Question: I don't know how to approach this problem. Please explain. Required: Return on net operating assets, RNOA, can be computed using two distinct methods that

I don't know how to approach this problem. Please explain.

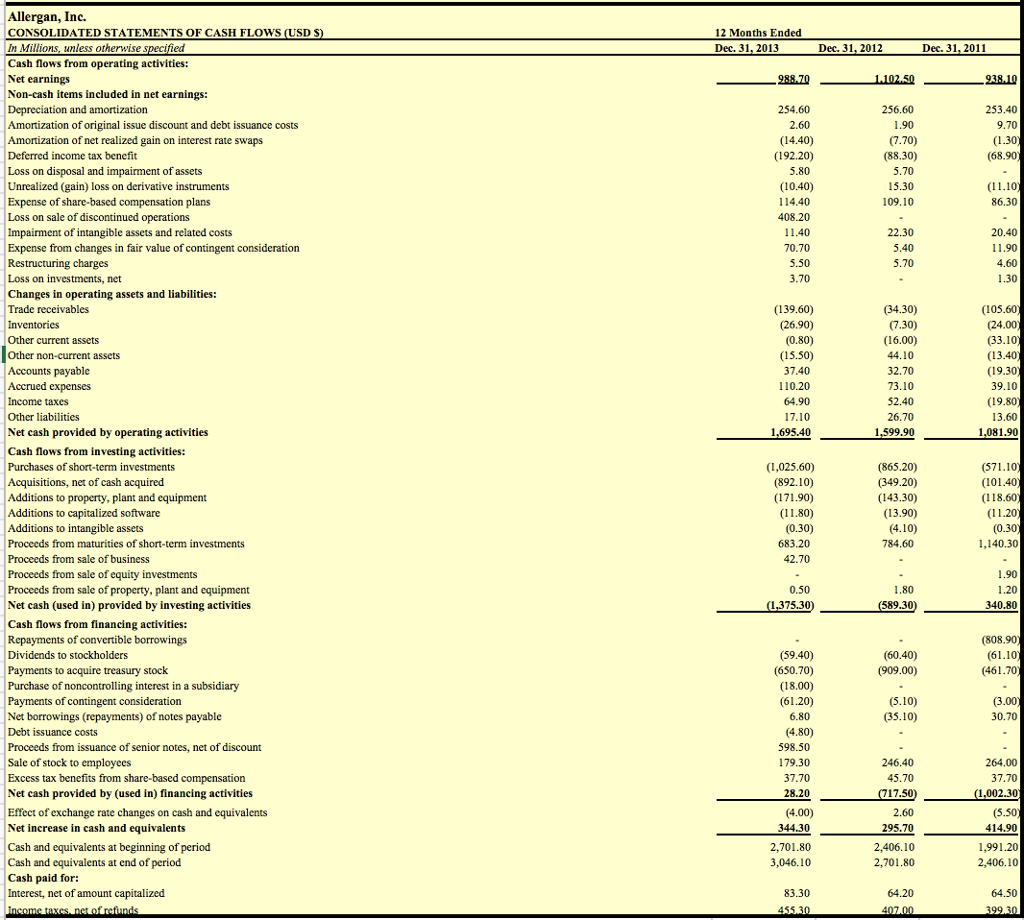

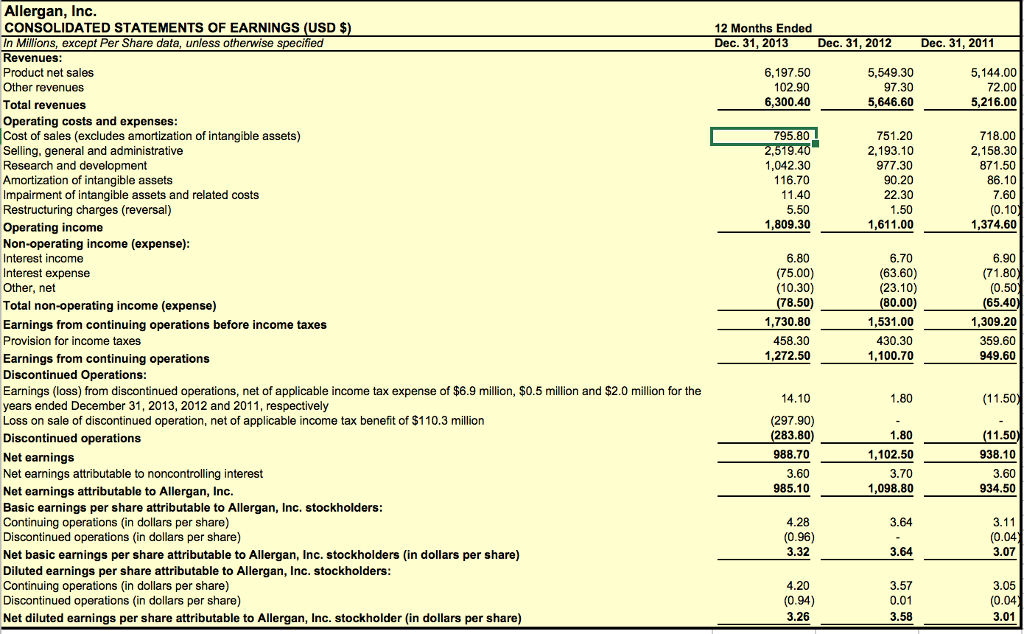

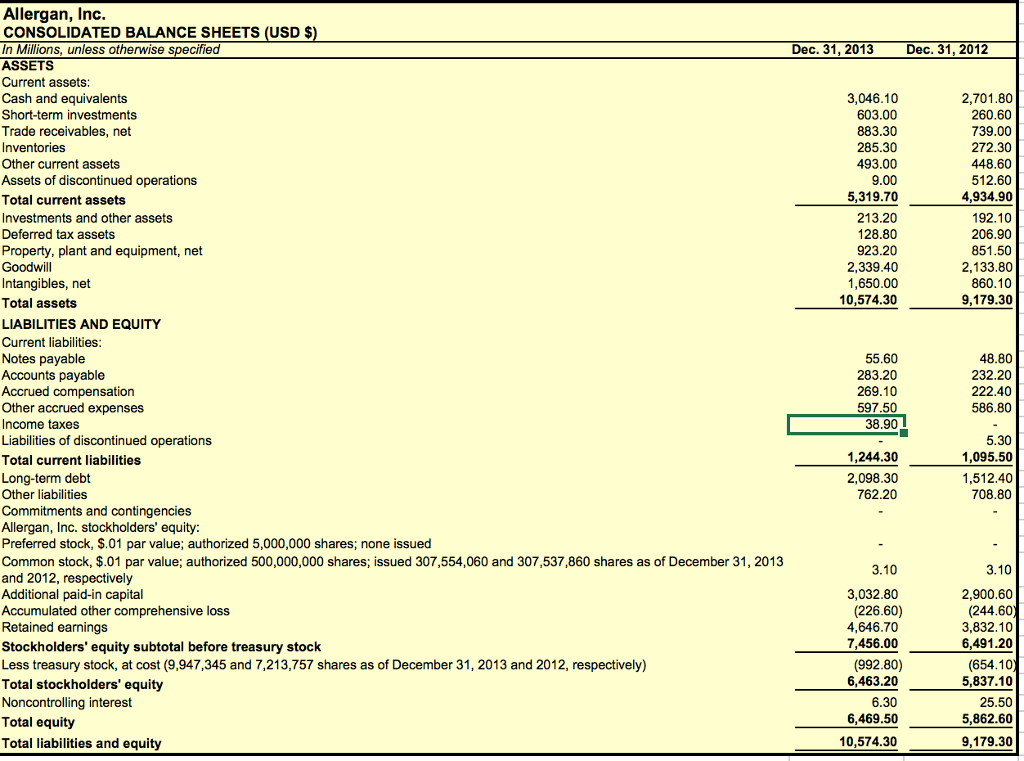

Required: Return on net operating assets, RNOA, can be computed using two distinct methods that should produce identical results. Under Method 1, RNOA is computed as a ratio of net operating assets after tax, NOPAT, and average net operating assets, NOA. Under Method 2, RNOA is computed as a product of net operating profit margin (ratio of NOPAT to sales) and net operating asset turnover (ratio of sales to average NOA) In this part of the project, you are required to compute RNOA using Methodsland 2, and compare the results of your computations, for the fiscal year ended December 31, 2013. Please show your computations andcomment whether the results of your compuations resulted in identical values. Answers: Computations of RNOA under Method 1: Computations of RNOA under Method 2: Balance Sheet or Income Statement Line Item Value Balance Sheet or Income Statement Line ltem Value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts