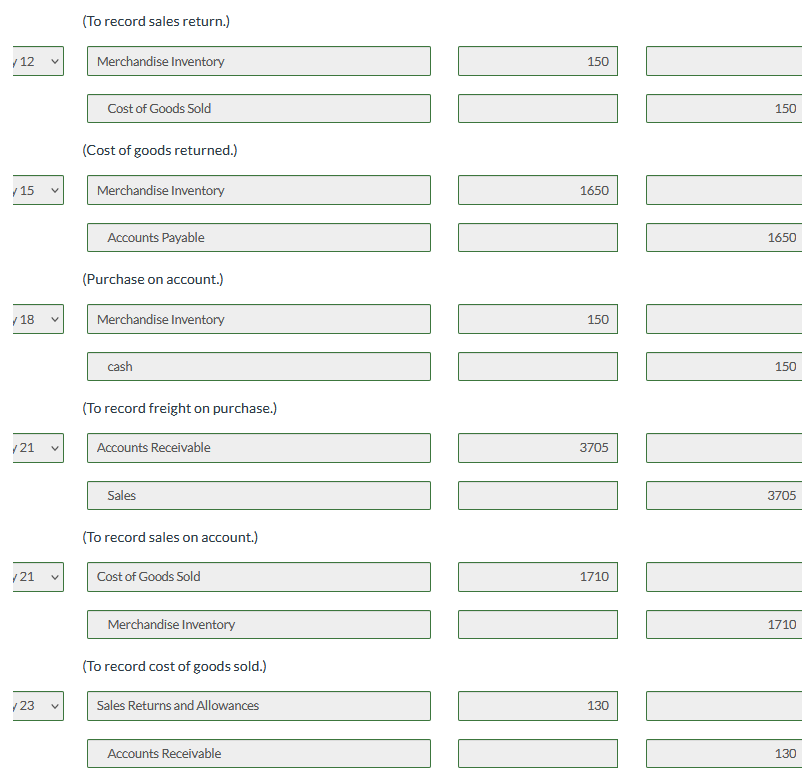

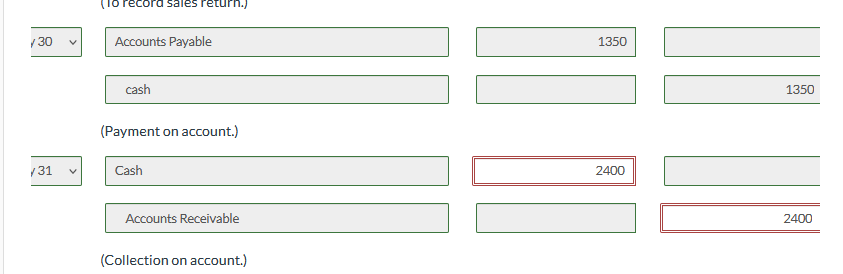

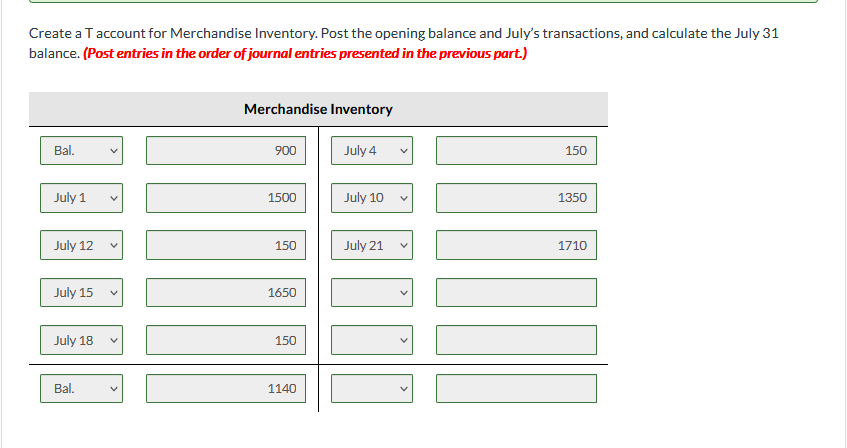

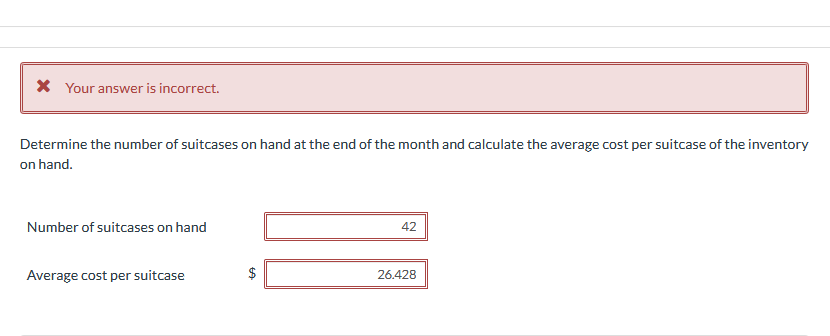

Grouper Warehouse distributes suitcases to retail stores and extends credit terms of n/30 to all of its customers. Grouper Warehouse uses a perpetual inventory system the earnings approach. At the end of June its inventory consisted of 30 suitcases purchased at $30 each. During the month of July, the following merchandising transactions occurred: July 1 Purchased 50 suitcases on account for $30 each from Trunk Manufacturers, terms n/30, FOB destination. The correct company paid $135 freight on the July 1 purchase. 2 4 10 Received $150 credit for five suitcases returned to Trunk Manufacturers because they were damaged. Sold 45 suitcases that cost $30 each to Satchel World for $65 each on account. Issued a $325 credit for five suitcases returned by Satchel World because they were the wrong colour. The suitcases were returned to inventory. 12 15 18 21 Purchased 60 additional suitcases from Trunk Manufacturers for $27.50 each, terms n/30, FOB shipping point. Paid $150 freight to AA Trucking Company for merchandise purchased from Trunk Manufacturers. Sold 57 suitcases that cost $30 each to Fly-By-Night for $65 each on account. Gave Fly-By-Night a $130 credit for two returned suitcases. The suitcases had been damaged and were sent to the recyclers. 23 30 Paid Trunk Manufacturers for the July 1 purchase. 31 Received balance owing from Satchel World. late Account Titles and Explanation Debit Credit /1 Merchandise Inventory 1500 Accounts Payable 1500 (Purchase on account.) 12 No Entry 0 No Entry 0 /4 V Accounts Payable 150 Merchandise Inventory 150 (To record credit for goods returned.) 10 Accounts Receivable 2925 Sales 2925 (To record sales on account.) /10 Cost of Goods Sold 1350 Merchandise Inventory 1350 (To record cost of goods sold.) /12 Sales Returns and Allowances 325 Accounts Receivable 325 (To record sales return.) /12 Merchandise Inventory 150 Cost of Goods Sold 150 (Cost of goods returned.) 15 Merchandise Inventory 1650 Accounts Payable 1650 (Purchase on account.) 18 Merchandise Inventory 150 cash 150 (To record freight on purchase.) /21 Accounts Receivable 3705 Sales 3705 (To record sales on account.) 121 Cost of Goods Sold 1710 Merchandise Inventory 1710 (To record cost of goods sold.) 123 Sales Returns and Allowances 130 Accounts Receivable 130 lo record sales return /30 Accounts Payable 1350 cash 1350 (Payment on account.) /31 Cash 2400 Accounts Receivable 2400 (Collection on account.) Create a T account for Merchandise Inventory. Post the opening balance and July's transactions, and calculate the July 31 balance. (Post entries in the order of journal entries presented in the previous part.) Merchandise Inventory Bal. 1140 X Your answer is incorrect. Determine the number of suitcases on hand at the end of the month and calculate the average cost per suitcase of the inventory on hand. Number of suitcases on hand 42 Average cost per suitcase $ 26.428

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts