Question: I don't completely understand how to do this question. If you can give a detailed answer that'd be great. A project requires an initial investment

I don't completely understand how to do this question. If you can give a detailed answer that'd be great.

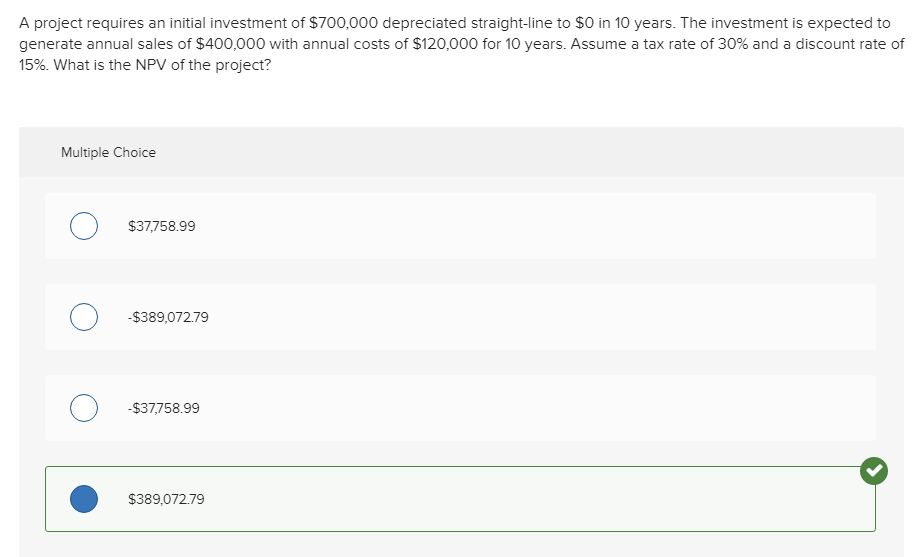

A project requires an initial investment of $700,000 depreciated straight-line to $0 in 10 years. The investment is expected to generate annual sales of $400,000 with annual costs of $120,000 for 10 years. Assume a tax rate of 30% and a discount rate of 15%. What is the NPV of the project? Multiple Choice $37,758.99 -$389,072.79 -$37,758.99 $389,072.79

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts